Municipal bond buyers saw some large deals head their way on Thursday as the fourth quarter of 2020 got underway. Muni prices showed little change, with yields on the AAA scales moving up by as much as one basis point on some longer maturities.

Citing the financial challenges caused by the COVID-19 pandemic, Moody's Investors Service downgraded New York City's $38.7 billion of outstanding general obligation bonds to Aa2 from Aa1.

“The downgrade reflects the substantial financial challenges New York City faces caused by the economic response to the coronavirus pandemic and our expectation that New York City is on a longer recovery path than most other major cities," Moody's said in a late Thursday afternoon release.

Moody's also cut New York State's GOs, personal income tax revenue, sales tax revenue, N.Y. Local Government Assistance Corp. and NYC Sales Tax Asset Receivable Corp STARC bonds to to Aa2 from Aa1.

For the first time in 20 weeks, investors pulled cash out of tax-exempt mutual funds. Refinitiv Lipper reported muni bonds saw almost $775 million of outflows in the latest reporting week.

In the third quarter, markets saw volatility as COVID-19 and the upcoming presidential election continued to drive uncertainty about an economic rebound, according to Daniel Himelberger, portfolio manager and fixed-income analyst at Cumberland Advisors.

“The net result of the volatility left the Treasury market little changed on the quarter, while spreads on investment-grade corporates and taxable municipals continued to grind lower from the peaks set at the end of the first quarter,” he wrote in a market note Thursday. “As the third quarter ends, the minimal movement in Treasury yields shows a shift to a slightly steeper yield curve, with short-term rates dropping and longer maturities remaining flat to slightly higher in yield for the quarter.”

"The September FOMC meeting was the fourth meeting in a row at which the Committee held the target fed funds rate in the 0–0.25% range and signaled that they expect to hold short-term rates lower for longer," he said. With the news of short-term rates remaining low, he said an argument can be made for a steeper yield curve moving forward.

“One of the biggest drivers of this argument is the recent uptick in inflation prints, which have temporarily suppressed the need for additional stimulus to the economy from the Fed,” Himelberger said. “The higher inflation and tightening spreads on investment-grade corporates and taxable municipals has led Cumberland Advisors to adjust our strategy and shorten our durations, as we expect higher rates on longer maturities going forward.”

Looking ahead, he said they were watching how COVID-19 and the presidential election in November may shape the U.S. economy.

“Our view is that once we can put COVID-19 and the election behind us, we will see Treasury yields start to increase on the long end as the yield curve steepens,” Himelberger said. “Our goal is to stay flexible while taking a conservative approach to investing in the face of a pandemic that has created new challenges for the investment management process.”

Primary market

BofA Securities priced the Salt River Project Agricultural Improvement and Power District, Ariz.’s (Aa1/AA+/NR/NR) $602.07 million of Salt River Project electric system revenue bonds.

The $224.67 million of Series 2020A bonds were priced to yield from 0.12% with a 5% coupon in 2022 to 0.65% with a 5% coupon in 2028. A split 2045 maturity was prices as 4s to yield 1.83% and as 5s to yield 1.66% and a 2048 maturity was priced as 2.375s to yield 2.40%.

The $100 million of Series 2020B taxables were priced at par to yield 2.57% in a 2050 bullet maturity.

BofA priced the North Texas Tollway Authority System’s (A1/A+/NR/NR) $517.545 million of Series 2020B first tier taxable revenue refunding bonds.

The bonds were priced at par to yield from 0.92% in 2024 to 2.527% in 2035, 3.029% in 2040, 3.079% in 2042 and 3.334% in 2052.

Raymond James & Associates priced the Hudson County Improvement Authority, N.J.’s (NR/AA/NR/NR) $343.405 million of county secured lease revenue bonds.

The bonds were priced to yield from 0.38% with a 4% coupon in 2022 to 2.20% with a 4% coupon in 2041; a 2046 maturity was priced as 4s to yield 2.33% and a 2051 maturity was priced as 4s to yield 2.37%.

Jefferies priced the North Texas Tollway Authority’s $243.39 million of system revenue refunding bonds.

