Only a day after the New York Metropolitan Transportation Authority spurned the Street for the Fed, the Lone Star State hit the market with a $7 billion note sale that went off without a hitch.

Municipals continued to weaken on Wednesday with long yields rising by as much as four basis points on the muni AAA scales.

Texas sold $7.2 billion of tax and revenue anticipation notes (MIG1/SP1+/F1+/K1+) to nine groups, including JPMorgan Securities, Wells Fargo Securities, Morgan Stanley, Citigroup, Barclays Capital, Goldman Sachs, RBC Capital Markets, Jefferies, and Bank of New York Mellon.

The details:

- JPMorgan won $2 billion with a bid of 4%, a premium of $73,620,000, an effective rate of 0.247025%; $1.045 billion with a bid of 4%, a premium of $38,351,500, an effective rate of 0.258240%; $1 billion with a bid of 4%, a premium of $36,850,000, an effective rate of 0.242947%; and $500 million with a bid of 4%, a premium of $18,455,000, an effective rate of 0.236830%.

- Wells Fargo won $600 million with a bid of 4%, a premium of $22,044,000, an effective rate of 0.254162%; and $100 million with a bid of 4%, a premium of $3,685,000, an effective rate of 0.242947%.

- Morgan Stanley won $500 million with a bid of 4%, a premium of $18,420,000, an effective rate of 0.243966%; and $500 million with a bid of 4%, a premium of $18,370,000, an effective rate of 0.254162%.

- Citigroup won $300 million with a bid of 4%, a premium of $11,022,000, an effective rate of 0.254162%; and won $165 million with a bid of 4%, a premium of $6,103,350, an effective rate of 0.228673%.

- Barclays won $160 million with a bid of 4%, a premium of $5,883,200, an effective rate of 0.251103%; and won $30 million with a bid of 4%, a premium of $1,106,100, an effective rate of 0.240908%.

- Goldman Sachs won $165 million with a bid of 4%, a premium of $6,103,350, an effective rate of 0.228673%.

- RBC won $100 million with a bid of 4%, a premium of $3,679,000, an effective rate of 0.249064%; and $50 million with a bid of 4%, a premium of $1,844,500, an effective rate of 0.238869%.

- Jefferies won $100 million with a bid of 4%, a premium of $3,671,005, an effective rate of 0.257216%.

- BNY Mellon won $50 million with a bid of 4%, a premium of $918,425, an effective rate of 0.254468%.

The TRANs [CUSIP: 882724SY4] are due Aug. 26, 2021 and had a weighted average net interest cost of 0.2483%.

“The tremendous demand for these notes is directly related to Texas’ conservative cash management and solid fiscal policies, which allowed the state to earn the highest possible short-term ratings ahead of this sale,” said Texas Comptroller Glenn Hegar. “With bids totaling nearly 3.5 times the amount offered, it’s clear the market is confident that Texas remains a solid investment during these unprecedented times amidst the COVID-19 pandemic.”

The comptroller's office said it received 66 bids worth $25.05 billion, 3.48 times the amount offered for sale.

Proceeds will be used to help fund expenditures such as public-school payments made early in the fiscal year, before the arrival of tax revenues later in the year.

Stifel was the financial advisor; Orrick Herrington and the State Attorney General were the bond counsel.

On Wednesday, the N.Y. MTA

Primary market

BofA Securities priced and repriced the New York City Transitional Finance Authority’s (Aa1/AAA/AAA/NR) $1.33 billion of tax-exempt future tax secured subordinate bonds for institutions after a two-day retail order period.

The $1.253 billion of Fiscal 2021 Series A bonds were repriced to yield from 0.26% with a 5% coupon in 2021 to 2.10% with a 3% coupon in 2039.

The $76.63 million of Fiscal 2021 Series B1 bonds were priced to yield from 0.98% with a 3% coupon in 2028 to 1.31% with a 5% coupon in 2031.

The Fiscal 2021 Series A bonds were tentatively priced to yield from 0.28% with a 5% coupon in 2021 to 2.16% with a 3% coupon in 2039; the Fiscal 2021 Series B1 bonds were tentatively priced to yield from 0.98% with a 3% coupon in 2028 to 1.32% with a 5% coupon in 2031.

