Munis were mixed Monday while U.S. Treasuries saw larger losses, moving yields to multi-year highs. Equities ended mixed.

Muni yields were cut up to three basis points, depending on the scale, while UST yields rose seven to 11 basis points.

As the 10-year reached a high of 4.684% — the highest level since 2007 — "market players are wondering what role quantitative tightening is having," said José Torres, senior economist at Interactive Brokers.

Indeed, he noted the "$963 billion of balance sheet runoff with more on the way is a significant drag, as the Treasury's largest price-insensitive buyer slowly leaves the table."

International players are also buying less, with "Beijing experiencing deep domestic troubles while Tokyo focuses on buying bonds at home to suppress yields," he said.

"Amidst the headwinds, continued political polarization, sticky inflation, record issuance, eye-watering budget deficits, and uncertain commodity prices, may push the 10-year above 5%," Torres said.

As for munis, "September was not too kind ... as munis lost about 2.93% for the month, bringing year-to-date returns into negative territory for the first time this year as year-to-date returns are now at -1.38%," said Jason Wong, vice president of municipals at AmeriVet Securities.

With the Fed "signaling that rates will remain higher and for longer than expected, investors will continue to wait on the sidelines until volatility subsides," Birch Creek Capital strategists said in a weekly report.

Since the start of September, Wong said "yields have jumped over 57 basis points marking the worst month since September of last year."

Last week, munis fared even worse than USTs, with triple-A yield curves rising up to 29 basis points and "ending the month with the second worst performance since November 2016," according to Birch Creek Capital strategists.

With rates climbing again, Wong said "munis are still attempting to catch up to Treasuries."

With the rise in yields, munis underperformed Treasuries once more but ratios have risen as the 10-year muni to UST ratio is now yielding 75.15%, versus 71.20% a month ago, he said.

The two-year muni-to-Treasury ratio Monday was at 72%, the three-year was at 72%, the five-year at 72%, the 10-year at 74% and the 30-year at 91%, according to Refinitiv Municipal Market Data's 3 p.m., ET, read. ICE Data Services had the two-year at 72%, the three-year at 74%, the five-year at 73%, the 10-year at 75% and the 30-year at 92% at 4 p.m.

Fund outflows intensified last week with Refinitiv Lipper reporting $1.2 billion of outflows, while exchange-traded funds saw inflows fall to $26 million.

This past week marked

Wong expects "heavier outflows to continue which in turn should put more pressure on the market."

"With the heavy outflows and extra spread on new issues, funds continued to turn to short-duration bonds to raise cash in the secondary market," said Birch Creek strategists in a report.

While these bonds "enable funds to monetize fewer losses given the low sensitivity to interest rates, it's resulting in a lengthening of the durations of the remaining portfolios," according to Birch Creek strategists.

As interest rates continue to rise, they will be "watching out for signs of accelerating losses due to duration extensions."

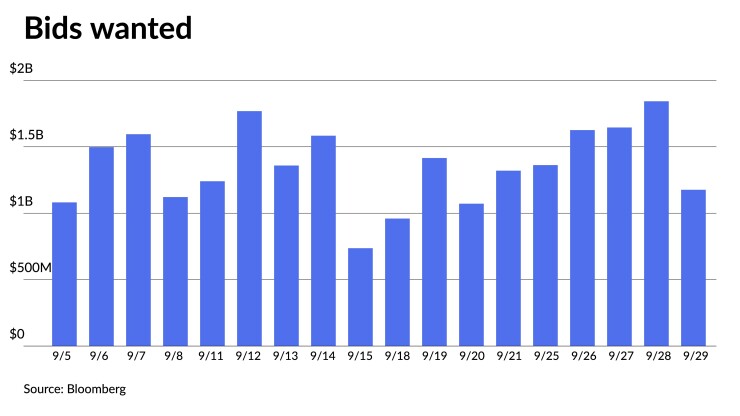

With these sales in mind, bids wanteds rose nearly 30% week over week, while overall trade activity also jumped, they noted.

"With pervasive losses, a major focus of the market has been on tax swaps which has helped prop up trade volumes," they said.

It has also led to "some artificially inflated prices as true bid levels were at times 10-20bps weaker than where swaps were being done," they said.

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

At the start of the year, munis were expensive versus taxables, but "that richness is receding mainly due to plentiful new-issue supply and muted demand," they said.

But while the muni market seems to be on shaky footing, Birch Creek strategists said there "are some positive signs emerging," they said.

The Bond Buyer 30-day visible supply at $13.364 billion.

The technical picture "improves in November through the beginning of the new year and yields are at multi-year highs," they said.

Further, with the recent underperformance, Birch Creek strategists said "valuations of munis relative to other fixed income options has improved."

However, with rising yields, "investors will continue to be skeptical of the markets as inflation continues to be a cause of concern," Wong said.

Secondary trading

DC 5s of 2024 at 3.83%. Maryland 5s of 2024 at 3.71% versus 3.25%-3.28% on 9/14 and 3.28% on 9/12. California 5s of 2025 at 3.68%-3.59% versus 3.58%-3.44% Thursday and 3.62%-3.42% Wednesday.

Maryland 5s of 2027 at 3.53%. Metropolitan Water District of Southern California at 3.29%. Virginia College Building Authority 5s of 2029 at 3.50% versus 3.53% Friday and 3.61% Thursday.

