-

New Jersey said it expects to issue up to $4.5 billion of tax-exempt and taxable bonds the week of Nov. 18 under the COVID-19 Emergency Bond Act.

October 29 -

Taxables march on while ICI reports billions of inflows and secondary trading shows long-end strength.

October 28 -

Municipals were little changed on Thursday as the supply surge continued ahead of the U.S. elections.

October 22 -

Municipals were a bit stronger on the long end Thursday as action heated up in the primary.

October 15 -

Municipals finished little changed Wednesday as a hefty slate of new deals came to market.

October 14 -

The Puerto Rico Aqueduct and Sewer Authority said it might be refinancing its bond debt with a new bond issue by the end of the year.

October 8 -

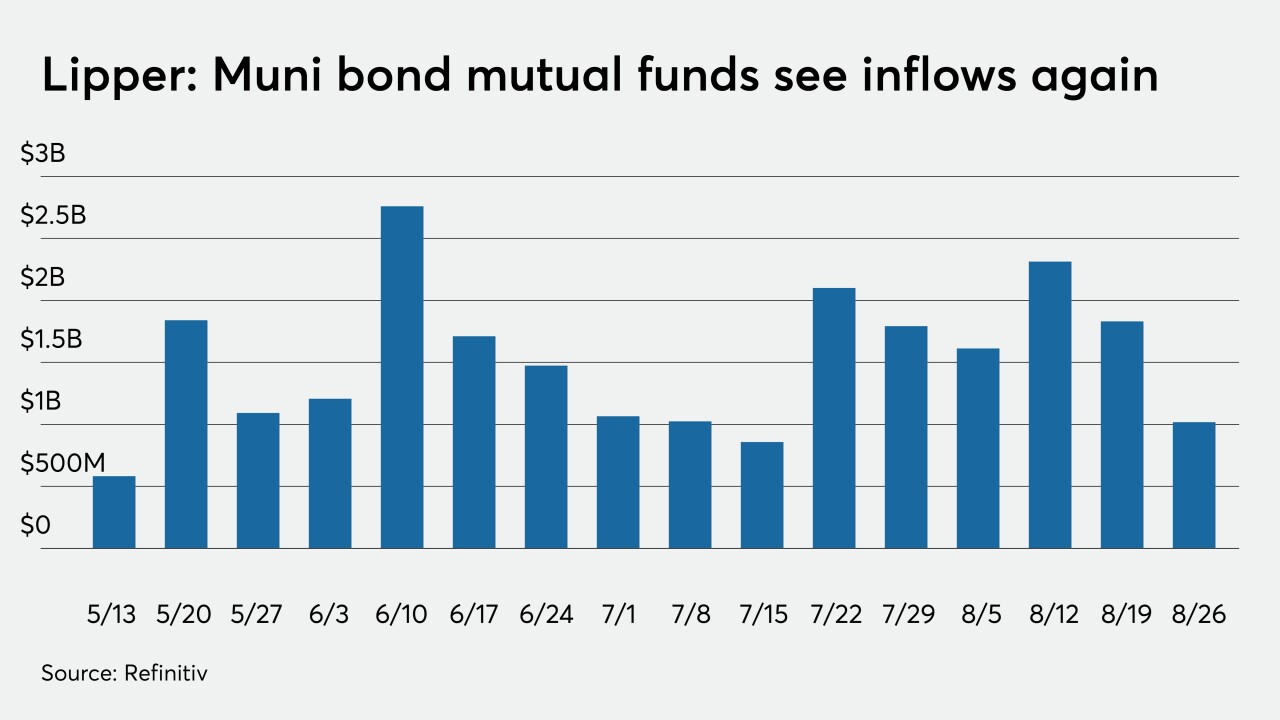

Another week of inflows as reported by ICI and the municipal market continues to push on. There is money to put to work, sources say, depending on who is willing.

October 7 -

Moody's cut NYC's $39 billion of outstanding GOs to Aa2 citing the effects of COVID-19 and also lowered the debt rating of New York State.