The $1.253 billion of Fiscal 2021 Series A bonds had been priced for retail to yield from 0.23% with a 5% coupon in 2021 to 2.08% with a 3% coupon in 2039. The $76.63 million of Fiscal 2021 Series B1 bonds were priced for retail to yield from 0.91% with a 3% coupon in 2028 to 1.13% with a 4% coupon in 2030.

The TFA also competitively sold $275 million of taxable future tax secured Fiscal 2021 bonds in two offerings.

Wells Fargo Securities won the $127.915 million of taxable Subseries B-2 bonds with a TIC of 0.679%. The bonds were priced at par to yield from 0.25% in 2021 to 0.95% in 2027.

UBS Financial Services won the $147.06 million of Subseries B-3 bonds with a TIC of 2.1328%.

Frasca & Associates and Public Resources Advisory Group were the financial advisors. Norton Rose and Bryant Rabbino were the bond counsel.

Georgia (Aaa/AAA/AAA/NR) competitively sold $1.14 billion of tax-exempt and taxable general obligation bonds in five offerings.

The winners were:

- BofA won the $287.2 million of Series 2020A Bidding Group 1 GOs with a TIC of 0.2576%. The bonds were priced with 5% coupons to yield from 0.13% in 2021 to 0.41% in 2027.

- JPMorgan Securities won the $267.505 million of Series 2020A Bidding Group 3 GOs with a TIC of 2.0733%.

- JPMorgan also won the $247.865 million of Series 2020A Bidding Group 2 GOs with a TIC of 1.2758%.

- Morgan Stanley won the $173.425 million of Series 2020B Bidding Group 1 taxable GOs with a TIC of 0.7606%.

- Morgan Stanley also won the $156.52 million of Series 2020B Bidding Group 2 taxable GOs with a TIC of 1.6631%.

Public Resources Advisory Group and Terminus Municipal Advisors were the financial advisors. Gray Pannell & Woodward LLP was the bond counsel and Kutak Rock LLP was the disclosure counsel.

Goldman Sachs priced the Los Angeles Department of Airports’ (Aa2/AA-/AA/NR) $1.041 billion of bonds for the L.A. International Airport.

The $541.18 million of Series 2020B senior refunding revenue private activity bonds not subject to the alternative minimum tax were priced to yield from 0.35% with a 5% coupon in 2024 to 1.90% with a 4% coupon and 1.70% with a 5% coupon in a split 2040 maturity.

The $380 million of Series 2020C senior revenue private activity bonds subject to the AMT were priced to yield from 0.60% with a 5% coupon in 2024 to 1.95% with a 5% coupon in 2040. A 2045 maturity was priced to yield 2.09% with a 5% coupon and 2050 maturity was priced to yield 2.34% with a 4% coupon.

Ramirez & Co. priced the Los Angeles Department of Water and Power, Calif.’s (Aa2/NAF/AA/AA+) $118.29 million of Series 2020B water system revenue bonds after a one-day retail order period.

The deal was priced to yield from 0.30% with a 5% coupon in 2026 to 0.76% with a 4% coupon in 2030. The bonds had been priced for retail to yield from 0.30% with 3% and 4% coupons in a split 2026 maturity to 0.68% with a 4% coupon in 2030.

BofA priced Hackensack Meridian Health, N.J.'s (NR/AA-/AA-/NR) $1 billion of Series 2020 taxable corporate CUSIP bonds.The bonds were priced at par to yield 2.675% in 2041 and 2.875% in 2050.

RBC received the official award on the Goose Creek Consolidated Independent School District, Texas’ (Aaa/NR/AAA/NR) $101.22 million of Series 2020 unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program.

The bonds were priced to yield from 0.13% with a 5% coupon in 2021 to 1.61% with a 3% coupon in 2040. A 2045 maturity was priced to yield 1.71% with a 4% coupon and a 2050 maturity was priced to yield 1.81% with a 4% coupon.

