Municipals were little changed to slightly stronger on Wednesday as a spate of new deals came to market. High-grade issuers from Maryland, Minnesota and Nevada sold competitively relative to benchmarks, while in the negotiated space, San Francisco Public Utilities Commission sold $300 million-plus green and non-green bonds and repriced to lower yields.

Yields on the triple-A benchmark scales were flat to down by as much as one basis point on the long end.

"Municipal bonds are moving higher today as the market gets back to work after Labor Day," ICE Data Service said. "Trade volume was above the past two trading sessions, but still light for a Wednesday."

Meanwhile, ICI reported that long-term muni funds alone had an inflow of $1.719 billion in the latest reporting week after an inflow of $2.133 billion in the prior week, originally reported as an inflow of $2.181 billion.

Primary market

On Wednesday, the Washington Suburban Sanitation District, Md., (Aaa/AAA/AAA/NR) sold $325.895 million of consolidated public improvement bonds of 2020 and Second Series consolidated public improvement green bonds of 2020.

Wells Fargo Securities won the Washtub bonds. The deal was priced to yield from 0.13% with a 5% coupon in 2021 to 2.32% with a 2.25% coupon in 2049.

The Wye River Group was the financial advisor; McKennon Shelton was the bond counsel.

Since 2020, the district has sold over $4.5 billion of bonds, with the most issuance occurring in 2017 when it offered $759 million.

Hennepin County, Minn., (NR/AAA/AAA/NR) competitively sold $141.935 million of general obligation and refunding bonds in two offerings.

Morgan Stanley won the $100 million of Series 2020A GOs with a TIC of 1.9436%. The deal was priced as 5s to yield from 0.14% in 2021 to 1.40% in 2040.

Piper Sandler won the $41.935 million of GO refunding bonds with a TIC of 0.618%.

PFM was the financial advisor; Dorsey & Whitney was the bond counsel.

Nevada competitively sold $140.805 million of highway improvement revenue bonds in two sales.

Citigroup won the $87.53 million of Series 2020A (Aa2/AAA/AA+/NR) motor vehicles fuel tax bonds with a TIC of 1.5855%. The bonds were priced to yield from 0.19% with a 5% coupon in 2021 to 2.07% with a 2% coupon in 2040.

Robert W. Baird won the $53.275 million of Series 2020B (Aa2/AA+/AA+/NR) indexed tax and subordinate motor vehicle fuel tax bonds with a TIC of 1.766%.

JNA Consulting was the financial advisor; Sherman & Howard was the bond counsel.

In the negotiated sector, BofA Securities priced and repriced the City and County of San Francisco's Public Utilities Commission's (Aa2/AA-/NR/NR) $347.72 million of Series A, B, C & D water revenue bonds to lower yields in all maturities.

The $151.24 million of Sub-Series A water system improvement program green bonds were repriced as 5s to yield 1.73% in 2045, as 4s to yield 2.01% and 5s to yield 1.83% in a split 2050 maturity. The $61.48 million of Sub-Series B regional water bonds were repriced as 5s to yield 1.65% in 2045 and 1.71% in 2050.

The $85.575 million of Sub-Series C local water bonds were repriced as 4s to yield 1.93% in 2045 and 2.02% in 2050. The $49.425 million of Sub-Series D Hetch Hetchy water bonds were repriced as 3s to yield 2.22% in 2045 and 2.30% in 2050.

JPMorgan Securities prices and repriced Broward County, Fla.’s (Aa2/AA+/AA+/NR) $99.01 million of half-cent sales tax revenue refunding bonds.

The bonds were priced to yield from 0.16% with a 5% coupon in 2022 to 1.01% with a 5% coupon in 2030 and to yield from 1.94% with a 3% coupon in 2037 to 1.81% with a 4% coupon in 2040

The biggest deals of the week will be coming Thursday. Oregon’s Department of Transportation issues $807 million of bonds while the Texas Private Activity Bond Surface Transportation Corp. is set to offer $578.095 million of senior lien revenue refunding bonds and the Michigan State Building Authority is coming to market with $768 million of revenue and revenue refunding bonds.

ICI: Muni bond funds see $1.3B inflow

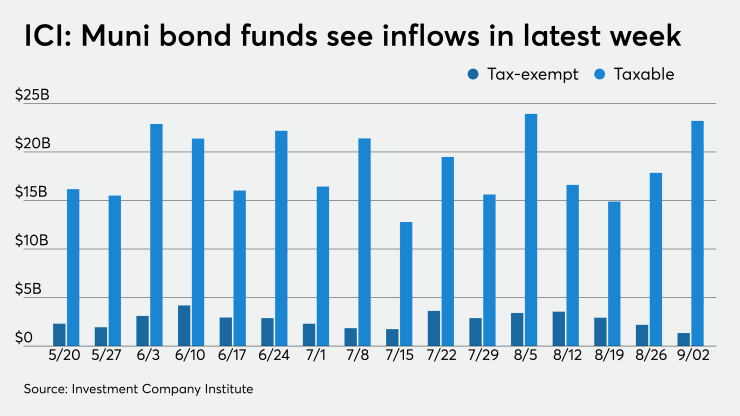

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $1.342 billion in the week ended Sept. 2, the Investment Company Institute reported Wednesday.