October 1 -

The Puerto Rico Housing Finance Authority’s deal came in three times oversubscribed and was an important step in the Commonwealth’s return to the capital markets.

September 30 -

Without more fiscal support, the outlook becomes murkier with the possibility of economic data disappointment and volatility in rates, and historically muni demand dampeners, Morgan Stanley said.

September 24 -

The new-issue market saw deals from Houston, the Illinois Finance Authority and the City and County of San Francisco, Calif., hit the screens.

September 17 -

Duane McAllister and Lyle Fitterer of Baird talk with Chip Barnett about low rates and credit quality. They discuss the best scenarios for investors and issuers in these challenging times. (20 minutes)

September 17 -

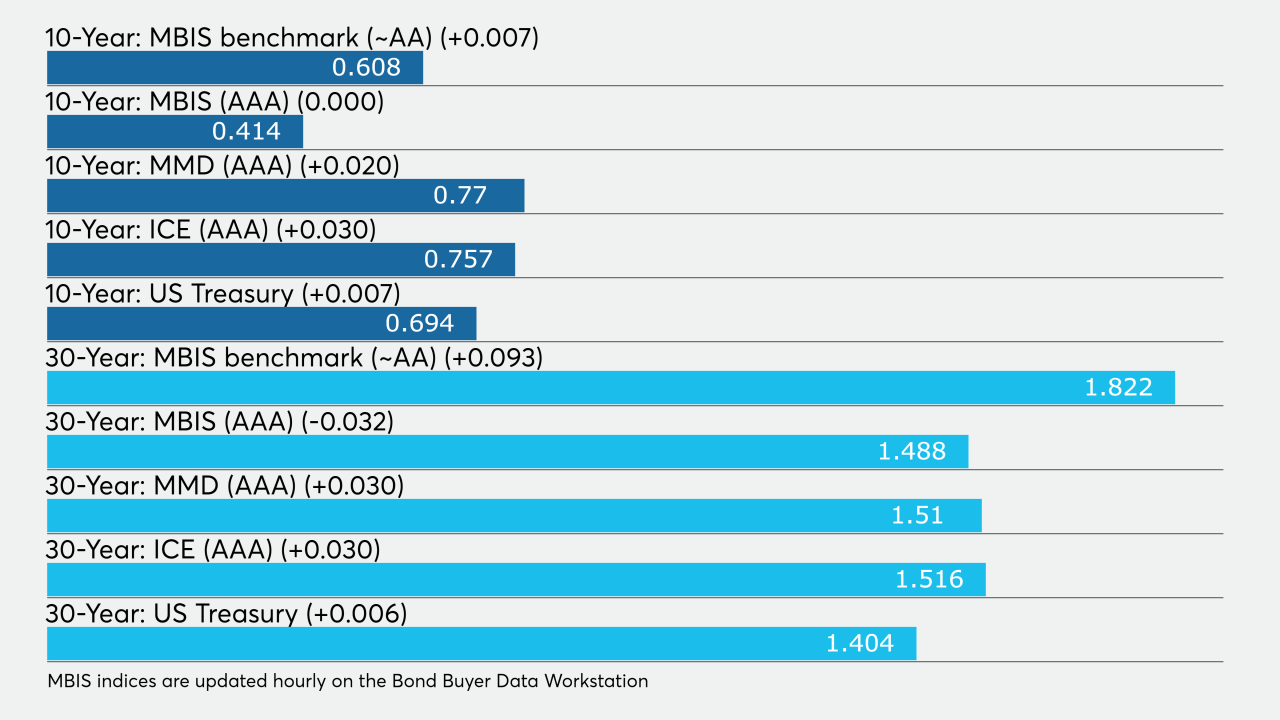

Longer-dated municipals strengthened Thursday as transportation deals from Oregon, Texas and Atlanta issuers came to market.