The $190.73 million of Series 2020A first tier bonds (A1/A+/NR/NR) were priced to yield from 0.45% with a 5% coupon in 2025 to 1.98% with a 4% coupon in 2038.

The $52.66 million of Series 2020C second tier bonds (A2/A/NR/NR) were priced to yield from 0.27% with a 5% coupon in 2021 to 0.79% with a 5% coupon in 2027.

Goldman Sachs priced the Lower Colorado River Authority, Texas’ (NR/A/A+/NR) $145.48 million of Series 2020A transmission contract refunding revenue bonds for the LCRA Transmission Services Corp. project.

The bonds were priced as 5s to yield from 0.28% in 2021 to 1.96% in 2040, 2.15% in 2045 and 2.22% in 2050.

BofA priced the San Jose Financing Authority, Calif.’s (Aa3/AA/AA-NR) $145.96 million of Series 2020B taxable lease revenue bonds for the Ice Center project.

The bonds were priced at par to yield from 0.757% in 2023 to 2.184% in 2030, 3.034% in 2035, 2.417% in 2041 and 3.517% in 2051.

In the competitive arena, Wells Fargo Securities won the Florida State Board of Education’s (Aaa/AAA/AAA/NR) $397.44 million of Series 2020D taxable public education capital outlay refunding bonds with a true interest cost of 0.469%. The bonds were priced at par to yield from 0.15% in 2021 to 0.55% in 2025.

The Florida State Division of Bond Finance was the financial advisor; Squire Patton Boggs was the bond counsel.

BofA won Montgomery County, Md.’s (Aa1/AA+/NR/NR) $95.36 million of Series 2020A certificates of participation for public facilities projects. The bonds were priced to yield from 0.18% with a 5% coupon in 2021 to 2.25% with a 2.125% coupon in 2040. Davenport & Co. is the financial advisor; McKennon Shelton is the bond counsel.

Raymond James received the official award on the University of Mississippi Medical Center’s (Aa2/NR/AA/NR) $158.125 million of taxable Series 2020B revenue bonds for the Medical Center Educational Building Corp.’s capital improvements and refinancing project.

RBC Capital Markets received the award on the Missouri Health and Educational Facilities Authority’s (A1/A+/NR/NR) $93.65 million of health facilities revenue bonds for the Saint Luke's Health System, Inc.

N.Y. plans $6.3B of bond sales in Q4

New York State, New York City and their main public authorities are planning to sell $6.28 billion of bonds in the fourth quarter, state Comptroller Thomas DiNapoli announced Thursday.

The planned offerings include $4.98 billion of new money and $1.3 billion of refundings and reofferings, consisting of:

- $6.16 billion scheduled for October, of which $4.91 billion is for new money and $1.25 billion for refunding and reoffering purposes;

- $125 million scheduled for November, of which $75 million is for new money and $50 million for refunding purposes; and

- No issuance was scheduled for December as of Thursday.

The anticipated sales in the fourth quarter compare to past planned sales of $5.06 billion during the third quarter of 2020 and $11.28 billion in the fourth quarter of 2019.

The calendar includes expected sales by:

- The City of New York;

- The Dormitory Authority of the State of New York;

- The Metropolitan Transportation Authority;

- The New York City Transitional Finance Authority;

- The New York State Environmental Facilities Corp.;

- The New York State Housing Finance Agency; and

- The State of New York Mortgage Agency.

All borrowings are scheduled at the request of the issuer and done under their borrowing programs.

Refinitiv Lipper reports $775M outflow

In the week ended Sept. 30, weekly reporting tax-exempt mutual funds saw $774.747 million of outflows. It followed a gain of $498.876 million in the previous week.

Exchange-traded muni funds reported outflows of $113.764 million, after inflows of $123.617 million in the previous week. Ex-ETFs, muni funds saw outflows of $660.983 million after inflows of $375.259 million in the prior week.

The four-week moving average remained positive at $335.309 million, after being in the green at $563.837 billion in the previous week.

Long-term muni bond funds had outflows of $940.623 million in the latest week after outflows of $33.146 million in the previous week. Intermediate-term funds had outflows of $237.022 million after outflows of $14.928 million in the prior week.

National funds had outflows of $667.853 million after inflows of $434.978 million while high-yield muni funds reported outflows of $56.759 million in the latest week, after inflows of $57.127 million the previous week.

