Municipals were mixed Thursday as the market searched for direction, with short yields slipping while longer dated yields rose as large negotiated deals from issuers in Oregon, Texas and Georgia came to market.

Meanwhile, municipal CUSIP request volume decreased in August for the second month in a row.

Available cash is keeping inflows steady in the municipal market with a backdrop of slightly rising yields, but credit and rate uncertainty are a concern for many institutional investors, according to a New York trader.

“Supply is building up and there are still inflows, but smaller than we have seen recently,” the trader said Thursday.

However, he said the overwhelming theme is concern over credit — especially New York City with the loss of revenues in the transportation and tourism sectors stemming from the COVID-19 pandemic.

“New York has a lot of uncertainty, as well as New Jersey,” he said.

“There’s money out there but there’s more credit and rate uncertainty,” he said, adding “these rates are not for retail,” with 2% in 40-years, or 0.35% in one-year keeping them on the sidelines.

“I think it’s the continuous uncertainty about where we are headed,” he said. “Yields were starting to drift higher and today we are off by one but nothing major.”

Traders noted that even while there is credit risk, the transportation sector is getting deals done.

"People will still need to move about their cities and towns and counties and transportation is key to moving them," another New York trader said. "I think investors are savvy enough to understand the long game here. It's why longer-duration investing has been key. Short-duration is somewhat scary without knowing what the immediate future holds."

"But you could say the same for why education, both higher ed and K-12 sectors, are still trading in a somewhat orderly manner. People need schools and teachers," she said. "People, investors know, cannot live in a vacuum."

Tax-exempt mutual funds saw $1.005 billion of inflows in the lastest reporting period, Refinitiv Lipper reported, the 18th week in a row of positive results.

Primary market

Transportation issues ruled the roost on Thursday.

Morgan Stanley priced the Oregon Department of Transportation’s $794.22 million of bonds.

The deal consists of $612.19 million of Series 2020B (Aa1/AAA/AA+/NR) taxable highway user tax revenue bonds and $182.03 million of Series 2020A (Aa2/AA+/AA+/NR) tax-exempt highway user tax revenue subordinate-lien bonds.

The Series 2020B taxables were priced at par in maturities ranging from 2021 to 2034. The Series 2020A tax-exempts were priced as 5s to yield from 1.41% in 2035 to 1.62% in 2040.

BofA Securities priced and repriced the Texas Private Activity Bond Surface Transportation Corp.’s (Baa2/NR/BBB-/NR) $548.08 million of senior lien revenue refunding bonds for the LBJ Infrastructure Group LLC’s I-635 managed lanes project to lower yields.

The $541.03 million of Series 2020A private activity bonds not subject to the alternative minimum tax were repriced to yield from 1.91% with a 4% coupon in 2030 to 2.56% with a 4% coupon in 2040. The $7.05 million of Series 2020B taxables were priced at par to yield 2.75% in 2026.

In the competitive arena, Barclays Capital won the Metropolitan Atlanta Rapid Transit Authority, Ga.’s (Aa2/AA+/NR/NR) $270.145 million of taxable sales tax revenue refunding bonds.

The MARTA bonds were priced at par to yield from 0.20% in 2021 to 2.60% in 2040.

Hilltop Securities and First Tryon Advisors were the financial advisors; Holland & Knight was the bond counsel.

Wells Fargo Securities priced and repriced Charlotte, N.C.’s (Aaa/AAA/AAA/NR) $333 million of water and sewer system refunding revenue bonds to lower yields. The deal was repriced to yield from 0.11% with a 5% coupon in 2021 to 2.07% with a 2% coupon in 2042; a 2046 maturity was priced as 4s to yield 1.76% and a 2050 maturity was priced as 2.25s to yield 2.28%.

Goldman Sachs priced the Southern California Public Power Authority’s (NR/AA-/AA-/NR) $271.33 million of refunding revenue bonds for the Canyon Power project.

The $113.255 million of Series 2020A fixed-rate bonds were priced as 5s to yield from 0.55% in 2028 to 1.11% in 2036. The $88 million of Series 2020C fixed tender bonds in term-rate mode were priced at par to yield 0.65% in 2040 with a mandatory tender date in 2025. The $70.075 million of Series 2020B taxable fixed-rate bonds were priced at par to yield from 0.439% in 2022 to 1.632% in 2028.

Barclays priced the Akron, Bath, and Copley Joint Township Hospital District, Ohio’s (Baa2/NR/A-/NR) $136.145 million of hospital facilities refunding revenue bonds for the Summa Health Obligated Group. The bonds were priced to yield from 1.17% with a 5% coupon in 2025 to 2.60% with a 4% coupon in 2038; a 2040 maturity was priced as 3s to yield 2.033%.

BofA priced Gainesville, Fla.’s (Aa3/NR/AA-/NR) $206.08 million of Series 2020 taxable special obligation bonds. The bonds were priced at par to yield from 0.541%

Refinitiv Lipper reports $1B inflow

In the week ended Sept. 9, weekly reporting tax-exempt mutual funds saw $139.364 million of inflows. It was the 18th week in a row of positive results and followed a gain of $139.364 in the previous week.

