Municipal bonds were mostly stronger on Tuesday as a surge of supply moved into the market, led by deals from Texas and Virginia.

Primary market

Citigroup priced and repriced San Antonio, Texas’ (Aaa/AAA/AA+) $454.895 million of Series 2019 general improvement and refunding bonds, combination tax and revenue certificates of obligation and tax notes.

Citi also priced the Indianapolis Local Public Improvement Bond Bank, Indiana’s (A1/NR/A) $149.695 million of Series 2019D refunding bonds, subject to the alternative minimum tax, for the Indianapolis Airport Authority project.

Loop Capital Markets priced Atlanta, Georgia’s (Aa2/AA/NR) $103.51 million of water and wastewater revenue refunding bonds.

BofA Securities priced the Chesapeake Bay Bridge and Tunnel District, Virginia’s (Baa2/BBB/NR) $378.14 million of Series 2019 first tier general resolution revenue bond anticipation notes.

Bofa priced and repriced Nuvance Health’s (A3/A-/NR) issue’s $443.715 million of revenue bonds for the Connecticut Health and Educational Facilities Authority and the Dutchess County Local Development Corp.

Citi received the award on a remarketing of New York City’s $200 million (Aa1-VMIG1/AA-A1/AA-F1) of Fiscal 2014 Series I Sub-Series I-3 GOs.

In the competitive arena on Tuesday, Hennepin County, Minnesota, (NR/AAA/AAA) sold $200 million of Series 2019B unlimited tax general obligation bonds. BofA Securities won the deal with a true interest cost of 2.4478%. Proceeds will be used to pay the capital costs of the Metro Green Line Extension Project in the southwest metropolitan area, known as the Southwest LRT project. PFM Financial Advisors is the financial advisor; Dorsey & Whitney is the bond counsel.

Portsmouth, Virginia, (Aa2/AA/AA) sold $129.295 million of Series 2019B taxable GOs. Raymond James won the bonds with a TIC of 2.6017%. Proceeds will be used to advance refund certain outstanding debt. Davenport & Co. is the financial advisor; McGuireWoods is the bond counsel.

"With negative net supply of $14 billion as of Aug.12, the supply-demand imbalance in munis still leads to oversubscription in new issues," said Eric Kazatsky, portfolio manager at Clark Capital Management. "Many deals so far this week were anywhere from 2 to 7 times over in many spots along the curve."

Kazatsky added that on one hand, cheap borrowing rates should be very enticing to municipal issuers. However, those low rates are coming at a time where the SALT cap has made the ability of local taxpayers to broadly subsidize municipal spending very difficult. "Borrowing more debt, especially for non-essential projects, has most likely run into headwinds with taxpayers."

He noted the market is in a lower for longer interest rate environment.

"The increasing amount of global negative rates, non-correlation to equities, and low historical default rates only adds to the attractiveness for municipals both home and abroad," Kazatsky said. "Even in the face of increased issuance, the amount and pace of municipal inflows continues to provide ample demand to absorb a further leg up in supply."

