-

Sale of the tax-exempt notes is expected on May 9 and proceeds will support improvements to educational technology in school's statewide.

May 2 -

The bond market is not an inherently racist market but, it does not exist in isolation from society at large. As a result, it has acted against the financial interests of municipalities whose residents are predominantly Black.

May 2 ArentFox

ArentFox -

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1 -

Public school districts account for most of the bonds on ballots as some need to finance new facilities to accommodate rising enrollment.

May 1 -

The Jacksonville office is the firm's first in Florida and 28th location in the United States.

May 1 -

Indianapolis Public Schools wants $410 million for projects throughout the district with 23 schools in line for improvements.

April 28 -

It's one of four state cases accusing Wall Street banks of a "robo-resetting" scheme that kept interest on variable-rate debt artificially high.

April 28 -

The state's record per-pupil spending counteracts concerns over enrollment declines.

April 28 -

Total volume for the month was $30.599 billion in 577 issues, down from $40.423 billion in 900 issues a year earlier. Total issuance year-to-date is at $107.626 billion, falling 25.2% from the same period of 2022.

April 28 -

One of the largest P3s in the university energy space has landed in court three years into a 50-year contract.

April 26 -

While the system took a hit during the COVID-19 pandemic, total traffic hit 94% of pre-pandemic levels in 2022. Traffic for the first two months of 2023 was 99% of levels in the same period of 2019.

April 25 -

Except for the riskiest sectors, high-yield credit fundamentals appear to be strong, but rising interest rates and fund outflows are dampening primary and secondary market activity.

April 24 -

The $7 billion portfolio consists of highly rated, lower-coupon muni debt. It is unlikely to be a single auction and the firm is currently circulating the list on the Street to gauge interest.

April 20 -

The taxable bonds would finance a bottling and other facilities, which would be leased to a private business.

April 20 -

Neal Pandozzi, a partner at the law firm of Bowditch & Dewey, talks with Chip Barnett about what environmental social and governance really means for public finance, separating politics from policy, polemics from principles. (34 minutes)

April 18 -

A John Miller-less speculative bond market may mean more diversification and price transparency, say some investors.

April 14 -

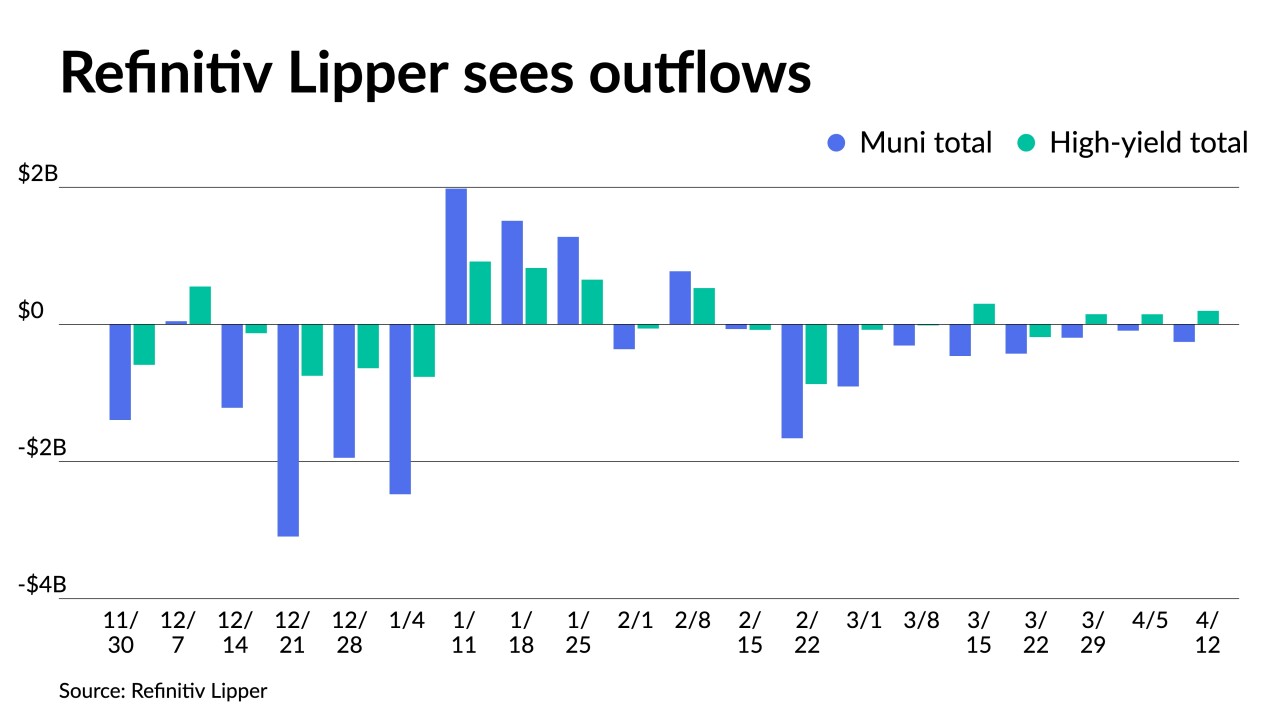

For the week ending Wednesday, outflows intensified as Refinitiv Lipper reported $255.794 million was pulled from municipal bond mutual funds after $91.713 million of outflows the week prior. High-yield saw inflows.

April 13 -

The Securities and Exchange Commission will host its Municipal Securities Disclosure Conference May 10

April 13 -

Ongoing litigation and a state investigative audit could impact bonds for a $5 billion expansion even if the debt is validated by the Oklahoma Supreme Court.

April 12 -

Brian Wynne joins Jefferies as co-head of the municipal syndicate, while Morgan Stanley continues to see turnover in its muni ranks.

April 12