Municipal issuers have a market in which to sell their bonds even if they are coming at a bit of a premium relative to lower yields experienced in August and September and a weaker U.S. Treasury market.

New York City priced $1 billion of general obligation bonds for institutions on Wednesday after a two-day retail order period, which saw $570 million of orders from individual investors, out of which about $466 million was usable. During Wednesday’s institutional pricing, the city received about $3.2 billion of priority orders, making the deal 4.8 times oversubscribed.

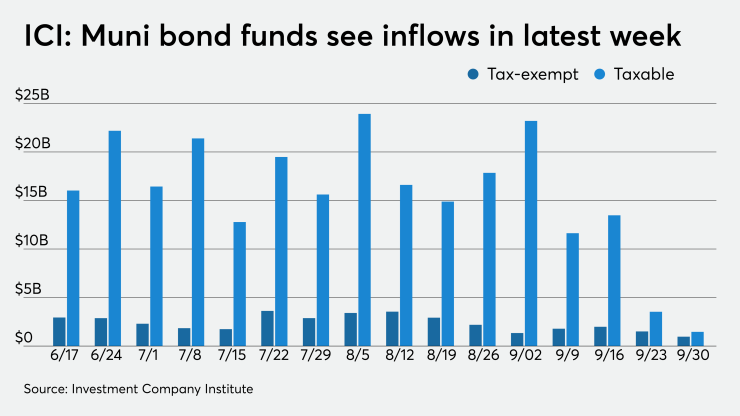

Municipal bond funds and exchange-traded funds saw combined inflows of $966 million in the week ended Sept. 30, ICI reported. It was the 22nd straight week of inflows and came after Refinitiv Lipper’s data showed outflows of $775 million in the week ended Sept. 30.

Meanwhile, the San Francisco Public Utilities Commission priced more than $341.9 million of taxable green bonds that will later be listed on the London Stock Exchange as one of the first issuers to do so for a European and international investor base.

"We believe green bonds represent an opportunity for U.S. muni bond issuers. Much of the $400 billion of annual U.S. municipal bond issuance is to fund green projects, like rail, green buildings, water supply, etc…," said Eric Sandler, chief financial officer and assistant general manager, business services for the San Francisco Public Utilities Commission. "However, because issuers don’t see a clear pricing benefit, only about $10 billion each are labeled green. I believe extending our investor base to Europe where there is more demand for green bonds will help grow the green bond market for U.S. municipalities and even start to influence project selection to ensure that the projects we’re building today are low-carbon and climate resilient."

Municipals were trading weaker, with yields on the AAA scales rising by as much as four basis points on longer-dated maturities.

"Municipal bonds are continuing the slide began on Monday," ICE Data Services said. "The front end of the ICE Muni yield curve is mixed, but five-years and out, yields are 1.5 to 3.5 basis points higher. The one- to 30-year curve has been creeping out over the month, a 15 basis points steepening to almost 160 basis points. Trade volumes so far today are on a par with yesterday’s level."

Primary market

Siebert Williams Shank priced and repriced New York City’s (Aa2/AA/AA/NR) $1.046 billion of tax-exempt fixed-rate general obligation bonds after holding a two-day retail order period.

Given the strong investor demand, yields were reduced by seven basis points for the 2026 maturities, four to five basis points for maturities in 2027 through 2038 and five to six basis points for maturities in 2039 through 2043.

Final yields ranged from 0.41% in 2022 to 2.40% for the 5% bond maturing in 2043 and 2.88% for the 2.75% bond maturing in 2044.

The $900 million of Fiscal 2021 Series C GOs were priced to yield from 0.41% with a 5% coupon in 2022 to 2.88% with a 2.75% coupon in 2044.

The $26.885 million of Fiscal 2008 Series J Subseries J-5 were repriced as a remarketing as 5s to yield 1.16% in 2027 and as 5s to yield 1.34% in 2028.

The $41.245 million of Fiscal 2008 Series J Subseries J-6 GOs were priced as a remarketing as 4s and as 5s to yield 0.54% in a split 2023 maturity and as 4s to yield 0.63% in 2024.

The $55.945 million of Fiscal 2008 Series J Subseries J-10 GOs were repriced as a remarketing as 5s to yield 0.95% in 2026 and as 5s to yield 1.16% in 2027.

The $21.825 million of Fiscal 2012 Series A Subseries A-3 GOs were repriced as a remarketing as 4s to yield 2.22% in 2035.

Co-managers were: BofA Securities; Citigroup; JPMorgan Securities; Jefferies; Loop Capital Markets; Ramirez & Co.; RBC Capital Markets; Wells Fargo Securities; Academy Securities; Barclays Capital; Blaylock Van; BNYMellon Capital Markets; Cabrera Capital Markets; Drexel Hamilton; Fidelity Capital Markets; Goldman Sachs; Great Pacific Securities; Janney; Morgan Stanley; Oppenheimer & Co.; Raymond James & Associates; Rice Financial Products Co.; Roosevelt & Cross; Stern Brothers & Co WMBE; Stifel; TD Securities; and UBS Financial Services.