Exchange-traded muni funds reported inflows of $255.920 million, after outflows of $457.679 million in the previous week. Ex-ETFs, muni funds saw inflows of $749.229 million after inflows of $597.043 million in the prior week.

The four-week moving average remained positive at $998.105 million, after being in the green at $1.325 billion in the previous week.

Long-term muni bond funds had inflows of $323.049 million in the latest week after outflows of $238.420 million in the previous week. Intermediate-term funds had inflows of $160.658 million after inflows of $101.882 million in the prior week.

National funds had inflows of $907.011 million after inflows of $156.953 million while high-yield muni funds reported outflows of $88.169 million in the latest week, after outflows of $145.115 million the previous week.

Money market muni funds fall $1.9B

Tax-exempt municipal money market fund assets fell $1.87 billion, bringing total net assets to $118.20 billion in the week ended Sept. 7, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was unchanged at 0.01% from the previous week.

Taxable money-fund assets decreased $30.61 billion in the week ended Sept. 8, bringing total net assets to $4.300 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 962 reporting money funds fell $32.47 billion in the week ended Sept. 8.

CUSIP: New muni requests fall in August

Municipal CUSIP request volume decreased in August for the second month in a row, according to CUSIP Global Services.

Issuance of new security identifiers can be an early indicator of debt activity over the next quarter.

The aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes and commercial paper — fell 11.8% to 1,396 in August from 1,582 in June. August’s decline came after a 10.1% decline in July.

On an annualized basis, total municipal CUSIP identifier request volumes are up 8.9% to 10,323 through August compared to 9,480 in the same period in 2019.

For municipal bonds alone, CUSIP requests in August fell 4.9% to 1,179 from 1,240 in July; they are up 12.5% to 8,435 on an annualized basis from 7,497 in the same period last year.

“Corporate and municipal debt issuers continued to access liquidity at a healthy pace throughout the COVID-19 crisis, which is why we're seeing strong year-over-year CUSIP request volume across several asset classes,” said Gerard Faulkner, director of operations for CGS. “Over the last two months, however, that pace has slowed — particularly in the municipal market, where we're seeing a second straight month of slowing CUSIP request volume. Given the highly publicized funding needs of municipalities, this is a trend we're going to watch closely.”

Among top state issuers, Texas, New York and California were the most active in August.

Secondary market

Some notable trades Thursday:

Delaware GOs, 5s of 2022, traded at 01.5%-0.14%. Prince George's County Maryland GOs 5s of 2023 traded at 0.17%. NYC TFAs, 5s of 2027, traded at 0.80%. Texas waters 5s of 2030 traded at 0.97%-0.96%. Washington GO, 5s of 2036, 1.37%-1.35%.

NYC TFA 3s of 2037 traded at 2.19%, originally selling at 2.03% in August. Cypress-Fairbanks ISD 3s of 2035 traded at 1.27%-1.22%. Miracosta Community College District California 2s of 2041 traded at 2.13%-2.07%.

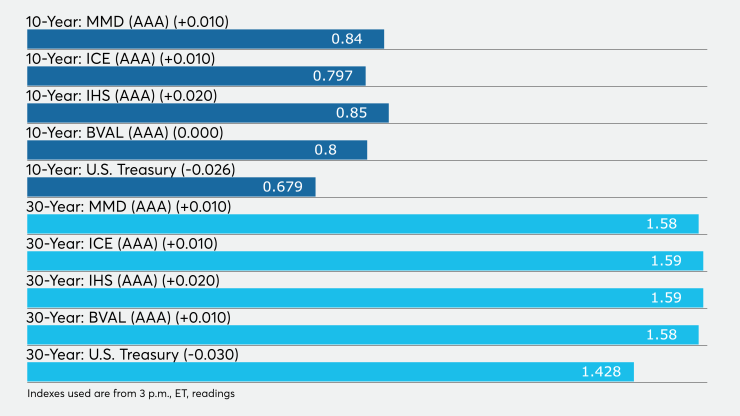

High-grade municipals were little mixed, according to readings on Refinitiv MMD’s AAA benchmark scale. Yields fell two basis points in 2021 and 2022, to 0.12% and 0.13%, respectively. The yield on the 10-year muni rose one basis point to 0.84% while the 30-year yield increased by one basis point to 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 122.8% while the 30-year muni-to-Treasury ratio stood at 109.7%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.13% and the 2022 maturity down one basis point to 0.13%; the 10-year maturity rose one basis point to 0.79% and the 30-year increased one basis point to 1.59%.

The 10-year muni-to-Treasury ratio was calculated at 122% while the 30-year muni-to-Treasury ratio stood at 109%, according to ICE.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.15%, the 2022 maturity at 0.16%, the 10-year muni at 0.85% and the 30-year at 1.59%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.12%, the 2022 maturity steady at 0.15%, the 10-year flat at 0.80% and the 30-year up one basis point to 1.58%.

Treasuries were stronger as stock prices dropped.

The three-month Treasury note was yielding 0.117%, the 10-year Treasury was yielding 0.679% and the 30-year Treasury was yielding 1.428%.

The Dow fell 1.33%, the S&P 500 decreased 1.67% and the Nasdaq dropped 2.25%.