Municipal bonds continued their rally on Wednesday, pushing tax-free yields to their lowest levels ever.

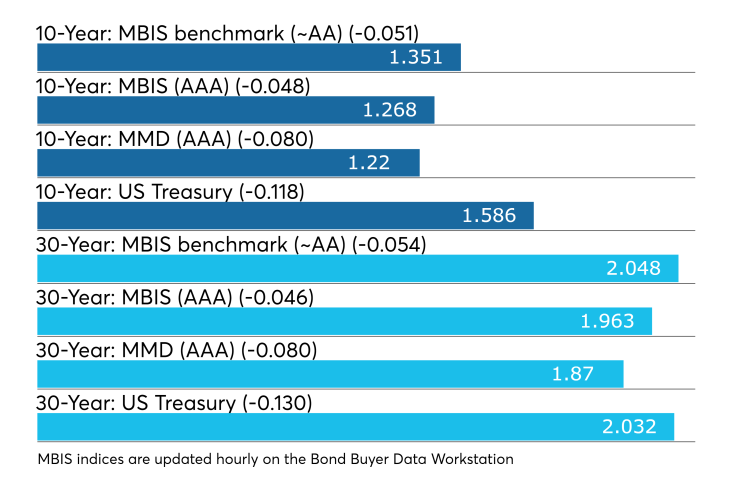

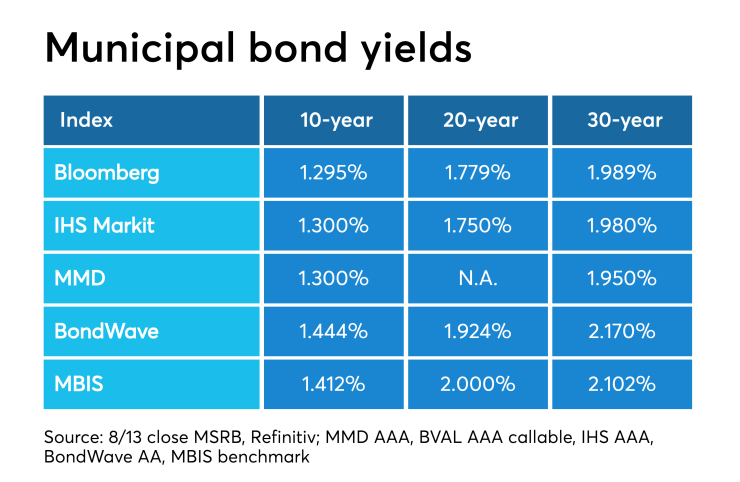

The 10- and 30-year muni GO both dropped eight basis points to 1.22% and 1.87%, respectively, according to Refinitiv Municipal Market Data’s AAA benchmark scale. The prior low records were set during the summer of 2016, according to MMD, when the 10-year hit 1.29% on June 27, 2016 and the 30-year fell to 1.93% on July 6, 2016.

Since the beginning of the year, the 10-year muni yield has fallen by 105 basis points while the 30-year has dropped by 112 basis points.

"The record lows in municipal yields is symptomatic of the pattern that we are seeing in the Treasury market where the 30-year Treasury yield has breached an all-time low, dropping below the level seen in 2016," said Vikram Rai, Head of Citi's Municipal Strategy group. "Front and intermediate municipal-Treasury yield ratios remain extremely rich on a tax-adjusted basis. But, the round-trip costs for exploiting the mispricing are too high in the face of the ultra-low yields. Thus it is possible that two-year and five-year ratios could remain near record lows though we could see some upward movement in 30-year ratios if we see a pick-up in supply in September."

Morgan Stanley was unimpressed with the recent yield slide.

“Though rates are lower, one-year-10-year MMD remains historically flat: carry and roll does not yet look attractive in our view. Unless cash rates fall substantially from here, we will continue to prefer a duration-neutral barbell (mixing 0-4-year with 17-22-year) to a front-end ladder,” Morgan Stanley Strategists Mark Schmidt and Michael Zezas said in a Wednesday report.

“Will munis become more volatile as the summer ends? We only find mixed evidence that excess returns weaken in the fall. Although munis are fully valued, seasonality factors are not reliable enough to be outright short the market. Technicals may become less favorable in the fall, but gross supply appears manageable. In fact, year to date gross supply has run below our $358 billion full-year forecast,” they said.

Also on Wednesday, for the first time since 2007, the yield on the two-year U.S. Treasury note moved higher than the yield on the 10-year UST. Many market participants see this

In late trading, the Treasury three-month was yielding 1.962%, the 2-year was yielding 1.587%, the 5-year was yielding 1.497%, the 10-year was yielding 1.586% and the 30-year was yielding 2.032%.

"The ICE muni yield curve is as much as six basis points lower, an impressive move, but lagging Treasuries again," ICE Data Services said in a market comment. "The front end, in an effort to keep from inverting for the first time since September 1966, is flat out to five years. High-yield and tobacco sectors are three basis points lower as well. Taxable yields are down nine basis points, mirroring the move in Treasuries."

The 10-year muni-to-Treasury ratio was calculated at 77.2% while the 30-year muni-to-Treasury ratio stood at 92.6%, according to MMD.