Money market muni funds fall $1B

Tax-exempt municipal money market fund assets fell $1.02 billion, bringing total net assets to $114.23 billion in the week ended Sept. 28, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 184 tax-free and municipal money-market funds rose to 0.02% from 0.01% in the previous week.

Taxable money-fund assets increased $2.70 billion in the week ended Sept. 29, bringing total net assets to $4.245 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 960 reporting money funds rose $1.68 billion in the week ended Sept. 29.

Secondary market

Some notable trades Thursday:

California infrastructure green bonds, 5s of 2021, traded at 0.14%. The State is planning a green bond deal next week with a green label from Nasdaq.

Washington GOs, 5s of 2024, traded at 0.26%. Katy, Texas, ISD 5s of 2025, traded at 0.28% to 0.26%. Harvards, 5s or 2025, at 0.28% to 0.27%. Montgomery County, Maryland GOs, 5s of 2026, at 0.26% to 0.40%. Delaware GOs, 5s of 2028 at 0.57%.

Fairfax County, Virginia GOs, 5s of 2029 at 0.80% to 0.79%. New York City TFAs, 5s of 2030 at 1.30% to 1.29%. Loudoun County, Virginia 3s of 2032 at 1.21%.

Out a little longer, Texas waters, 4s of 2038% after originally 1.81% in May. Charlotte, North Carolina GOs, 2.125s in 2045 at 2.18% to 2.15% after originally pricing on Sept. 21 at 2.25%.

New York City TFA subs, 4s of 2047 traded at 2.40% to 2.39% after pricing on Sept. 14 at 2.37%.

Cleveland, Texas ISDs, 4s of 2050, at 1.92% to 1.70% after originally pricing on Tuesday at 1.98%.

"What this trading shows is the dislocation the market is experiencing. Look at those Monty County GOs. 14 basis points? Cleveland ISDs with a 22 basis point differential?," a New York trader said. "There are certainly a lot of people making money off of it."

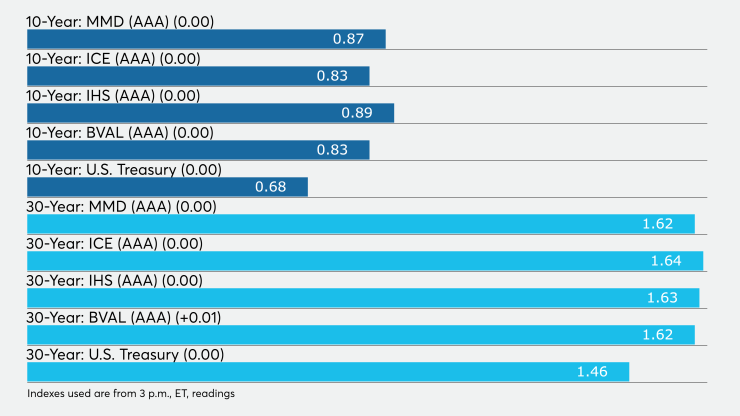

High-grade municipals were flat Thursday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were steady in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was unchanged at 0.87% while the 30-year yield was flat at 1.62%.

The 10-year muni-to-Treasury ratio was calculated at 128.1% while the 30-year muni-to-Treasury ratio stood at 111.3%, according to MMD

The ICE AAA municipal yield curve showed short maturities steady, with the 2021 maturity at 0.12% and the 2022 maturity at 0.13%. The 10-year maturity was unchanged at 0.83% and the 30-year remained at 1.64%. The 10-year muni-to-Treasury ratio was calculated at 128% while the 30-year muni-to-Treasury ratio stood at 111%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields at 0.13% in 2021 and 0.14% in 2022 while the 10-year muni was at 0.89% and the 30-year at 1.63%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity unchanged at 0.13%, the 10-year flat at 0.83% and the 30-year up one basis point to 1.62%.

Treasuries were mixed as stock prices traded higher.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.68% and the 30-year Treasury was yielding 1.46%.

The Dow rose 0.15%, the S&P 500 increased 0.54% and the Nasdaq gained 1.52%.

Lynne Funk contributed to this report.