Issuers and buyers will both be watching the direction yields take this week as the 30-year municipal bond slips beneath the 2% threshold and 10-year heads toward record-low territory.

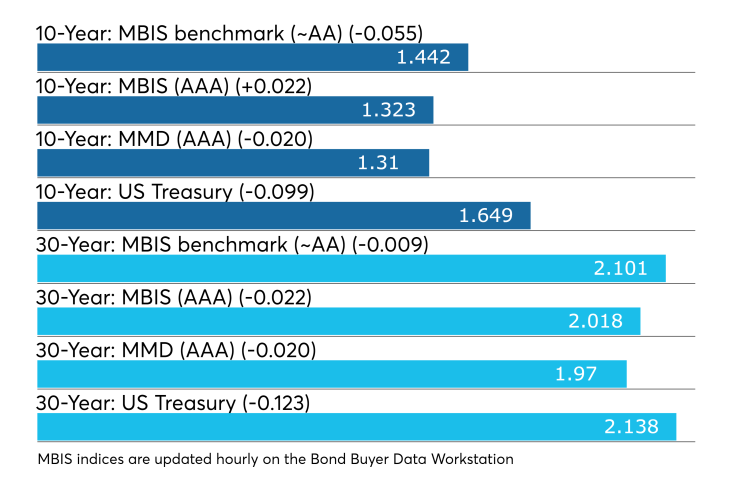

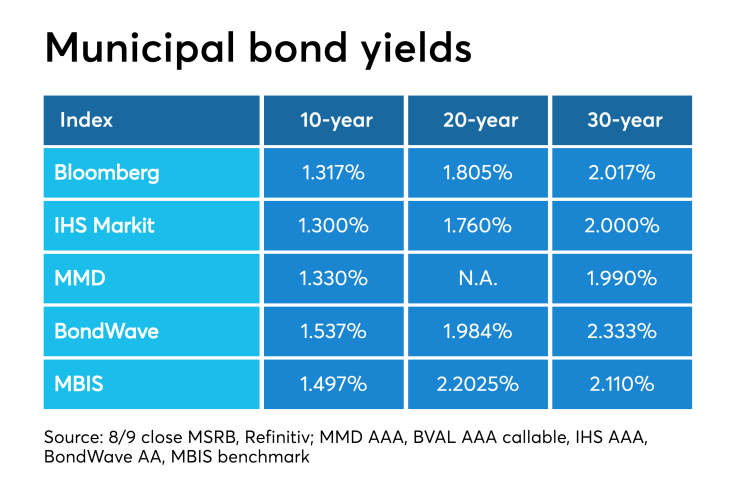

On Monday, the 10-year general obligation on Refinitiv Municipal Market Data’s AAA scale fell to 1.31%, two basis points away from the record low while the 30-year muni yield dropped to 1.97%, four basis points above the record low. The record low yield for the 10-year on MMD's scale is 1.29%, which was set on June 27, 2016; the record low on the 30-year AAA GO is 1.93%, hit on July 6, 2016.

Writing in a weekly Court Street Group Research market commentary, George Friedlander noted the recent drop in bond yields was due to several factors, such as geo-political factors like Sino-U.S. trade tensions and the weakening of economies around the world.

“Clearly, this dramatic set of yield-sapping patterns has moved into the U.S. generally, but also into munis specifically — to an even larger degree. Five-, 10- and 30-year yields, according to IHS Markit are down 101 basis points, 120 basis points and 106 basis points, respectively,” he wrote. “Despite a voracious drop in yields on Treasuries, munis have outperformed, with ratios as a percentage of Treasury yields down from 71% to 63%, 84% to 75%, and 98% to 88%, respectively in those three maturities.”

He noted that with such low yields, this was the time for state and local governments to take advantage of the low-cost of financing.

“…this is a spectacular opportunity for state and local governments to start on major projects, at yields close to or at historical lows, and yields as a percentage of Treasury yields also close to recent lows, all along the yield curve,” Friedlander wrote. “…governors in many states are beginning to become more proactive in starting needed infrastructure projects, rather than waiting on the Federal government. It will be interesting to see whether this new collapse in borrowing costs leads to a further rebound in the initiation of needed projects.”

Primary market

On Tuesday, Citigroup is set to price San Antonio, Texas’ (Aaa/AAA/AA+) $462 million of Series 2019 general improvement and refunding bonds, combination tax and revenue certificates of obligation and tax notes.

Loop Capital Markets is expected to price Atlanta, Georgia’s (Aa2/AA/NR) $108 million of water and wastewater revenue refunding bonds.

