After a wild and crazy week that saw the yield curve invert for the first time in 12 years, recession talk and set record lows for muni yields — there was a much calmer tone on Friday to close out the week.

There is an estimated $6.35 billion of deals on tap, with $5.08 billion of negotiated deals and $1.27 billion of competitive sales. Next week looks to be more than the yearly average of $5.5 billion. The calendar features 17 deals $100 million or larger.

“In terms of relative value, the gap continues to widen,” one New York trader said. “So that despite real yields having fallen so quickly in a short period, at least available cash is somewhat supported with fair-value comparisons.”

Though a lazy Friday ended with light volume and scarce buyers on a quiet summer day, next week’s $6 billion-plus of new-issues should provide ample supply, a Florida trader said.

“People are tired from all the volatility and some people took the day off so there’s a thinner staff, and volume is lighter,” he said. “There’s really no bid lists and there is light street flow — other than that it’s a quiet summer day.”

He noted that if the market was looking for a bid side they would find a relatively good bid side, but there’s not enough people around today.

“Right now it feels like the market is lethargic and worn out.”

However, that mood should quickly turn around as buyers are still flush with cash and the arrival of next week’s slate should be enticing.

“We continue to see other non-domestic, foreign demand come into the marketplace and everyone seems to want the primary market first — and judging by this week and last week’s supply, the customer does not seem tired yet,” the trader said. “Primary flows are still really, really solid and buyers are still participating.”

The largest deal of the week comes from the short-term sector, as Texas (MIG1/SP1+/F1+/K1+) is scheduled to competitively sell $8 billion of tax anticipation notes on Wednesday.

Houston (Aa2/AA/ ) is coming to market with a total of $1.27 billion of bonds in two deals. Citi is the lead manager on the $785 million of combined utility system first lien revenue refunding featuring taxable and forward delivery bonds on Tuesday.

Ramirez will run the books on the $483.5 million of public improvement refunding, including taxable and forward delivery bonds on Thursday.

Morgan Stanley is set to price Colorado Health Facilities Authority and Montana Facility Finance Authority’s (Aa3/AA-/AA-) $545.95 of revenue refunding bonds for Sisters of Charity of Leavenworth Health System on Wednesday.

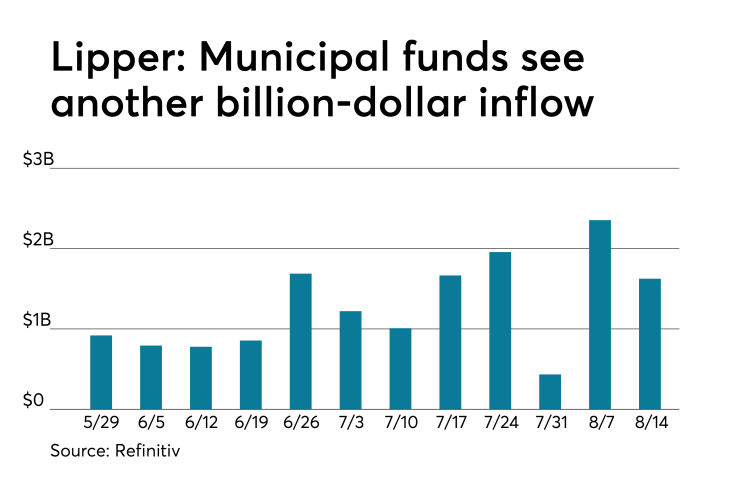

Lipper: Record amount of inflows into munis

For 32 straight weeks investors have poured cash into municipal bond funds, according to data from Refinitiv Lipper. Tax-exempt mutual funds that report weekly received $1.625 billion of inflows in the week ended Aug. 14 after inflows of $2.353 billion in the previous week.

Exchange-traded muni funds reported inflows of $123.479 million after inflows of $288.027 million in the previous week.

Ex-ETFs, muni funds saw inflows of $1.501 billion after inflows of $2.065 billion in the previous week.

The four-week moving average remained positive at $1.592 billion, after being in the black at $1.602 billion in the previous week.

Long-term muni bond funds had inflows of $959.453 million in the latest week after inflows of $1.341 billion in the previous week. Intermediate-term funds had inflows of $331.650 million after inflows of $413.956 million in the prior week.

National funds had inflows of $1.450 billion after inflows of $2.050 billion in the previous week. High-yield muni funds reported inflows of $383.715 million in the latest week, after inflows of $634.617 million the previous week.

“What could explain this decline for muni fund flows? Despite volatility in the stock market, equity funds reported inflows of slightly more than $3 billion after last week’s carnage that featured outflows of more than $25 billion,” Dan Berger, senior market strategist at Refinitiv's Municipal Market Data said.

Secondary market

On the MBIS benchmark muni scale, munis were weaker as yields rose two basis points in the 10-year and the 30-year unchanged. High-grades were also weaker, with MBIS’ AAA scale showing yields rising two basis points in the 10-year maturity and no change in the 30-year maturity.

The 10- and 30-year GOs both remained at the record low levels set on Wednesday of 1.22% and 1.87%, respectively, according to the final read of Refinitiv Municipal Market Data’s AAA benchmark scale.

In late trading, the Treasury three-month was yielding 1.871%, the 2-year was yielding 1.480%, the 5-year was yielding 1.420%, the 10-year was yielding 1.547% and the 30-year was yielding 2.009%.

The 10-year muni-to-Treasury ratio was calculated at 79.0% while the 30-year muni-to-Treasury ratio stood at 93.2%, according to MMD.

Previous session's activity

The MSRB reported 33,799 trades Thursday on volume of $15.03 billion. The 30-day average trade summary showed on a par amount basis of $11.11 million that customers bought $5.64 million, customers sold $3.38 million and interdealer trades totaled $2.08 million.

California, New York and Texas were most traded, with the Golden State taking 18.377% of the market, the Empire State taking 11.57% and the Lone Star State taking 10.965%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-2 4.329s of 2040, which traded 34 times on volume of $66.25 million.

.