-

Increasing capital requirements for banks may incentivize them to buy Treasuries over other assets, including munis, said market participants.

December 20 -

U.S. regulators' swift action in March to ring-fence the banking sector after the collapse of Silicon Valley Bank might have had an unintended consequence of driving cash out of bond funds by enhancing the appeal of deposits, two New York Fed researchers say.

November 28 -

In a speech, the Federal Reserve Board governor said tighter monetary policy is not to blame for the volatility seen in the banking system this spring.

June 16 -

House Republicans are seizing on the debt ceiling crisis to hammer home criticisms of economic policy.

June 6 -

The New Mexico treasurer recently sent an alert to local governments warning that some are bypassing state banking rules on public deposits.

May 26 -

Banks reduced their quarterly muni holdings during the first quarter at the fastest rate in 20 years, per Municipal Market Analytics.

May 12 -

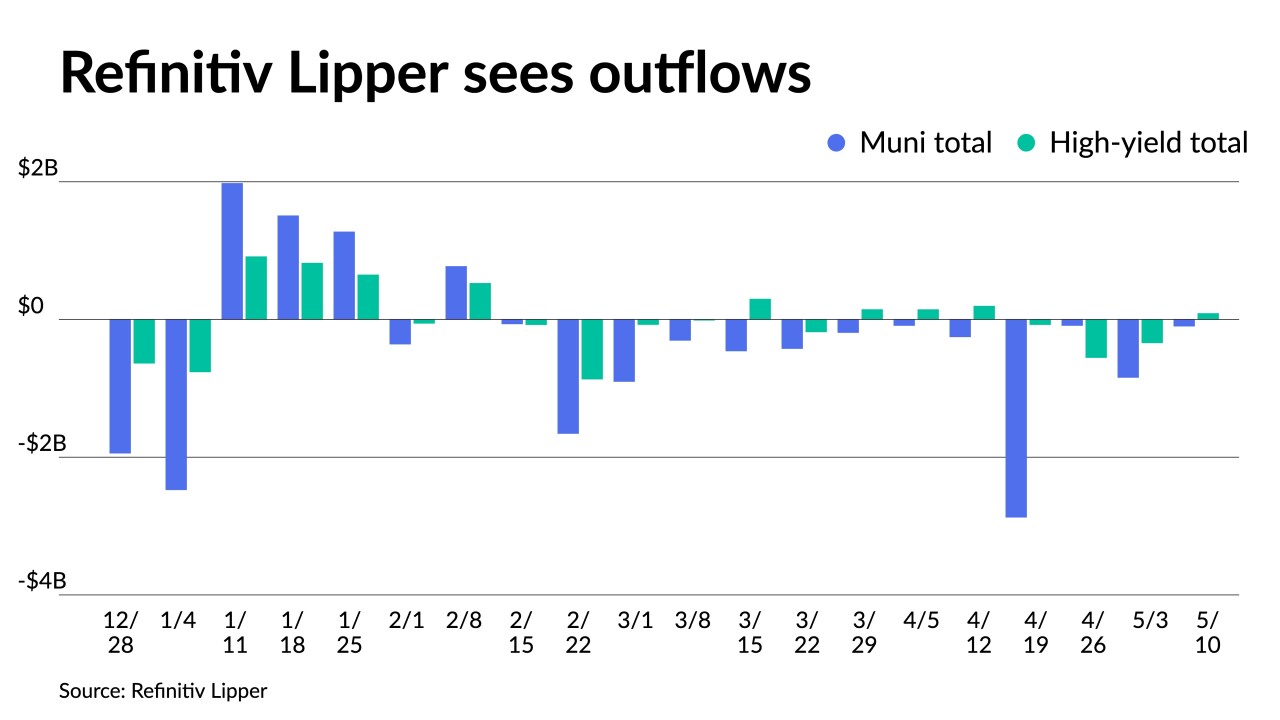

Outflows were seen again from municipal bond mutual funds, though they lessened this week as Refinitiv Lipper reported $101.664 million was pulled as of Wednesday.

May 11 -

The Federal Reserve took action against a small bank in southern Illinois whose exposures to interest rate changes left it with negative equity last year. The enforcement action comes as regulators review their oversight practices following Silicon Valley Bank's failure.

May 5 -

"We need to have the debt ceiling raised quickly with close to $30 trillion in debt at risk," said Steve Mnuchin, the former treasury secretary.

May 3 -

Municipals were in the red to close out April, down 0.2%, per the Bloomberg Municipal Index, but are in the black 2.5% year-to-date.

May 1 -

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1 -

First Republic Bank was shuttered by regulators early Monday, and all its deposits and most of its assets were acquired by JPMorgan. San Francisco-based First Republic was undone by low-rate mortgages it made to its wealthy customers as well as by the fallout from last month's banking crisis.

May 1 -

The $7 billion portfolio consists of highly rated, lower-coupon muni debt. It is unlikely to be a single auction and the firm is currently circulating the list on the Street to gauge interest.

April 20 -

The decrease in long-term interest rates this year has helped banks' bond portfolios recover a bit. Some of them may consider restructuring their securities portfolios in the short run, and longer-term changes are also possible as the fallout from last month's crisis continues.

April 12 -

Municipals' strong fundamentals and high credit quality combined with market inefficiencies and dislocations present opportunities.

March 27 -

Yields on top-rated municipal bonds fell as much as nine basis points on Friday as bank contagion fears resurfaced and investors looked to safe-haven securities. The primary calendar is rebounding, with volume rising to an estimated $5.4 billion in the week ahead.

March 24 -

Municipals should continue to be part of banks' high-quality portfolio of assets, but some think ownership may be curtailed by the banking collapse.

March 21 -

"Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security," said Gov. Ron DeSantis.

March 21 -

The reverberations from the Silicon Valley Bank and Signature Bank failures make the outcome of this week's Federal Open Market Committee meeting unpredictable.

March 20 -

Governments across the Northeast announced support for emerging industries affected by the collapse of Silicon Valley Bank and Signature Bank.

March 17