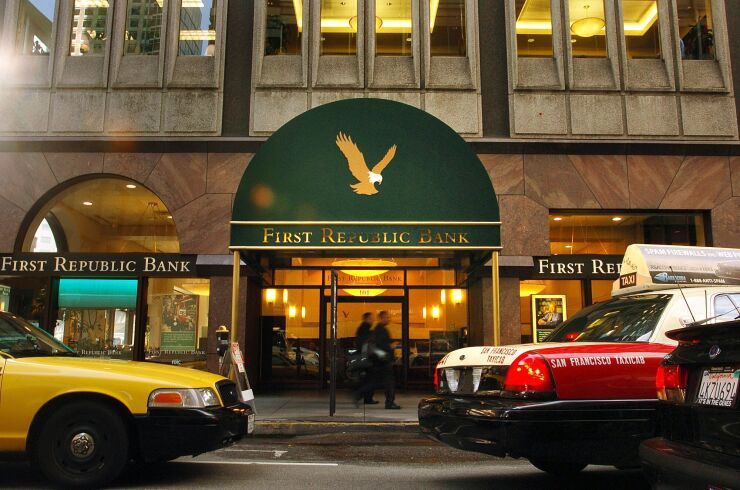

JPMorgan Chase & Co.'s purchase of First Republic Bank Monday brought some relief to municipal market participants worried that FRB's sizable municipal portfolio would flood a market already acting cool toward a much smaller portfolio from the now-defunct Silicon Valley Bank.

JPMorgan's move injected a measure of certainty over the near-term fate of FRB's $19.4 billion muni portfolio, though the latest bank collapse raises the specter of future liquidated bond holdings from other struggling banks, market participants said. Sector turmoil may also dampen banks' appetite to buy more bonds in the future as well, participants said.

"It's potentially a strong positive for the market in that it averts a strong negative of the bonds having to be liquidated in the open market," said Matt Fabian, partner at Municipal Market Analytics. "In general, none of this is good for the muni bond market, but at least here we have some hope that it won't be an immediate negative impact."

The

It's the second-largest bank failure in U.S. history by assets, according to the FDIC, and

First Republic held $19.4 billion of municipal bonds as of Dec. 31, up from $8.19 billion in 2019, according to its most recent filing, making it the third-largest bank holder of municipal bonds in the fourth quarter of 2022.

JPMorgan purchased all of FRB's securities, including its full bond portfolio, a bank spokesman confirmed Monday, declining to comment about what the banking giant plans to do with its new holdings.

FRB's sizable portfolio consists largely of high-quality, long-duration bonds, like SVB's $7 billion portfolio, market participants said.

"JPMorgan just acquired high-quality muni bonds trading at deep discounts well below any type of recovery value," said James Pruskowski, chief investment officer at 16Rock Asset Management who wrote an

There should not be any material dislocations to the muni market, according to Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co.

"Assuming that these securities will be acquired at discounted levels, there is probable motivation for JPMorgan to largely hold these muni positions with a degree of attention paid to credit and structure," Lipton said.

With concerns eased about the immediate fate of the FRB portfolio, the fate of SVB's $7 billion portfolio remains less clear amid reports that it has struggled to attract bids. The

Like FRB, the portfolio consists largely of high-quality paper, investors said. The problem is the overwhelming amount of low coupons. Traditional buyers of low-coupon bonds — banks and mutual funds — are not in the market to buy right now, participants said.

SVB's bond lists have been circulating for a couple weeks and "a lot of the dealers are interested in getting involved," said Dan Solender, partner and director of tax free fixed income at Lord Abbett. "Given how thin the primary market has been, there should be sufficient interest if they sell at the right pace and pick the moments when it is good to sell."

The holdings "consist of structure, not credit risk, which likely will require deep concessions relate to [evaluations] given liquidity and U.S. de minimus tax risk," Pruskowski said. To get the bonds sold, BlackRock should shop them to global buyers or even the municipalities that floated them in the first place, he said.

The low-coupon bonds "are going to be very difficult to sell," predicted Matt Posner, principal at Court Street Group. "And when they are sold, it will be at discounts."

In a note Monday, Barclays said it remains "cautious on low-coupon debt," which has become richer compared to 5% coupons. Meanwhile, the bank said, "a substantial portion of muni portfolios of the failed banks that are set to be liquidated consist of long-dated, low-coupon bonds that would create an overhang for the secondary market."

Structure questions aside, buy-siders said they have few concerns over the credit quality of the muni sectors.

"We continue to posit that the muni asset class is well-positioned ahead of an anticipated recession with respect to credit, offering defensive attributes to an investment portfolio," Lipton said.

"The day-to-day municipal market is likely to remain close to unchanged, all things being equal," Tom Kozlik, managing director and head of public policy and municipal strategy at Hilltop Securities Inc. said Monday. "If anything, I think the way the municipal market has continued to function almost unbothered reinforces the stability of public finance."