And Citi is set to price the Indianapolis Local Public Improvement Bond Bank, Indiana’s (A1/NR/A) $107 million of Series 2019D refunding bonds, subject to the alternative minimum tax, for the Indianapolis Airport Authority project.

In the competitive arena on Tuesday, Hennepin County, Minnesota, (NR/AAA/AAA) will sell $200 million of Series 2019B unlimited tax general obligation bonds. Proceeds will be used to pay the capital costs of the Metro Green Line Extension Project in the southwest metropolitan area, known as the Southwest LRT project. PFM Financial Advisors is the financial advisor; Dorsey & Whitney is the bond counsel.

Portsmouth, Virginia, (Aa2/AA/AA) is selling $127.85 million of Series 2019B taxable GOs. Proceeds will be used to advance refund certain outstanding debt. Davenport & Co. is the financial advisor; McGuireWoods is the bond counsel.

Last week's actively traded issues

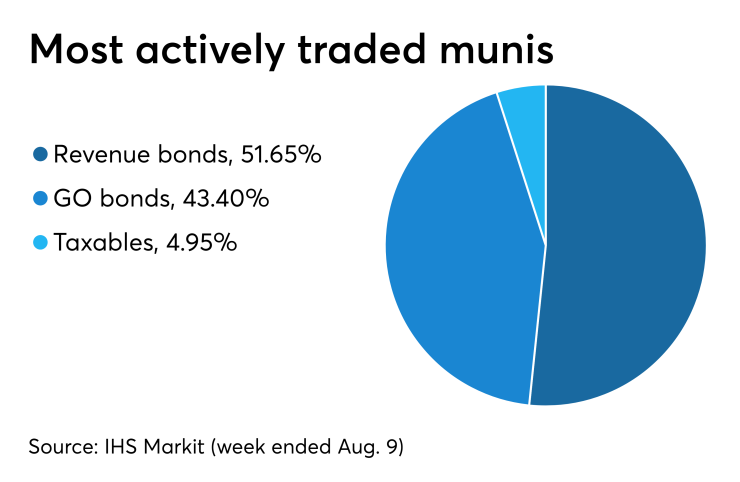

Revenue bonds made up 51.65% of total new issuance in the week ended Aug. 9, down from 51.87% in the prior week, according to

Some of the most actively traded munis by type in the week were from California, Colorado and Texas issuers.

In the GO sector, the Oakland Unified School District, Calif., 3s of 2040 traded 45 times. In the revenue bond sector, the Colorado Health Facilities Authority 4s of 2049 traded 94 times. In the taxable bond sector, the Dallas-Ft. Worth International Airport, Texas, 3.144s of 2045 traded 74 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended Aug. 9, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 26 unique dealers. On the ask side, the California taxable 7.5s of 2034 were quoted by 57 dealers. Among two-sided quotes, the COFINA revenue 5s of 2058 were quoted by 16 dealers.

Secondary market

Munis were stronger late trade on the

The 10-year muni-to-Treasury ratio was calculated at 79.8% while the 30-year muni-to-Treasury ratio stood at 92.5%, according to MMD.

Treasuries were stronger as stocks traded lower. The Treasury three-month was yielding 1.989%, the two-year was yielding 1.584%, the five-year was yielding 1.490%, the 10-year was yielding 1.649% and the 30-year was yielding 2.138%.

Previous session's activity

The MSRB reported 24,758 trades Friday on volume of $9.42 billion. The 30-day average trade summary showed on a par amount basis of $10.71 million that customers bought $5.55 million, customers sold $3.16 million and interdealer trades totaled $2.00 million.

California, New York and Texas were most traded, with the Golden State taking 15.541% of the market, the Empire State taking 13.921% and the Lone Star State taking 12.55%.

The most actively traded security was the Compton Unified School District, California, GO Series 2019B 4s of 2049, which traded 18 times on volume of $32.15 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $42 billion of three-months incurred a 1.960% high rate, down from 1.990% the prior week, and the $42 billion of six-months incurred a 1.890% high rate, off from 1.950% the week before.

Coupon equivalents were 2.003% and 1.940%, respectively. The price for the 91s was 99.504556 and that for the 182s was 99.044500.

The median bid on the 91s was 1.935%. The low bid was 1.900%. Tenders at the high rate were allotted 64.54%. The bid-to-cover ratio was 2.99.

The median bid for the 182s was 1.875%. The low bid was 1.845%. Tenders at the high rate were allotted 83.55%. The bid-to-cover ratio was 3.06.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.