-

Bond yields are shooting up for the second time in as many months. Federal Reserve Gov. Christopher Waller attributes the volatility to concerns about rising national debt levels.

May 22 -

Democrats on the House Ways and Means Committee announced a new bill that would restore the power of applying tariffs back to Congress amidst accusations of market manipulation and political ineptitude by the Trump administration.

April 10 -

The rising costs of federal debt, an impending budget showdown, and Congressional turmoil is highlighting the complex relationship between Treasury securities and municipal bonds.

February 13 -

-

Economic forecasts include the possibility of higher inflation and slower growth that could stall future cuts to the federal fund rates.

December 5 -

Taxable munis have returned 1.48% month to date and 0.29% year-to-date while investment-grade munis have seen 0.44% returns so far in March and 0.05% year-to-date. USTs are in the black at 1.43% so far this month but returning -1.76% year-to-date while corporate bonds are returning 1.24% in March but -0.46% year-to-date.

March 12 -

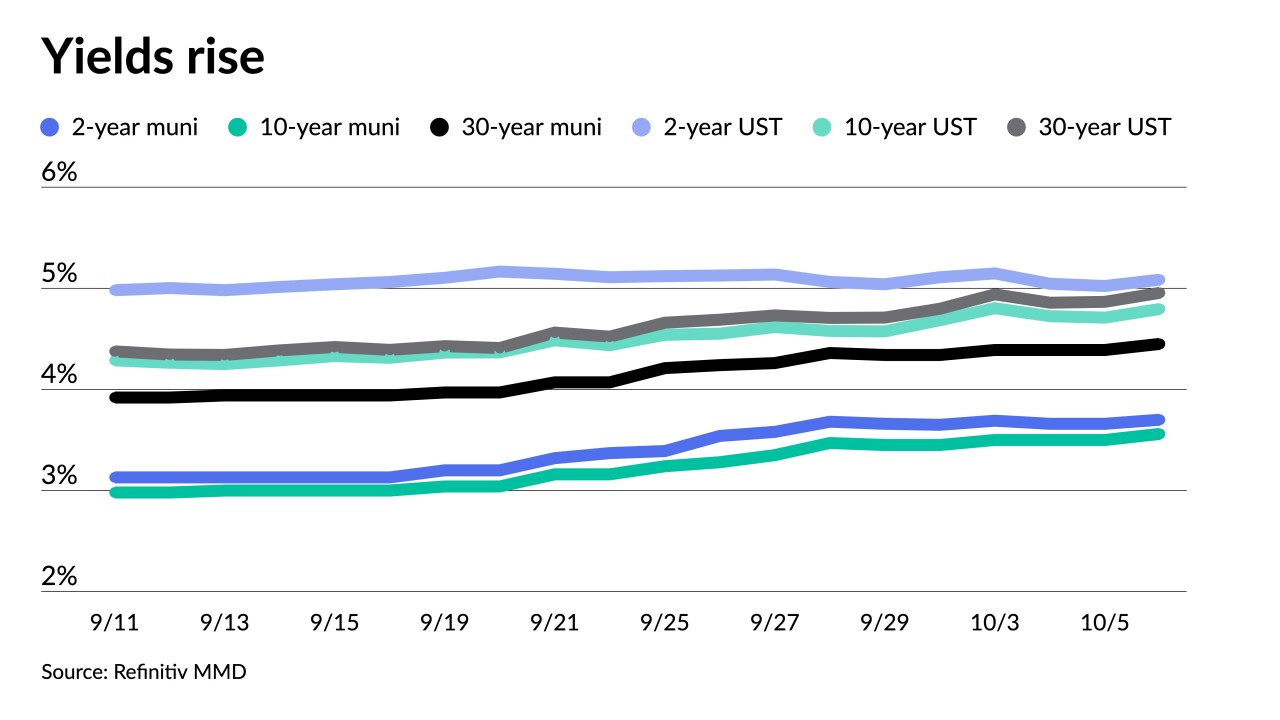

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

Munis saw smaller losses, outperforming a UST sell-off after the employment report came in stronger than expected, leading analysts to suggest Federal Reserve rate cuts may come later than anticipated.

