The school that describes itself as the "world's premier culinary college" will return to the municipal bond market next week.

The Culinary Institute of America plans to borrow $17 million.

The negotiated deal is set to price through the Dutchess County Local Development Corp. in New York. BofA Securities is the manager, with Excelsior Capital and Blue Rose Capital Advisors as co-municipal advisors. Harris Beach Murtha is counsel.

The deal has a Baa1 rating from Moody's Ratings.

According to the investor presentation for the deal, this issuance will refund a series from 2013, which the college borrowed through the Dormitory Authority of the State of New York.

The Culinary Institute of America is the alma mater of famous chefs such as Anthony Bourdain, Roy Choi, and Anne Burrell. The school offers associate's, bachelor's and master's degree programs on its campuses in New York, California, Texas and Singapore.

The investor presentation for the bonds highlights the college's industry conferences and consulting services, which "have made the CIA the 'think tank' of the food service industry."

The college has $98.7 million of outstanding debt, according to the presentation.

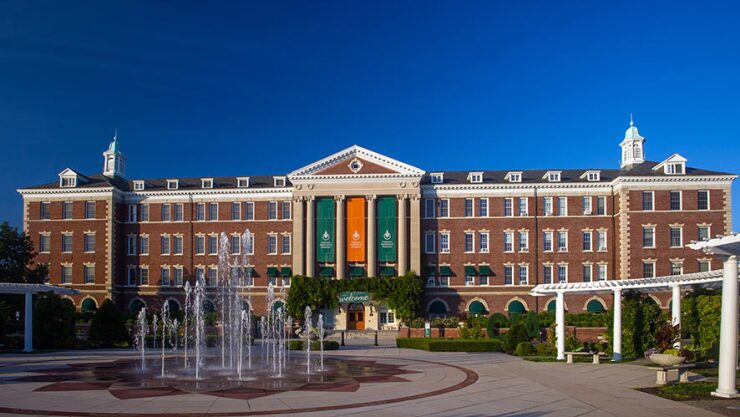

The 2013 deal was $30.8 million; today, $18.5 million of that debt is still outstanding. Those bonds financed an 800-seat auditorium and conference center, as well as three kitchens and a 500-seat dining room for the student union building at its original campus in Hyde Park, New York..

The college also refunded portions of the 2013 issuance in its

"The 2013 bonds are anticipated to be redeemed in full with proceeds of the series 2025 bonds," the offering statement said.

Moody's upgraded the institute to Baa1 from Baa2 in February.

"The upgrade of the issuer rating to Baa1 from Baa2 is driven by a multi-year trend of improving operating performance, steady enrollment and tuition revenue growth, and gains in total wealth,"

The college does not receive funding from the federal government outside of tuition assistance for its students. However, the offering statement acknowledges that potential actions from the federal government may "have a material adverse effect on the financial profile and operating performance of the college."

Those federal actions included staffing changes at the Department of Education and approaches toward diversity, equity and inclusion policies, and potential changes to taxes or immigration laws.