Municipal bond buyers saw some the last large deals come to market on Thursday, led by Alabama’s education social bonds.

Municipals traded little changed on the day, with yields steady to slightly stronger along the AAA scales.

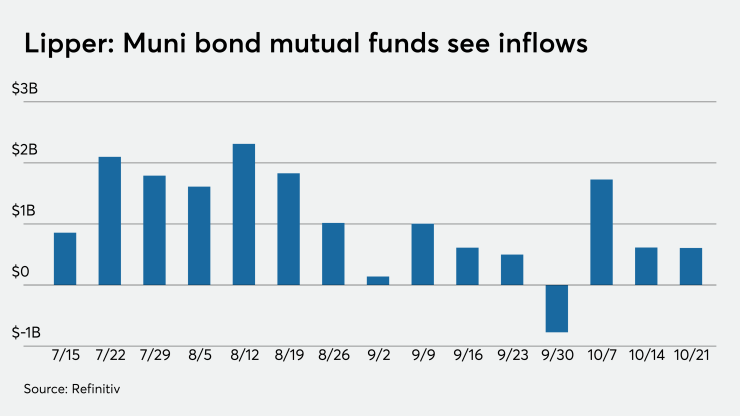

Investors continued to put cash back into tax-exempt mutual funds, with Refinitiv Lipper reporting muni bond funds saw about $607 million of inflows in the latest reporting week.

Primary market

Wells Fargo Securities priced the

The $1.275 billion of tax-exempts were priced to yield from 0.26% with a 5% coupon in 2022 to 1.98% with a 4% coupon in 2040.

The $58.81 million of Series 2020B taxable refunding bonds were priced at par to yield 0.253%, 10 basis points above the comparable Treasury security in 2021, and 0.353%, 20 basis points above Treasuries in 2022. The $147.335 million of Series 2020C taxable refunding bonds were priced at par to yield from 0.253%, 10 basis points above Treasuries in 2021, to 2.444%, 160 basis points above Treasuries in 2035.

In the competitive arena, the Tarrant Regional Water District, Texas (NR/AAA/AA+/NR) sold $388.185 million of Series 2020B taxable water system revenue refunding bonds.

Citigroup won the deal with a true interest cost of 2.5746%. The bonds were priced to yield from 0.24% with a 0.30% coupon in 2021 to 2.86% with a 2.90% coupon in 2041; a 2049 maturity was priced to yield 3.01% with a 3% coupon.

Hilltop Securities and Kipling Jones were the financial advisors. McCall Parkhurst, Kintop Smith and the State Attorney General acted as bond counsel.

Clark County, Nev., (A1/AA/NR/NR) sold $200 million of Series 2020B limited tax general obligation building bonds. BofA Securities won the deal with a TIC of 2.3224%. The bonds were priced to yield from 0.55% with a 5% coupon in 2022 to 2.65% with a 2.5% coupon in 2040.

The deal was insured by Build America Mutual. Zions Public Finance was the financial advisor; Sherman & Howard was the bond counsel.

The City and County of San Francisco, Calif., (Aaa/AAA/AA+/) sold $111.925 million of Series 2020D-1 public health and safety general obligation bonds.

TD Securities won the deal with a TIC of 2.5283%. NHA Advisors and Backstrom McCarley Berry were the financial advisors. Fox Rothschild and Curls Bartling were the bond counsel.

Suffolk County, N.Y. (NR/BBB+/BBB+/NR) sold $105.195 million of Series 2020A public improvement bonds. Citigroup won the deal with a TIC of 1.6369%. The bonds were priced to yield from 0.85% with a 5% coupon in 2021 to 1.87% with a 2% coupon in 2031.

Assured Guaranty Municipal insured the 2023 through 2020 maturities, which are rated AA by S&P Global Ratings. Capital Markets Advisors was the financial advisor; Harris Beach was the bond counsel.

RBC received the written award on the Tacoma School District No.10 Pierce County, Wash., (Aaa/AA+/NR/NR) $484.28 million of unlimited tax general obligation social bonds.

The deal consists of $249.28 million of Series 2020B tax-exempts and $235 million of Series 2020C taxables. The bonds are is backed by the Washington state school district credit enhancement program.

California GO deals saw strong interest

California’s competitive sale of $1.1 billion of general obligation bonds saw strong investor demand, California State Treasurer Fiona Ma said late Wednesday.

Separate bids were accepted for $321 million of taxable new money GOs, $588 million of tax-exempt GO bonds, and $198 million of taxable GO refunding bonds.

Proceeds will fund voter-approved projects and programs, pay down outstanding commercial paper and refund $663 million of previously issued GOs for debt service savings.