February 2 -

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

October 6 -

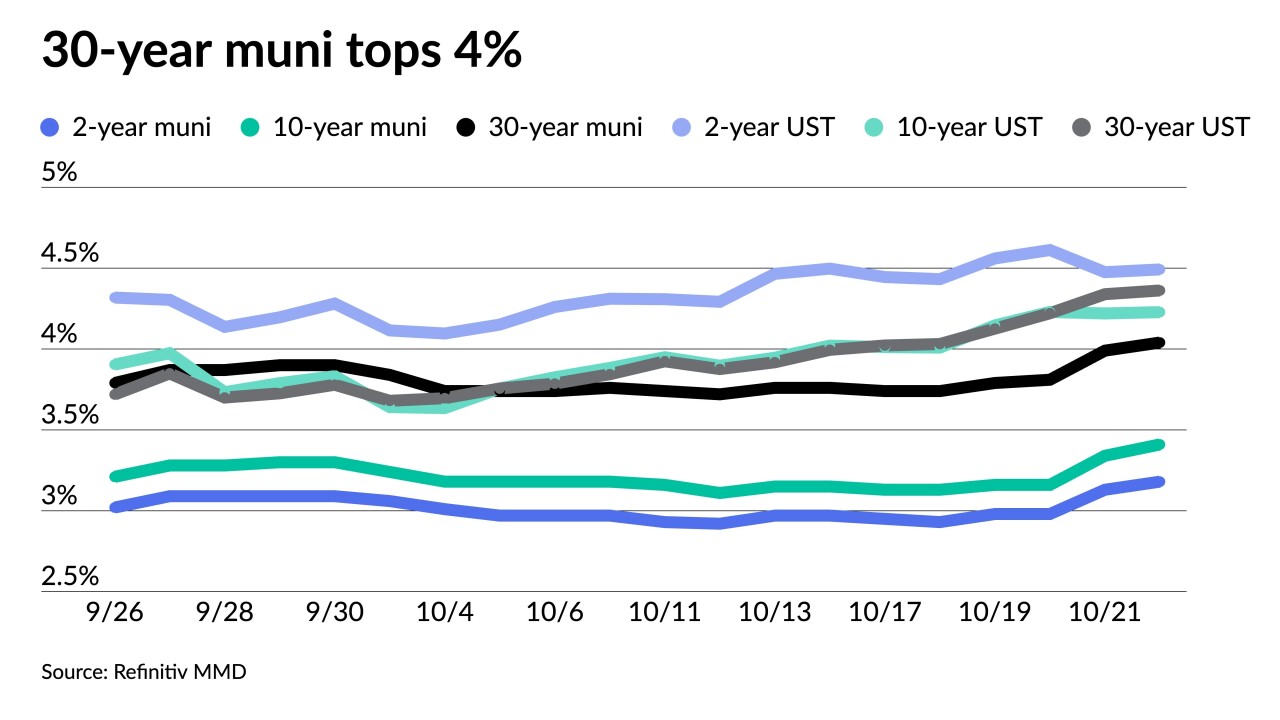

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

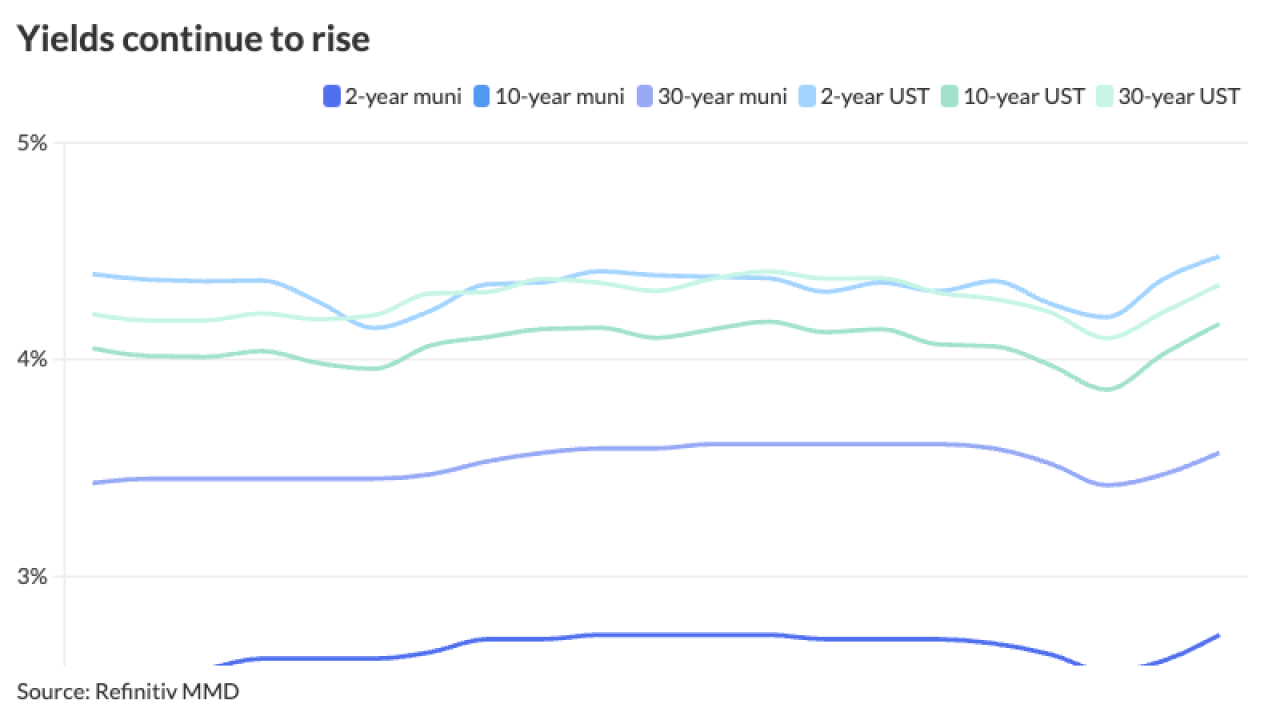

"Bearish Treasury moves have kept some pressure on the muni market and prevented an attempt to rally during the summer season when large redemptions trump issuance," BofA Global Research said in a report.

August 18 -

While it's still relatively early to tell how much — if at all — the muni market will be impacted, Kara South, portfolio manager at GW&K Investment Management, said downgrades of certain municipal bonds are likely to follow.

August 2 -

Matthew Gastall and Daryl Helsing of Morgan Stanley delve into how municipals are performing versus other asset classes, where taxable munis fit and how they see the market performing heading into the summer reinvest. Jessica Lerner hosts. (36 minutes)

June 13 -

The bill passed through the committee on a 21 to 17 vote, over fierce Democratic opposition.

March 9 -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

The 10- and 30-year Treasuries haven't reached these levels since November.