Tuesday’s bond sales

Secondary market

Munis were mostly stronger in late trade on the

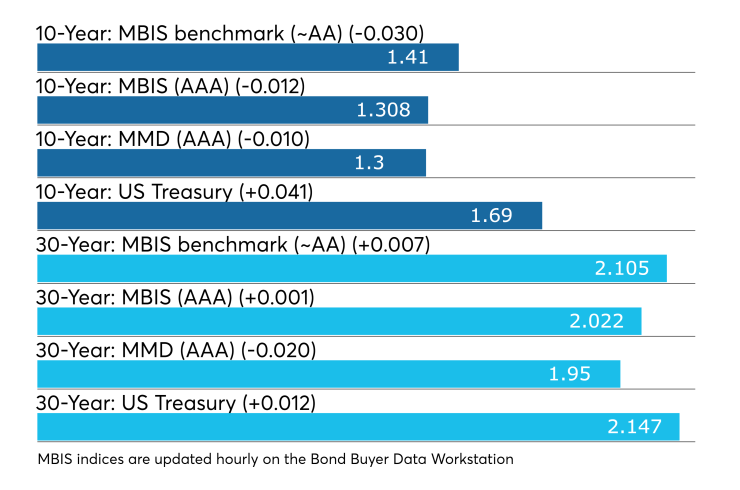

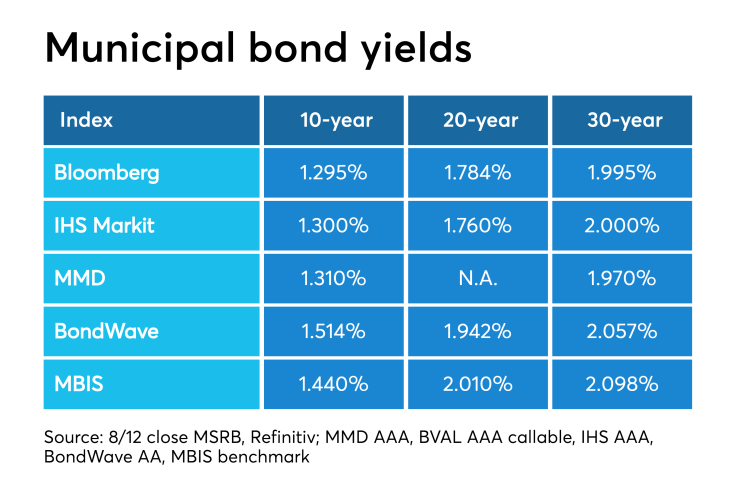

Yields continued to move toward record low levels, according to Refinitiv Municipal Market Data’s AAA benchmark scale. On Tuesday, the 10-year muni GO slipped one basis point to 1.30% and the 30-year yield dropped two basis points to 1.95%. The record low on the 10-year is 1.29% and 1.93% on the 30-year, both set in 2016. Since Jan. 2, the 10-year muni yield has fallen by 97 basis points while the 30-year has dropped by 104 basis points.

"With muni and Treasury yields near all-time lows, one wonders how much lower we can go," said one Southern trader. "Historically, low rates and a flat curve prompted waves of advance refundings, but the tax law change killed that."

He added that the markets have started to price in worst-case scenarios and that any positive news can be a big market mover.

Regarding new issuance, the trader said that "I think the low rates will make issuers move up the timing of financings, but it remains to be seen if it will be a motivator to start new projects."

The 10-year muni-to-Treasury ratio was calculated at 77.4% while the 30-year muni-to-Treasury ratio stood at 91.3%, according to MMD.

Treasuries were weaker as stocks traded higher. The Treasury three-month was yielding 2.005%, the two-year was yielding 1.685%, the five-year was yielding 1.577%, the 10-year was yielding 1.690% and the 30-year was yielding 2.147%.

Previous session's activity

The MSRB reported 28,174 trades Monday on volume of $7.98 billion. The 30-day average trade summary showed on a par amount basis of $10.65 million that customers bought $5.48 million, customers sold $3.18 million and interdealer trades totaled $2.00 million.

California, Texas and New York were most traded, with the Golden State taking 14.01% of the market, the Lone Star State taking 12.517%and the Empire State taking 11.004%.

The most actively traded security was the Colorado Health Facilities Authority’s CommonSpirit Series 2019A2 revenue 3.25s of 2049, which traded 65 times on volume of $43.83 million. The CommonSpirit 3.25s, originally priced at 97.746 to yield 3.37%, traded on Monday at a high price of 100.97 cents on the dollar, a low yield of 3.136% and a low price of 98.25 cents, a high yield of 3.343%, according the MSRB’s EMMA website.

Treasury auctions year bills

The Treasury Department Tuesday auctioned $28 billion of 364-day bills at a 1.800% high yield, a price of 98.180000.

The coupon equivalent was 1.855%. The bid-to-cover ratio was 2.66. Tenders at the high rate were allotted 54.93%. The median yield was 1.750%. The low yield was 1.690%.

Treasury to sell $55B 4-week bills

The Treasury Department said it will sell $55 billion of four-week discount bills Thursday. There are currently $35.001 billion of four-week bills outstanding.

Treasury also said it will sell $40 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.