The volatility of 2022 caused household and U.S. bank ownership of individual bonds to fall and the overall size of the market to shrink in the final quarter of the year, the latest Fed data shows.

The total market value of the muni market "increased by 2.2% in the fourth quarter of 2022, but for the year, total market value declined by 12.2%," according to Pat Luby, a CreditSights strategist.

The increase in market value in Q4 2022 disguises some of the volatility during that time, as returns fluctuated. Munis saw losses of 0.83% in October, returned 4.68% in November and 0.29% in December.

"It's like a pinball going from one side of the machine to the other," Luby said.

The total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, as it fell to $23 billion to $4.01 billion in the fourth quarter of 2022.

This decline indicates there "wasn't enough issuance in the year to offset the maturities that were going out of the market," according to David Litvack, a tax-exempt strategist at the chief investment office at Bank of America.

Municipal bond issuance for 4Q 2022 was down 41.1% to $70.290 billion from $119.990 billion in 4Q 2021. Total 2022 municipal bond sale volume dropped 21% from 2021, with $384.086 billion of debt issued in 2022 versus 2021's $483.234 billion.

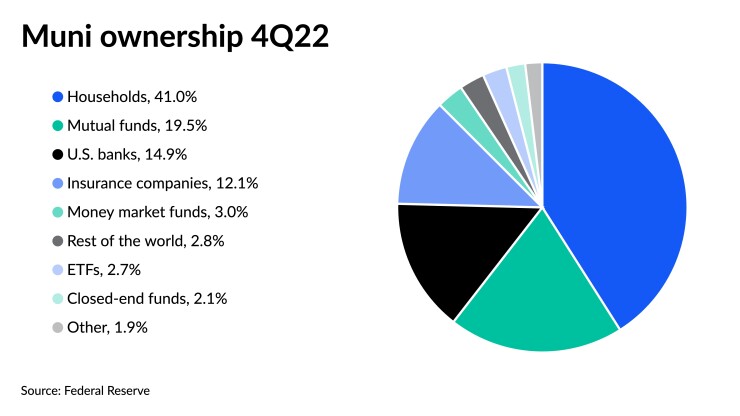

The largest category of investors remains household ownership of individual bonds — including direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts or separately managed accounts — with 41% of the market.

For household ownership, Litvack said, investors "have their bonds and know when they mature and when their cash flows will be."

"People like having that type of certainty, as opposed to a mutual fund or an ETF where your value in your household portfolio fluctuates," he said. Additionally, "you have the visibility of seeing what your cash flows are for your portfolios and knowing what to expect."

The value of munis owned by households, though, was $1.6 trillion in 4Q 2022, decreasing by $211.9 billion or 11.7% from the previous quarter.

Household ownership of individual bonds is lower than 2008, with Matt Fabian, a partner at Municipal Market Analytics, saying "it's the only major investor category where investors now own less in dollars than they did after the financial crisis."

"It's kind of remarkable pullback by households," he said. "Part of it is market value, but a fair bit is overall demand, or at least a shift in their demand into mutual funds than through other proceeds."

The decrease can be partially attributed to investors "spending down," according to Luby.

If the income from the investors' portfolio in the "distribution phase of their investing life," is lacking, he said, in some cases, "they're going to start taking some of that principle to live on." Therefore, in this type of scenario, he said not all maturing and call bonds will be reinvested.

However, household ownership of individual bonds may not reveal the full picture.

"Even though the number has been relatively in line with the market, it masks the enormous shift of assets out of self-directed brokerage accounts into a fiduciary relationship where the households hire an advisor or an asset manager to make their security selection decisions," Luby said.

He said the extreme volatility reveals to investors that it makes sense for their portfolio to be supervised full-time by a professional manager.

With the volatility of the economy and market valuations, Luby said, "this is when active management is more important in safeguarding portfolios principle than trying to save a few basis points and managing it yourself."

Mutual funds also saw declines. The total market value for mutual funds was $758.4 billion for the quarter, decreasing $232.4 billion or 23.5%, in part due to the $43.8 billion of outflows, Luby said.

He said the data confirms the "reduced exposure of mutual funds, which remains one of the most important types of ownership vehicles."

