Turmoil in the bank sector may accelerate concentration of the municipal bond buyer base, as banks shed muni holdings and pull back from buying more.

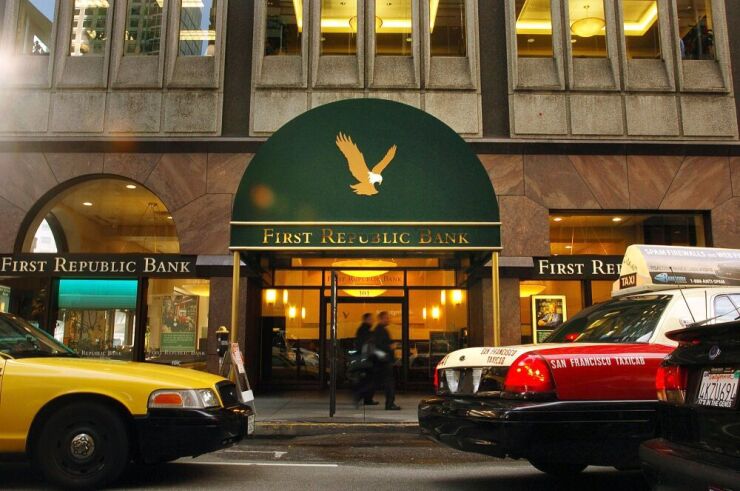

Instability among smaller banks began in March with the

Banks under pressure have backed off muni buying and reduced their holdings, which are often heavy on low-coupon paper.

That's accelerating the years-long trend of a shrinking muni buyer base, said Vikram Rai, Citigroup Global Markets' chief municipal strategist.

"I've been complaining about this for years," Rai said. "And now the footprint of banks in the muni space is going to decrease after this turmoil in the banking sector, there's no doubt about that," Rai said. "Every asset class needs a diverse buyer base."

As of the fourth quarter of 2022,

Texas-based Frost Bank offers a case in point. The bank, which owns $8.4 billion of munis, sold $900 million during the first quarter, bank officials said in an April 27 earnings call.

"We took advantage of market dislocations, which allowed us to improve interest income going forward," said Chief Financial Officer Jerry Salinas. The bank bought $390 million of munis with a taxable equivalent yield of about 5.01%, Salinas said. Throughout the rest of the year, the bank assumes that it will not make any more investment purchases "given all the noise and concerns about liquidity and all the questions that were coming up," he said.

Bank holdings in the first quarter saw the largest quarterly decline in aggregate municipal security holdings since at least 2003, Municipal Market Analytics said in a May 8 Outlook report.

Banks shed $17.2 billion of market value of munis, or $21.3 billion on a cost basis, dropping the first quarter bank holdings to $367 billion — the smallest since the third quarter of 2020, MMA said. That includes the removal of SVB's $7.4 billion portfolio.

Since the second half of 2022, banks shed $41 billion, or 9.5% of their bonds, MMA said.

Assuming that "banks continue to slowly shed duration and reallocate away from municipal asset class in the rest of 2023, similar dollar reductions as above could result, negatively affecting sector-wide performance and liquidity," the firm said.

Banks have also started to shift their muni holdings to available-for-sale bucket from the held-to-maturity bucket, suggesting they may be preparing to sell more in the future, MMA said.

The latest bank to come under stress, PacWest Bancorp, which said Thursday it will sell more assets to pledge as collateral to the U.S. Federal Reserve to boost its borrowing capacity, carries roughly $1.6 million of municipal securities in its portfolio, according to a

That includes $1.24 billion of held-to-maturity munis — nearly all of which are either AAA or AA-rated — and $345.6 million of available-for-sale securities.

Even as SVB's $7.4 billion muni book

"We already have $7 billion from SVB assets, so if we now have an additional $20 billion [from First Republic], people were getting worried. But now we don't have to worry about that," said Barclays strategist Mikhail Foux.

"The smaller banks, they may also be liquidated at some point, but it's not a major factor in my view," Foux said. "In general, I don't think they'll sell at the end of the day. They'll just not buy, but they're not buying already."

Direct bank loans to municipalities may also decline, Foux said, noting that eventually municipalities will need to find another borrowing source to fill the vacuum.

"Longer term, for some of the smaller issuers, that's a bit of a problem," he said.

Many of the bonds owned by the banks feature low coupons, but buy-siders said they're not overly worried about deep discounts.

BlackRock's sale of SVB's book will offer a preview of of investor appetite for the low-coupon, high-grade paper.

"The entire point of the [Federal Deposit Insurance Company] tapping a seasoned manager like BlackRock is to ensure no there are no fire sales," Rai said. "There will be discounts due to market factors, but it's not something special."

The market volatility offers an opportunity, Rai said. "In general, the market is under pressure, but investors are able to buy paper cheap. They should use it as a buying opportunity."