After effortlessly taking down $13.2 billion of bonds this past week, muni buyers will see another above-average issuance week with $7.6 billion. It will not be nearly enough to “feed the beast."

There will be $5.70 billion of negotiated deals slated for next week and $1.95 billion of competitive sales, equating to more than the yearly average of $5.5 billion. The calendar features 18 deals $100 million or larger, including one billion-dollar deal.

“Everything was flying off the shelves this past week, and I don’t see it ebbing, at least not yet,” said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. “This pick up in supply is nice, but it is not enough to feed the beast of demand.”

Heckman noted that he did not participate in any of the deals that came during the busiest week of the year, as allocations would have been meager, so he focused on finding deals in the secondary as much as he could.

“The availability of bonds is shrinking, week by week we continue to see more bonds get called and mature than we do new bonds coming into the market,” he said. “The calling of bonds will only accelerate in the coming months with yields where they are at.”

Heckman added that money managers got a slap in the face when they saw the 10-year drop all the way down to 1.60% at one point and that it was a wake-up to extend duration.

“We continue to point to the long end of the curve, as opposed to those who did not calculate risks of lower rates and are too focused on the short end of the curve.”

He also said that the fact that we got flooded with issuance and then saw yields go lower, “speaks to the strength of the market right now.”

Barclays is expected to price the

Goldman Sachs is expected to price the Lower Alabama Gas District’s (A3/NR/A) $639.76 million of revenue bonds for Project No. 2.

Citi is slated to run the books on San Antonio’s (Aaa/AAA/AA+) $461.87 million of general improvement and refunding bonds and combination tax and revenue certificates of obligation on Tuesday.

In the competitive arena, Maryland (Aaa/AAA/AAA) is scheduled to sell $500 million in three separate tax-exempt and taxable sales on Wednesday.

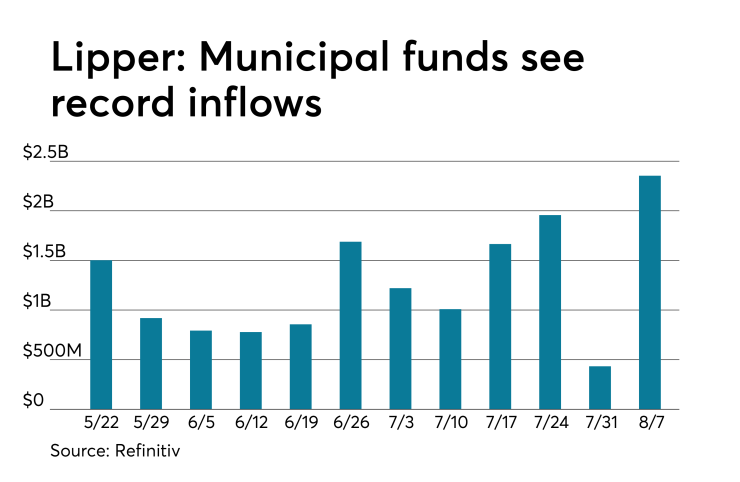

Lipper: Record amount of inflows into munis

For 31 straight weeks investors have poured cash into municipal bond funds, according to data from Refinitiv Lipper. Tax-exempt mutual funds that report weekly received $2.353 billion of inflows in the week ended Aug. 7 after inflows of $433.609 million in the previous week. This most recent report marks a record for biggest amount of weekly inflows into municipals since data started being tracked. There was also a record number of outflows from equities this week in 2019, as investors pulled $25.187 billion from equity funds.

Exchange-traded muni funds reported inflows of $288.027 million after inflows of $41.597 million in the previous week.

Ex-ETFs, muni funds saw inflows of $2.065 billion after inflows of $392.011 million in the previous week.

The four-week moving average remained positive at $1.602 billion, after being in the green at $1.266 billion in the previous week.

Long-term muni bond funds had inflows of $1.341 billion in the latest week after inflows of $296.280 million in the previous week. Intermediate-term funds had inflows of $413.956 million after inflows of $91.159 million in the prior week.

National funds had inflows of $2.050 billion after inflows of $307.270 million in the previous week. High-yield muni funds reported inflows of $634.617 in the latest week, after inflows of $87.648 million the previous week.

Secondary market

Munis were mixed in late trading on the

Munis were mixed on Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year was steady, while the 30-year was down two basis points to 1.33% and 1.99%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 76.4% while the 30-year muni-to-Treasury ratio stood at 88.4%, according to MMD.

Treasury yields were mixed and stocks were also, as the Dow was slightly in the green while Nasdaq and S&P 500 were in the red. The Treasury three-month was yielding 1.999%, the two-year was yielding 1.628%, the five-year was yielding 1.556%, the 10-year was at 1.731% and the 30-year was yielding 2.241%.

Previous session's activity

The Municipal Securities Rulemaking Board reported 34,139 trades Thursday on volume of $20.259 billion, making it the busiest trading day of 2019. The 30-day average trade summary showed on a par amount basis of $10.87 million that customers bought $5.67 million, customers sold $3.19 million and interdealer trades totaled $2.01 million.

New York, Texas and California were most traded, with the Empire State taking 12.899% of the market, the Lone Star State taking 12.935% and the Golden State taking 14.596%

The most actively traded security was the Colorado Health Facilities Authority CommonSpirit Health 4s of 2049, which traded 45 times on volume of $89.77 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.