March 2 -

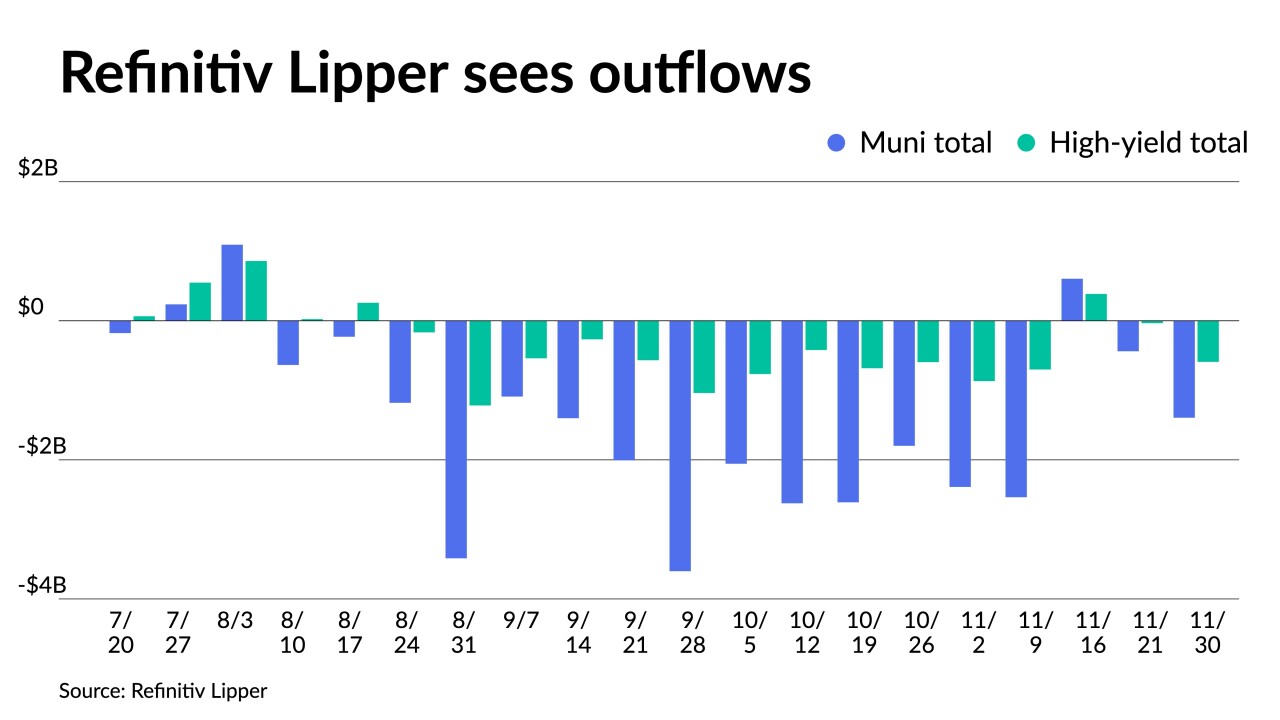

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

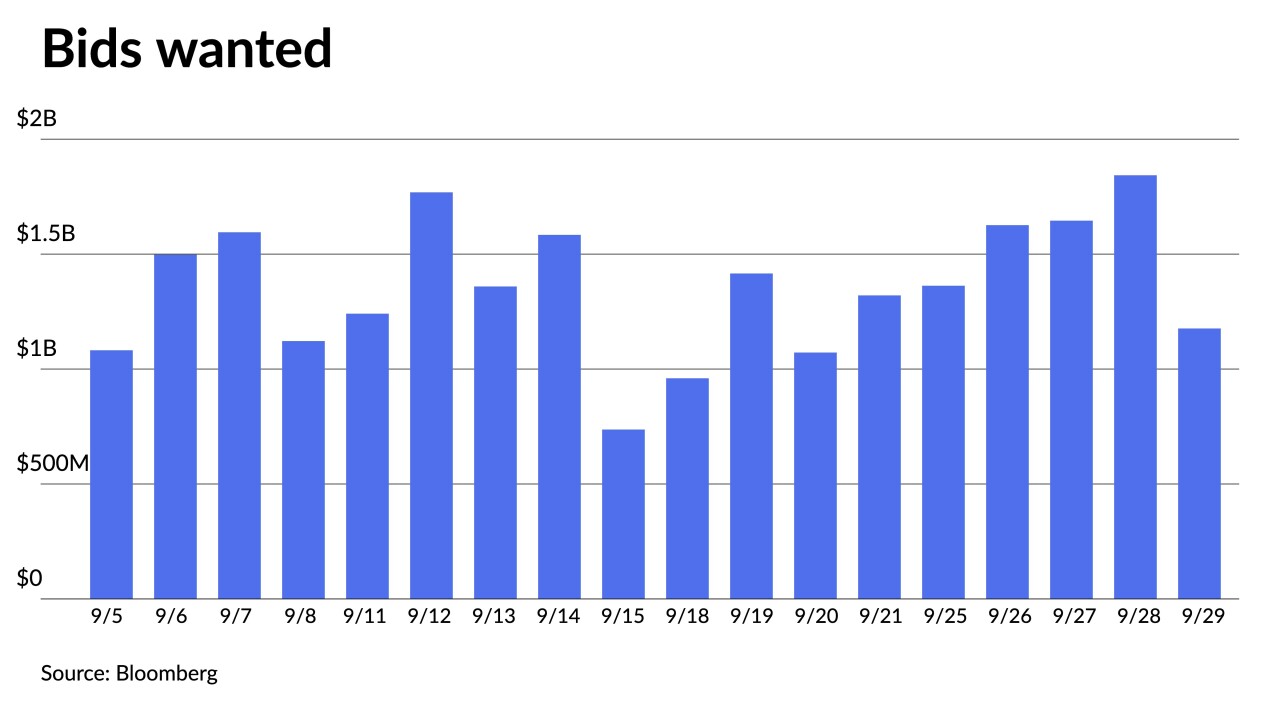

Refinitiv Lipper reported $2.537 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.389 billion the week prior.

November 10 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

New-issue volume grows to $10.7 billion led by a $2.7 billion taxable Massachusetts ESG deal, $1.35 billion of Oklahoma natural gas taxables, $1.25 billion from the Regents of the University of California and $1.1 billion from New York City.

August 12