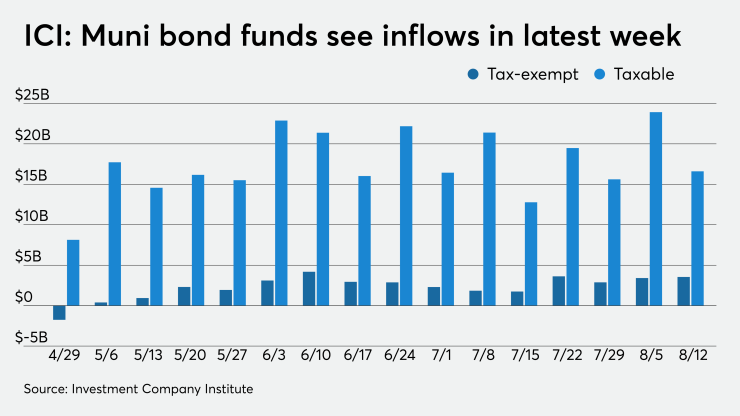

ICI: Muni bond funds see $3.5B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $3.545 billion in the week ended Aug. 12, the Investment Company Institute reported Wednesday.

It marked the 15th week in a row the funds saw inflows. In the previous week, muni funds saw an inflow of $3.410 billion, ICI said.

Long-term muni funds alone had an inflow of $2.898 billion in the latest reporting week after an inflow of $2.975 billion in the prior week.

ETF muni funds alone saw an inflow of $647 million after an inflow of $435 million in the prior week.

Taxable bond funds saw combined inflows of $16.607 billion in the latest reporting week after inflows of $23.924 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $16.220 billion after a revised inflow of $9.340 billion in the previous week, originally reported as a $9.279 billion inflow.

Secondary market

A few trades of note:

The NYC TFA 5s of 2022, traded at 0.22% to 0.20%. Alexandria Virginia 5s of 2025 traded at 0.25%.

Loudoun County, Virginia, 5s of 2029, traded at 0.70%. Originally priced at 0.87%.

Baltimore County 4s of 2036 traded at 1.32%-1.31%.

Houston ports 4s of 2038 1.40%-1.47%. Washington GOs 5s of 2042 1.45%-1.40% and Northwest Texas ISDs 4s of 2045 1.54%-1.50%.

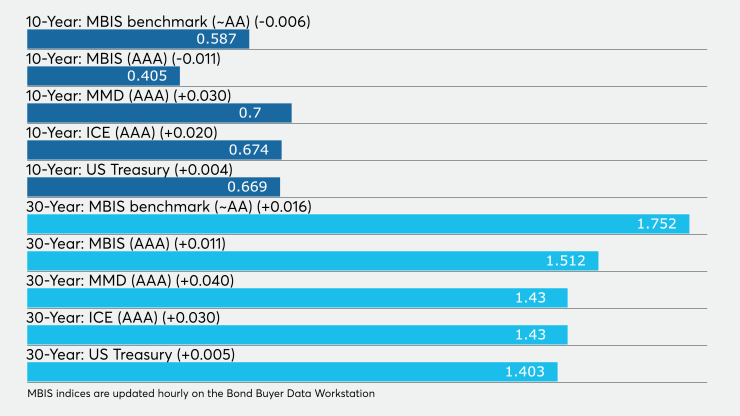

Municipals were weaker on the long end Wednesday, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

Yields were unchanged at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year muni was up three basis points to 0.70% while the 30-year yield rose four basis points to 1.43%.

The 10-year muni-to-Treasury ratio was calculated at 104.5% while the 30-year muni-to-Treasury ratio stood at 101.4%, according to MMD.

“Muni bonds are selling off again today,” ICE Data Services said. “Yields on the ICE muni curve are higher by one to almost three basis points out in the long end. Trade volumes are consistent with yesterday’s levels.”

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.120% and the 2022 maturity was steady at 0.131%. The 10-year maturity was up two basis points to 0.674% and the 30-year increased three basis points to 1.430%.

ICE reported the 10-year muni-to-Treasury ratio stood at 107% while the 30-year ratio was at 101%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.12% and the 2022 maturity at 0.13% while the 10-year muni was at 0.69% and the 30-year stood at 1.41%.

The BVAL AAA curve showed the curve mostly unchanged with the 2021 maturity yielding 0.10% and the 2022 maturity at 0.12%, while the 10-year muni was at 0.64%, plus 1 basis point and the 30-year at 1.39%, plus 3.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were slightly weaker as stock prices traded little changed.

The three-month Treasury note was yielding 0.108%, the 10-year Treasury was yielding 0.669% and the 30-year Treasury was yielding 1.403%.

The Dow rose 0.16%, the S&P 500 was unchanged and the Nasdaq lost 0.04%.