Municipals finished weaker Thursday, with yields on long-dated maturities rising by as much as four basis points on the AAA GO scales.

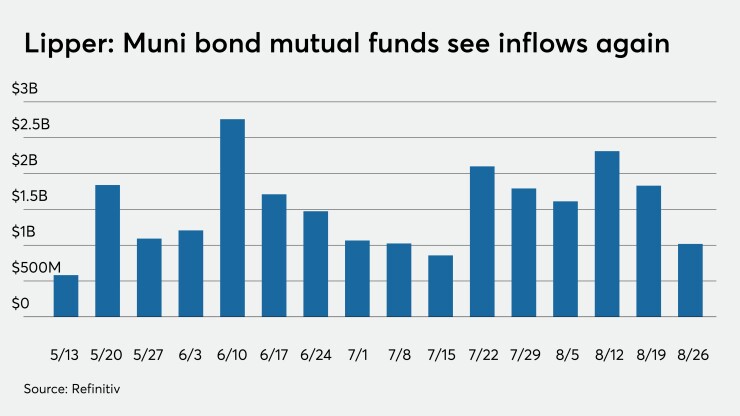

Lipper reported $1.017 billion of inflows into muni mutual funds in the latest reporting period, the 16th week in a row of positive results.

Action was quieter in the primary as deals from around the country marked the end of big offerings coming this week.

Lipper reports $1.8B inflow

Investors continued to put cash into bond funds, the latest data from Refinitiv Lipper showed.

In the week ended Aug. 26, weekly reporting tax-exempt mutual funds saw $1.017 billion of inflows, after inflows of $1.831 billion in the previous week.

It was the 16th straight week that investors put cash into the bond funds.

Exchange-traded muni funds reported outflows of $19.633 million, after inflows of $88.059 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.037 billion after inflows of $1.742 billion in the prior week.

The four-week moving average remained positive at $1.693 billion, after being in the green at $1.887 billion in the previous week.

Long-term muni bond funds had inflows of $65.842 million in the latest week after inflows of $1.011 billion in the previous week. Intermediate-term funds had inflows of $205.493 million after outflows of $274.189 million in the prior week.

National funds had inflows of $951.416 million after inflows of $1.736 billion while high-yield muni funds reported outflows of $15.485 million in the latest week, after inflows of $217.326 million the previous week.

Primary market

Siebert Williams Shank priced and repriced the Chicago Transit Authority’s (NAF/A+/NAF/AA-) $367.895 million of Series 2020A second lien sales tax receipts revenue refunding bonds.

The bonds were repriced to yield 2.74% with a 5% coupon in 2045, 128 basis points above the MMD scale, and 3.02% with a 4% coupon in 2050, 151 basis points above MMD and in a split 2055 maturity to yield 2.92% with a 5% coupon, 141 basis points above MMD, and 3.12% with a 4% coupon, 161 basis points above MMD.

The bonds had been tentatively priced to yield 2.86% with a 5% coupon in 2045, +140 basis points over MMD, 3.14% with a 4% coupon in 2050, +163 basis points and 3.04% with a 5% coupon, +153 basis points, and 3.24% with a 4% coupon, +173 basis points in a split 2055 maturity.

Morgan Stanley priced and repriced the Austin Independent School District in Travis County, Texas’ (Aaa/NR/AR/NR) $255.57 million of unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program.

The bonds were repriced to yield from 0.17% with a 5% coupon in 2021 to 2.07% with a 2% coupon in 2040. The bonds had been tentatively priced to yield from 0.19% with a 5% coupon in 2021 to 2.02% with a 2% coupon in 2040.

BofA priced the Arkansas Development Finance Authority’s (Caa1/B/NR/NR) $265 million of Series 2020 tax-exempt industrial development revenue green bonds, subject to alternative minimum tax. The bonds were priced at par to yield 4.75% in a 2049 bullet maturity.

In the competitive arena, the Kern High School District, Calif., (Aa2/AA/AA-/NR/NR) sold $128.3 million of 2016 Election Series C general obligation bonds. The deal is insured by Assured Guaranty Municipal Corp.

Citigroup won the bonds. The deal was priced to yield from 0.20% with a 2% coupon in 2021 to 1.85% with a 2% coupon in 2035.

Dale Scott Co. was the financial advisor; Jones Halls was the financial advisor.

JPMorgan Securities received the written award on Michigan’s (Aa2/AA+/NR/NR) $800 million of state trunk line fund bonds issued under the Rebuilding Michigan program.