September 10 -

Muni yields fell a basis point on some AAA curves Wednesday as deals from Maryland and California hit the screens.

September 9 -

Refinitiv Lipper reported $139.364 million of muni fund inflows, the 17th week in a row of positive results, but the lowest gain since July.

September 3 -

The Florida State Board of Administration Finance Corp. deal was upsized by $1 billion on a day that gave muni buyers a wide variety of paper to choose from.

September 2 -

More supply sold Thursday as the Chicago Transit Authority, the Austin ISD, Texas and Kern HSD, Calif., all came to market.

August 27 -

Ashton Goodfield, head of municipal bonds at DWS Group, talks with Chip Barnett about how the municipal bond market has been coping with the effects of the COVID-19 pandemic and what's in store for the rest of the year. (22 minutes)

August 27 -

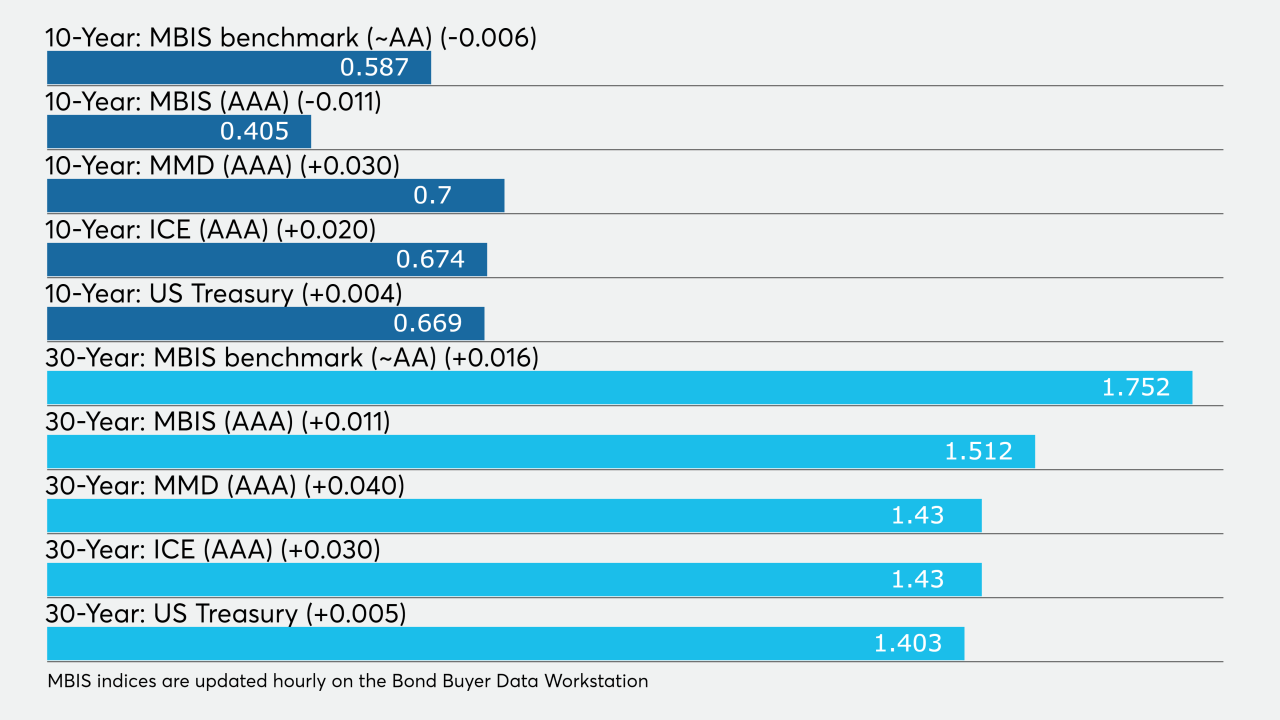

Munis continued to weaken with yields on the AAA scales rising by as much as three basis points.

August 26 -

The muni market steadied Wednesday as a strong dose of supply hit the screens.

August 19