It marked the 18th week in a row the funds saw inflows. In the previous week, muni funds saw a revised inflow of $2.190 billion original reported as an inflow of $2.238 billion, ICI said.

Long-term muni funds alone had an inflow of $1.719 billion in the latest reporting week after an inflow of $2.133 billion in the prior week, originally reported as an inflow of $2.181 billion.

ETF muni funds alone saw an outflow of $3777 million after an inflow of $57 million in the prior week.

Taxable bond funds saw combined inflows of $23.201 billion in the latest reporting week after a revised inflow of $17.848 billion in the prior week, originally reported as a $17.846 billion inflow.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $4.211 billion after a revised inflow of $368 million in the previous week, originally reported as a $414 million inflow.

BlackRock: Munis slow down in August

The robust recovery in municipal bonds finally lost steam in August, BlackRock said it its latest municipal market update.

A lack of clarity around fiscal aid will likely exacerbate near-term volatility.

“After a strong three-month recovery, the muni market took a breather in August, with the S&P Municipal Bond Index returning -0.24% for the month, but leaving year-to-date performance still strong at 3.16%," Peter Hayes, head of the municipal bonds group, James Schwartz, head of municipal credit research and Sean Carney, head of municipal strategy, said on Wednesday.

“All-time low yields, uncertainty around additional fiscal support, rising interest rates and less favorable supply-demand dynamics weighed on the market in August,” they wrote. “Longer-dated bonds were particularly pressured toward month end as a shift in the Fed’s mandate spurred higher inflation expectations.”

They said that while issuance remained strong, rising uncertainty tempered demand.

“Issuance remained relatively high for the month of August at $41.3 billion. Supply continued to outpace reinvestment of income from coupons, calls and maturities, negating the net negative supply that typically occurs at this time of year,” they wrote. “In the secondary market, bid-wanted activity increased over the month while dealer inventories hovering near multi-year lows signaled a weaker appetite for muni bonds among the broker community.”

They noted that new issues were oversubscribed by a lower rate in August, at 4 times over, compared to the year-to-date average, 5.9 times over, dragged down by weakness in the last two weeks of the month, 2.3 times over.

“We foresee increased volatility in the months ahead and anticipate that a less favorable supply and demand dynamic will likely act as a drag on the market in the near term,” they wrote. “We believe that clarity around the size and scope of additional federal stimulus is necessary to alleviate uncertainty and ease investor concerns.”

Secondary market

Some notable trades Wednesday:

New York City TFA, 5s of 2022, traded at 0.39%-0.30%. Gilt-edged Georgia GOs, 5s of 2023, at 0.17%. Fairfax County, Virginia 5s of 2024 at 0.21%. Tuesday, they traded at 0.23%. Washington Suburban Sanitation District, Maryland 5s of 2028 traded at 0.67%, a basis point lower than it was won Wednesday in its compatitive sale. University of Texas 5s of 2030 traded at 0.98%-0.96%. Dallas waters, 4s of 2037, traded at 1.52%. Virginia resources Authority state revolving fund 2.25s of 2045 traded at 2.17% to 20.7% while on Tuesday they traded as much as 2.22%. NYC TFAs, 3s of 2046, traded at 2.43%.

High-grade municipals were little changed, according to readings on Refinitiv MMD’s AAA benchmark scale. Yields were unchanged in 2021 and 2022 at 0.14% and 0.15%, respectively. The yield on the 10-year muni was flat at 0.83% while the 30-year yield remained at 1.57%.

The 10-year muni-to-Treasury ratio was calculated at 117.7% while the 30-year muni-to-Treasury ratio stood at 107.7%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.13% and the 2022 maturity down one basis point to 0.14%; the 10-year maturity dropped one basis point to 0.79% and the 30-year swcreased one basis point to 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 117% while the 30-year muni-to-Treasury ratio stood at 107%, according to ICE.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.15%, the 2022 maturity at 0.16%, the 10-year muni at 0.82% and the 30-year at 1.56%.

The BVAL AAA curve showed the yield on the 2021 maturity at 0.12%, the 2022 maturity at 0.15%, the 10-year at 0.80% and the 30-year at 1.57% — all unchanged.

Treasuries were weaker as stock prices rose.

The three-month Treasury note was yielding 0.120%, the 10-year Treasury was yielding 0.701% and the 30-year Treasury was yielding 1.458%.

“Treasuries turned in one of their worst performances of the year in August,” ICE Data Services said. “Crimping returns during the month was the fact that close of business July 31 represented the all-time low yield for most of the curve, save the long bond. Front-end yields inched higher by only a few basis points as Fed control of short-term rates held that part of the curve in check.”

ICE said the back end suffered because of increased supply, the “quarterly refunding” record amount; generally stronger economic conditions as many business reopened; a weaker dollar; and growing political uncertainty ahead of the presidential election in November.

“Yields on the seven-year out to the end of the curve rose from 11 to 28 basis points in August,” ICE said. “The full yield curve, three-months to 30-years steepened out to 137 basis points, 28 basis points greater than month end July and the steepest level since the first week of June.”

The Dow rose 2.40%, the S&P 500 increased 2.60% and the Nasdaq gained 3.00%.