The bonds were priced to yield from 0.13% with a 5% coupon in 2020 to 1.87% with a 4% coupon in 2041; a split 2045 maturity was priced as 5s to yield 1.78% and as 4s to yield 2.03%.

JPMorgan also received the written award on the Tampa-Hillsborough County Expressway Authority, Fla.’s $202.21 million of Series 2020B taxable refunding revenue bonds and $20.09 million of Series 2020A tax-exempt revenue bonds. Build America Mutual insured the deal except for the Series 2020A 2021-25 maturities and the Series 2020B 2020-2021 maturities.

Citigroup priced Jacksonville, Fla.’s (NR/AA/AA-/NR) $105.485 million of Series 2020C taxable special revenue and refunding bonds. The bonds were priced at par to yield from 0.393% in 2021 to 2.281% in 2035 and 2.766% in 2041.

New York City said Thursday that its sale of $1.4 billion of general obligation refunding bonds achieved $239 million in debt service savings, nearly all in fiscal year 2021.

The city said refunding savings on a present value basis totaled $233 million, or 14.3% of the refunded par amount.

Citigroup priced the city’s (Aa1/AA/AA/NR) $1.1 billion of Fiscal 2021 Series A and B tax-exempt GOs for institutional investors on Wednesday after holding a one-day retail order period. The city also competitively sold $287 million of taxable fixed-rate bonds, comprised of two subseries.

Morgan Stanley won the $150.79 million of Subseries A-2 taxables with a true interest cost of 0.3677% and BofA Securities won the $135.455 million of Subseries B-2 taxables with a TIC of 1.7172%. The first subseries attracted 10 bidders while the second subseries attracted nine bidders.

During the one-day retail order period for the tax-exempts, the city received $233 million of orders from individual investors, out of which $212 million was usable. During the institutional order period, the city received about $1.9 billion of priority orders, representing a 2.1 times oversubscription for the bonds.

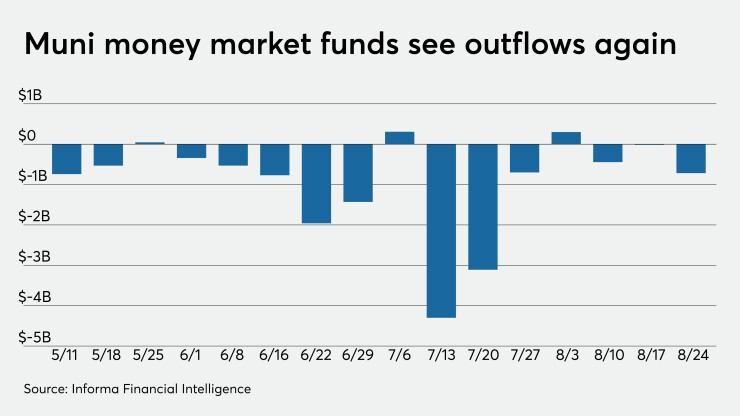

Money market muni funds fall $717M

Tax-exempt municipal money market fund assets fell $716.9 million, bringing total net assets to $121.11 billion in the week ended Aug. 24, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was unchanged at 0.02% from the previous week.

Taxable money-fund assets decreased $9.67 billion in the week ended Aug. 25, bringing total net assets to $4.362 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds remained at 0.03% from the prior week.

Overall, the combined total net assets of the 962 reporting money funds fell $10.39 billion in the week ended Aug. 25.

Secondary market

Municipals were again weaker out long, according to the final readings on Refinitiv MMD’s AAA benchmark scale Thursday.

Yields were unchanged in 2021 and 2022 at 0.15% and 0.16%, respectively. The yield on the 10-year muni rose three basis points to 0.80% while the 30-year yield gained four basis points to 1.55%.

The 10-year muni-to-Treasury ratio was calculated at 107.2% while the 30-year muni-to-Treasury ratio stood at 103.4%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity unchanged at 0.140% and the 2022 maturity steady at 0.152%. The 10-year maturity rose two basis points to 0.775% and the 30-year gained four basis points to 1.558%.

ICE reported the 10-year muni-to-Treasury ratio stood at 108% while the 30-year ratio was at 102%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.17% and the 2022 maturity at 0.18% while the 10-year muni was at 0.80% and the 30-year stood at 1.52%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.101%, the 10-year Treasury was yielding 0.749% and the 30-year Treasury was yielding 1.500%.

The Dow rose 0.91%, the S&P 500 increased 0.37% and the Nasdaq fell 0.07%.