“We had a strong showing, which confirms investor confidence in

The tax-exempt refunding bonds issued for debt service savings will save taxpayers $153 million over the next 15 years, or $138 million on a present value basis. The taxable GO refunding bonds issued for debt service savings will save taxpayers $66 million over the next 16 years, or $61 million on a present value basis.

Refinitiv Lipper reports $607M inflow

In the week ended Oct. 21, weekly reporting tax-exempt mutual funds saw $607.029 million of inflows. It followed a gain of $614.447 million in the previous week.

Exchange-traded muni funds reported outflows of $116.503 million, after inflows of $191.893 million in the previous week. Ex-ETFs, muni funds saw inflows of $723.532 million after inflows of $422.553 million in the prior week.

The four-week moving average remained positive at $543.841 million, after being in the green at $516.803 billion in the previous week.

Long-term muni bond funds had outflows of $97.084 million in the latest week after inflows of $170.662 million in the previous week. Intermediate-term funds had inflows of $61.102 million after inflows of $14.194 million in the prior week.

National funds had inflows of $584.010 million after inflows of $652.176 million while high-yield muni funds reported inflows of $21.399 million in the latest week, after outflows of $85.651 million the previous week.

Informa: Money market muni funds fell $1.2B

Tax-exempt municipal money market fund assets fell $1.22 billion, bringing total net assets to $112.29 billion in the week ended Oct. 19, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds remained at 0.02% from the previous week.

Taxable money-fund assets dropped $726.3 million in the week ended Oct. 20, bringing total net assets to $4.188 trillion.

The average, seven-day simple yield for the 779 taxable reporting funds remained at 0.01% from the prior week.

Overall, the combined total net assets of the 966 reporting money funds fell $1.94 billion in the week ended Oct. 20.

Secondary market

Some notable trades on Thursday:

Comal Texas ISD 5s of 2024 traded at 0.34%. Washington GOs 5s of 2027 at 0.65%. Fairfax County, VA GOs 4s.5s of 2029 traded at 0.94%. Northwest Texas ISD 5s of 2030 traded at 1.11%-1.04%. Georgia GOs, 5s of 2031 at 1.07%-1.06%.

Ohio waters, 5s of 2033 traded at 1.31%. Maryland GOs, 5s of 2035, traded at 1.41%-1.40%. NYC TFA subs 5s of 2037 at 1.92% while on Wednesday at 1.88%. Texas waters, 4s of 2045 traded at 1.89%-1.88%.

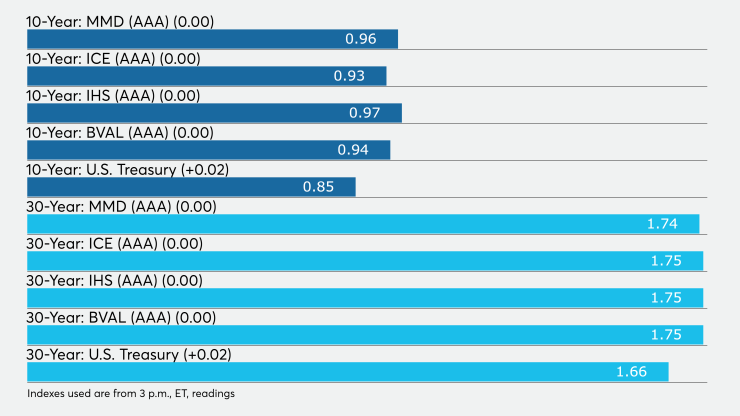

High-grade municipals were unchanged on Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields in 2021 and 2022 were flat at 0.17% and 0.18%, respectively. The yield on the 10-year muni was steady at 0.96% while the yield on the 30-year remained at 1.74%.

The 10-year muni-to-Treasury ratio was calculated at 112.9% while the 30-year muni-to-Treasury ratio stood at 104.8%, according to MMD

The ICE AAA municipal yield curve showed short maturities weakened as the 2021 maturity rose one basis point to 0.19% and rose one basis point 0.20% in 2022. The 10-year maturity remained at 0.93% and the 30-year was flat at 1.75%.

The 10-year muni-to-Treasury ratio was calculated at 110% while the 30-year muni-to-Treasury ratio stood at 105%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields steady at 0.15% and 0.16% in 2021 and 2022, respectively, with the 10-year yielding 0.97% and the 30-year at 1.75%.

The BVAL AAA curve showed the yield on the 2021 maturity up one basis point to 0.14%, the 2022 maturity up one basis point to 0.16% while the 10-year was steady at 0.94% and the 30-year was at 1.75%.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.85% and the 30-year Treasury was yielding 1.66%.

The Dow rose 0.60%, the S&P 500 increased 0.55% and the Nasdaq gained 0.25%.