NY Dorm PIT 5s of 2033 at 3.72%-3.71% versus 3.74%-3.73% Thursday and 3.71% Wednesday. Iowa Finance Authority 5s of 2033 at 3.58%-3.57%. Anne Arundel County, Maryland, 5s of 2034 at 3.58%-3.57% versus 3.64%-3.62% original on Thursday.

NYC Municipal Water Finance Authority 5s of 2047 at 4.63% versus 4.65% Friday and 4.52% on 5/25. Massachusetts Transportation Fund 5s of 2051 at 4.63%-4.61% versus 4.53% Friday and 4.31% original on 9/20.

AAA scales

Refinitiv MMD's scale was little changed: The one-year was at 3.70% (unch, no roll) and 3.65% (unch, -1bp Oct. roll) in two years. The five-year was at 3.41% (unch, no roll), the 10-year at 3.45% (unch, no roll) and the 30-year at 4.34% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to three basis points: 3.73% (unch) in 2024 and 3.67% (+2) in 2025. The five-year was at 3.39% (+3), the 10-year was at 3.42% (+3) and the 30-year was at 4.35% (+3) at 4 p.m.

The S&P Global Market Intelligence municipal curve was unchanged: The one-year was at 3.71% in 2024 and 3.66% in 2025. The five-year was at 3.43%, the 10-year was at 3.45% and the 30-year yield was at 4.34%, according to a 3 p.m. read.

Bloomberg BVAL was cut two to three basis points: 3.73% (+2) in 2024 and 3.66% (+3) in 2025. The five-year at 3.38% (+2), the 10-year at 3.45% (+3) and the 30-year at 4.38% (+2) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.109% (+7), the three-year was at 4.887% (+9), the five-year at 4.715% (+11), the 10-year at 4.684% (+11), the 20-year at 5.005% (+9) and the 30-year Treasury was yielding 4.798% (+9) near the close.

Primary to come

The San Diego County Regional Airport Authority (A1//AA-/) is set to price $1.03 billion of senior airport revenue bonds Tuesday. Serials, 2024-2025, 2028-2043, terms 2048, 2053, 2058. Jefferies.

New York City (Aa2/AA/AA/AA+) is set to price $965 million of taxable general obligation bonds Wednesday. Serials, 2025-2038, terms 2046, 2053. Barclays Capital.

The Utility Debt Securitization Authority of New York State (Aaa/AAA//) is set to price $823.3 million of tax-exempt and taxable restructuring bonds Tuesday. J.P. Morgan Securities.

The Omaha Public Power District (Aa2/AA//) is set to price $581.8 million of electric system revenue bonds Tuesday. Serials 2025-2043, terms 2048, 2053. Goldman Sachs & Co. LLC.

Fort Lauderdale, Fla. (Aa1/AA+//) is on tap to price $504.9 million of water and sewer revenue bonds for the Prospect Lake Water Treatment Plant Project Thursday. Morgan Stanley & Co. LLC.

The Tennessee Housing Development Agency (Aa1/AA+//) is set to issue $305 million of residential finance program bonds Tuesday. Serials 2024-2035, terms 2038, 2043, 2048, 2053, 2054. Citigroup Global Markets Inc.

South Carolina's Building Equity Sooner for Tomorrow (Aa2///) is set to price $275.8 million of installment purchase revenue refunding bonds on behalf of the School District of Greenville County, S.C., Wednesday. J.P. Morgan Securities LLC.

The Alameda County, Calif., (Aa1/AA+/AA+/) is set to price $197.3 million of lease revenue refunding bonds for the Highland Hospital Project Thursday. Serials 2024-2034. Citigroup Global Markets Inc.

The Illinois Housing Development Authority (Aaa///) is set to price $178.7 million of revenue bonds Thursday. Serials 2025-2035, terms 2038, 2043, 2047 2053. Wells Fargo Bank.

The Chicago Park District ( /AA-/AA-/AA) is set to price $167.4 million of GO limited tax park bonds and refunding bonds, and unlimited tax and refunding bonds Tuesday. Mesirow Financial Inc.

The Virginia Housing Development Authority (Aaa/AAA//) is set to issue $150 million of taxable commonwealth mortgage bonds Wednesday. Serials 2024-2033, terms 2038, 2043, 2048, 2053. BofA Securities. It will also issue $100 million of non-AMT commonwealth mortgage bonds Wednesday. Serials 2024-2035, terms in 2038, 2043, 2048, 2053.

The New York State Housing Finance Agency (Aa2///) is set to price $149.5 million of affordable housing sustainability revenue bonds Wednesday. Serials 2024-2035, terms 2038, 2043, 2048, 2053, 2058, 2062 2063. Ramirez & Co., Inc.

The Florida Housing Finance Corp. (Aaa///) is set to price $100 million of Series 6 taxable homeowner mortgage revenue bonds Thursday. Serials 2025-2033, terms 2038, 2043, 2048, 2054, 2055. Citigroup Global Markets Inc.

Competitive

Montgomery County, Pa., (Aaa///) will sell $151.1 million of GO debt Tuesday. Serials 2024-2043.

California (Aa2/AA-/AA/) is set to sell a total of $943 million of taxable GOs Wednesday — $440 million maturing serially in 2031 and 2041 and $502 million maturing serially in 2028 and 2031.