BofA Securities priced the Integris Baptist Medical Center Inc.’s (A3/A/NR/NR) $550 million of Series 2020A corporate CUSIP taxable bonds.

The bonds were priced at par to yield 3.675% (AGM) and 3.875% in a split 2050 maturity. Assured Guaranty Municipal insured $85 million of the 2050 maturity.

In the competitive arena, the Maryland Department of Transportation (Aa1/AAA/AA+/NR) sold $300 million of consolidated transportation revenue bonds.

JPMorgan won the bonds with a true interest cost of 1.5798%. The deal was priced as 5s to yield from 0.21% in 2023 to 1.52% in 2035.

PFM Financial Advisors and People First Financial Advisors were the financial advisors. Kutak Rock was the bond counsel. Proceeds will fund part of the capital projects including highways and certain other transportation activities.

On Thursday, the Dormitory Authority of the State of New York announced they would competitively sell about $1.9 billion of state personal income tax revenue bonds in six offerings.

DASNY's sales consist of $486.365 million of Series 2020A Bidding Group 2 PITs, $485.085 million of Series 2020A Bidding Group 5 PITs, $439.855 million of Series 2020A Bidding Group 3 PITs, $415.705 million of Series 2020A Bidding Group 4 PITs, Series 2020A $53. 293 million of Bidding Group 1 bonds and $48.155 million of Series 2020B taxable PITs.

North Carolina is competitively selling $400 million of public improvement GOs for the Connect NC program on Thursday. Davenport & Co. and the Local Government Commission in Raleigh are the financial advisors. Womble Bond is the bond counsel.

ICI: Muni bond funds see $966M inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $966 million in the week ended Sept. 23, the Investment Company Institute reported Wednesday.

It marked the 22nd straight week that the funds saw inflows. In the previous week, muni funds saw an inflow of $1.464 billion, originally reported as a $1.505 billion inflow. ICI said.

Long-term muni funds alone had an inflow of $947 million in the latest reporting week after a revised inflow of $1.300 billion originally reported as a $1.343 billion inflow in the prior week.

ETF muni funds alone saw an inflow of $19 million after an inflow of $164 million in the prior week.

Taxable bond funds saw combined inflows of $3.391 billion in the latest reporting week after a revised inflow of $3.572 billion in the prior week originally reported as a $13.474 billion inflow.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $9.396 billion after a revised outflow of $14.586 billion in the previous week, originally reported as a $14.582 billion outflow.

Secondary market

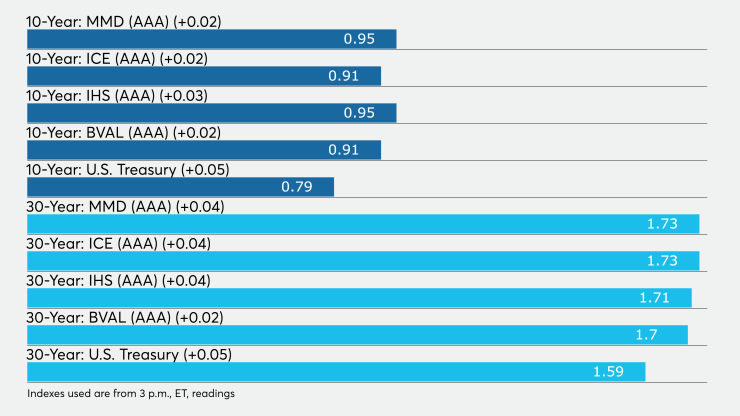

High-grade municipals were mostly weaker, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields in 2021 and 2022 were unchanged at 0.14% and 0.15%, respectively. The yield on the 10-year muni rose two basis points 0.95% while the 30-year yield was up four basis points to 1.73%.

The 10-year muni-to-Treasury ratio was calculated at 120.0% while the 30-year muni-to-Treasury ratio stood at 108.9%, according to MMD

The ICE AAA municipal yield curve showed short maturities unchanged, with the 2021 maturity at 0.13% and the 2022 maturity at 0.15%. The 10-year maturity was up two basis points to 0.91% and the 30-year was up four basis points to 1.73%. The 10-year muni-to-Treasury ratio was calculated at 1`9% while the 30-year muni-to-Treasury ratio stood at 107%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields at 0.15% in 2021 and 0.16% in 2022 while the 10-year muni rose to 0.95% and the 30-year was atup to 1.71%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity unchanged at 0.13%, the 10-year up two basis points to 0.91% and the 30-year up two basis points to 1.70%.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.79% and the 30-year Treasury was yielding 1.59%.

The Dow rose 2.08%, the S&P 500 increased 1.87% and the Nasdaq gained 1.93%.