On the

Equities traded sharply lower throughout the day on recession and trade war worries.

"The equity meltdown and bond grab also substantially increased the odds of a 50 basis point Fed rate cut in September according to market pricing and the CME Fed Watch tool. Odds of a 50 basis point rate reduction now stand at 23.5% for September versus just 3.8% yesterday afternoon following the stock rally," MMD said in a late market comment.

“At some point, we could decouple from Treasuries and widen out if the rate rally continues," a Southwest traded said. “If that happens, I believe munis will get their second wind. The challenge is going to be how we hedge out that risk if buyers step back and muni/Treasury ratios widen.”

Primary market

Barclays Capital priced the Airport Commission of the City and County of San Francisco’s (A1/A+/A+) $1.156 billion of revenue bonds for the San Francisco International Airport.

Barclays also priced Montgomery County, Ohio’s (Baa1/NR/A) $283.875 million of Series 2019A hospital facilities revenue refunding bonds for the Premier Health Partners Obligated Group.

Goldman Sachs priced the Private Colleges and Universities Authority, Ga’s (Aa2/AA/NR) $258.79 million of Emory University revenue bonds.

Citigroup priced the Los Angeles County Public Works Authority, California’s (Aa2/AA+/AA) $251.89 million of Series 2019E1 and Series 2019E2 lease revenue bonds.

BofA priced Hawaii’s (A2/A+/A) $194.735 million of taxable Series 2019A airports system customer facility charge revenue bonds.

In the competitive arena, Maryland (Aaa/AAA/AAA) sold about $550 million of state and local facilities loan of 2019 general obligation bonds in three sales.

BofA Securities won the $251.325 million of Second Series A Bidding Group 2 GOs with a true interest cost of 1.9848%. Morgan Stanley won the $248.675 million of Second Series A Bidding Group 1 GOs with a TIC of 1.1337%. And Raymond James & Associates won the $50 million of Second Series B taxable GOs with a TIC of 1.6095%. Public Resources Advisory Group is the financial advisor; Ballard Spahr is the bond counsel. Proceeds of the Series A and B bonds will be used for a variety of public purposes.

Delaware (Aaa/AAA/AAA) sold $104.395 million of Series 2019A GOs. JPMorgan Securities won the bonds with a TIC of 1.0893%. PFM Financial Advisors is the financial advisor; Saul Ewing Arnstein is the bond counsel. Proceeds will be used to current refund certain outstanding debt.

Wednesday’s bond sales

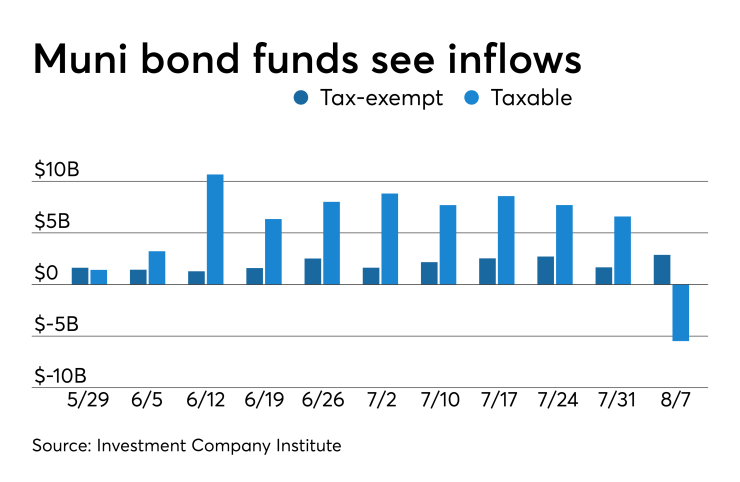

ICI: Muni funds see $2.9B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.872 billion in the week ended Aug. 7, the Investment Company Institute reported on Wednesday.

It was the 31st straight week of inflows into the tax-exempt mutual funds and followed a revised inflow of $1.660 billion in the previous week.

Long-term muni funds alone saw an inflow of $2.441 billion after a revised inflow of $1.542 billion in the previous week; ETF muni funds alone saw an inflow of $432 million after an inflow of $119 million in the prior week.

Conversely, taxable bond funds saw combined outflows of $5.484 billion in the latest reporting week after revised inflows of $6.589 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $25.596 billion after revised inflows of $10.721 billion in the prior week. Equity funds were the biggest losers, seeing $22.601 billion of outflows during the latest reporting week.

“Inflows continue in our space both from domestic and foreign buyers,” said the Southwest trader. "I also think the U.S. is one of the last markets where yields have room to run and that includes munis.”

Previous session's activity

The MSRB reported 30,446 trades Tuesday on volume of $9.81 billion. The 30-day average trade summary showed on a par amount basis of $10.60 million that customers bought $5.39 million, customers sold $3.21 million and interdealer trades totaled $2.00 million.

California, Texas and New York were most traded, with the Golden State taking 13.745% of the market, the Lone Star State taking 11.484% and the Empire State taking 11.051%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured zeros of 2046, which traded 49 times on volume of $58.50 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.