There is still "an enormous amount of bonds held and mutual funds, but clearly investors have continued to move out of mutual funds and into other holdings." The data to show this point is limited, though, but anecdotally money has moved into separately managed accounts from mutual funds.

Despite the drop, Fabian said, "We are probably as an industry more dependent on the mutual funds than anyone is comfortable with because … if you're an increasingly large share of the market, it's harder for you to trade your position without changing the market itself," Fabian said.

The market's increasing connection to mutual fund flows can be seen in 2022. "Fund flows come in and the market rallies very well, but funds flows go out, and the market has extreme difficulty in operating as the primary source of liquidity in the market is going away," Fabian said.

The more connected the market is to mutual funds, the more connected it is to the credit cycle.

"Mutual funds can afford to be more aggressive in their underwriting than typical investors because mutual funds have a diversification and some syndication of risks," he said.

"Mutual funds are better adapted to buying risky positions than your typical day bank, retail or insurance companies," Fabian said. "So we could wind up with riskier structure of muni bonds coming to market."

He noted that is "a pro-cyclical element where bonds lose value in a down market."

Litvack said the outflows from mutual funds were impacted by the Fed rate hikes in the quarter. As the Fed raised rates, yields increased and NAVs went down. "Retail buyers didn't like to see falling NAVs and many of them sold their holdings," he said.

This was especially true toward the end of 2022, where "investors who were still in the mutual funds, were able to realize tax losses by selling holdings in their mutual funds and going into ETFs in order to retain exposure in muni," according to Litvack.

Exchange-traded funds increased for the quarter, rising by $20.7 billion to $104 billion, or 24.8%. This included net inflows of $15.5 billion for the quarter, Luby said.

Unlike individual investors' almost exclusive use of mutual funds, ETFs, which continue to accrue market share, have broader users. This includes individual investors using ETFs themselves and self-directed accounts, along with others using them as either a supplement to bond portfolios or the portfolio entirely.

"The growth of assets in ETFs benefit from the interest from multiple types of users and even investors who are in accumulation mode," he said.

U.S. banks seem to "have reduced munis in the quarter as the value of their holdings was nearly unchanged," Luby said. The total market value for U.S. banks dropped $51.4 billion to $579.9 billion in the quarter.

U.S. banks' holding of munis is expected to decrease further in 1Q 2023 and 2Q 2023 following recent bank failures.

"A minority, but still material portion of absolute and relative municipal bond market performance since 2020 has come from commercial bank buying of public securities via the primary and secondary markets," Fabian said

Silvergate, Silicon Valley Bank and First Republic Bank, three of the largest and most-reliable banks "liquidated their portfolio, will see their portfolio liquidated, and, at a minimum, will likely buy fewer municipals going forward, respectively," he noted.

Future "SVB and FRB actions may well depress near-term municipal performance," Fabian said, "but a larger or longer-term impact may come from a wider breadth of banks choosing to own fewer municipals going forward, meaning either selling positions or, more likely, reinvesting less of maturing principal back into the asset class."

Fed data through the end of Q1 2023 showed year-to-date "bank investments in "Other Securities, Minus MBS" (roughly 35-40% of which, in aggregate, are municipal bonds) has already fallen by 2.0% ($21 billion) since the start of March," he said.

Fabian expects "that a material diminution of aggregate bank demand for municipals can and may offset the benefit of scarcity value in tax-exempts, even in a year when total issuance projections are falling rapidly."

The Fed's most recent numbers for Q4 2022 do not always represent bond market volatility, but the current volatility can be ascribed to the market becoming close to an economic turning point.

"There's a lot of speculation as to when the Fed is going to start is going to stop raising rates, if it hasn't done so already, and when, when to start cutting rates," Litvack said. "So, all of that is being viewed very closely by the market, every new piece of economic data and inflation meeting comes out of immediately factored into bond prices. And that's caused an increase in volatility."

"Volatility is influencing how investors are investing in muni or maintaining their exposure," Luby said.

There is not a lot of new money coming into munis, and Luby doesn't see that changing in the future. Instead, he predicts movement within the market, from "one product type to another, or perhaps changing strategies if inflation remains high."