Municipal bond buyers saw the last of the week’s large deals come to market on Thursday as bond prices showed little change, with yields on the AAA scales barely moving at all.

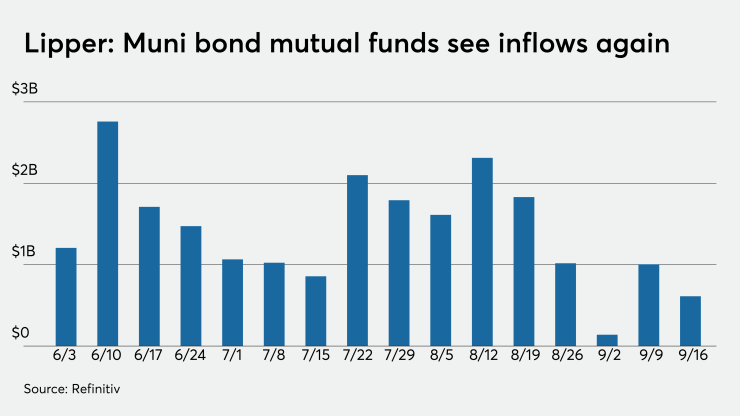

In the latest week, tax-exempt mutual funds saw nearly $612 million of inflows. It was the 19th week in a row of positive results, but was down from last week's gain of $1.005 billion and came after ICI reported nearly $2 billion of inflows for the previous week.

The new-issue market saw Houston airports, an Illinois Finance Authority healthcare deal and two larger competitive deals from the City and County of San Francisco, Calif., transportation bonds and two Midwestern deals from Minneapolis and a school district in Missouri. The New York Municipal Water Finance Authority announced another $500-million-plus deal on tap for next week.

The municipal bond market has absorbed more than 20 tax-exempt and taxable issues of $100 million or more in the space of about a week, according to Kim Olsan, senior vice president at FHN Financial.

“The obvious level of distraction for distribution has really created a stalemate for yields, but there has been just enough follow-through trading in new issues to hold a steady tone,” she said.

Olsan noted that Pennsylvania’s GO sale drew spreads on the shorter-premium bonds in line with recent trading, but the unusual opportunity was to see 2.00% and 3.00% couponing at yields over 2% between 2038 and 2040.

“Other recent pricings were whittling down balances nearby original levels, helped in part by manageable bids-wanteds volumes that would otherwise be a distraction,” she said. “Among short maturities there has been an uptick in line items posted for sale in pre-refunded structures, with strong levels being paid.”

Olsan said that for sellers there were varying levels of implied profits, “depending on whether positions were put on during the March/April period when rates exceeded 3% or with more nominal performance. Potential bidders can leverage the inherent quality and defensive nature of a pre-refunded bond.”

Primary market

Morgan Stanley priced and repriced Houston, Texas’ (A1/A/NR/NR) airport system subordinate lien revenue refunding bonds.

The Series 2020A bonds subject to the alternative minimum tax were repriced to yield from 0.66% with a 5% coupon in 2023 to 2.61% with a 4% coupon in 2040; a 2047 maturity was priced as 4s to yield 2.75%. The Series 2020B non-AMT bonds were repriced as 5s to yield from 0.70% in 2026 to 1.38% in 2030.

The Series 2020A bonds had been tentatively priced to yield from 0.69% with a 5% coupon in 2023 to 2.63% with a 4% coupon in 2040; a 2047 maturity was priced as 4s to yield 2.80%. The Series 2020B bonds had been priced as 5s to yield from 0.75% in 2026 to 1.43% in 2030.

JPMorgan Securities priced and repriced the Illinois Finance Authority’s (A3/A/A/NR) $443.66 million of revenue bonds for the ISF Healthcare System.

The $121.51 million of Series 2020A tax-exempts were repriced in a split 2050 maturity as 3s to yield 3.15% with an average life of 28.668 years and as 4s to yield 2.80% with an average life of 28.615 years.

The $151.125 million of Series 2020B tax-exempts were repriced in two tranches. The $65.86 million of Series B-1 bonds were repriced as 5s to yield 0.86% in 2050 with a mandatory put in 2024; the $85.265 million of Series B-2 bonds were repriced as 5s to yield 1.14% in 2050 with a mandatory put in 2026.

The $171.025 million of Series 2020C taxables were priced at par to yield from 2.11% (165 basis points above the comparable Treasury security) in 2026 to 3.079% (+240 basis points above Treasuries) in 2035 and 3.51% (+208 basis points above) in 2041.

UBS Financial Services priced the Harris County Flood Control District, Texas’ (Aaa/NR/AAA/NR) $252.21 million of Series 2020A improvement refunding bonds.

The bonds were priced to yield from 0.16% with a 3% coupon in 2021 to 1.93% with a 3% coupon in 2040; a 2045 maturity was priced as 4s to yield 1.86%

Piper Sandler priced the Fresno Unified School District, Calif.’s (Aa3/NR/NR/NR) $137.615 million of GOs.

The $92.615 million of taxable GOs were priced at par to yield from 0.237% (+10 bps to UST) in 2021 to 2.267% (+160 bps) in 2035 and 2.763% (+135 bps) in 2040 and 3.013% (+160 bps) in 2047. The $45 million of tax-exempt Election of 2016 Series C GOs were priced to yield 0.15% with a 3% coupon in 2021 and to yield from 0.46% with a 4% coupon in 2026 to 2.25% with a 3% coupon in 2040; a 2043 maturity was priced as 2.5s to yield 2.62%.

In the competitive arena, the City and County of San Francisco, Calif., (Aaa/AAA/AA+/) sold $136.09 million of Series 2020B general obligation transportation and road improvement bonds.

Citigroup won the deal with a true interest cost of 1.5939% The bonds were priced to yield from 0.12% 2021 with a 2% coupon in 2021 to 2% at par in 2040.

Fieldman, Rolapp & Associates was the financial advisor. Orrick Herrington and Curls Bartling were the bond counsel.

Minneapolis, Minn., sold $136.16 million of GOs in three offerings.

JPMorgan Securities won the $97.185 million of GOs with a TIC of 0.8925%. Morgan Stanley won the $26 million of taxable convention center refunding GOs with a TIC of 0.5999%. Huntington Securities won the $12.975 million of parking assessment refunding GOs with a TIC of 0.9551%

Ehlers & Associates was the financial advisor; Kennedy & Graven was the bond counsel.

The Wentzville R-IV School District, Mo., (Aa2/NR/NR/NR) sold $105 million of GOs issued under the Missouri Direct Deposit program.

The deal was won by BofA Securities with a TIC of 1.9047%The bonds were priced to yield from 0.97% with a 4% coupon in 2030 to 1.96% with a 1.875% coupon in 2040.

Stifel was the financial advisor; Thompson Coburn was the bond counsel.

NYC MWFA announces $533M deal

The New York City Municipal Water Finance Authority said it will issue about $533 million of tax-exempt fixed-rate bonds next week.

Raymond James will priced the deal on Wednesday, Sept. 23 after a one-day retail order period. Barclays, BofA Securities, Goldman Sachs, Loop Capital Markets, Siebert Williams Shank and UBS are co-senior managers.

Proceeds will be used to fund capital projects and refund certain outstanding bonds for savings.

Refinitiv Lipper reports $612M inflow

In the week ended Sept. 16, weekly reporting tax-exempt mutual funds saw $611.960 million of inflows. It was the 19th week in a row of positive results and followed a gain of $1.005 billion in the previous week.

Exchange-traded muni funds reported inflows of $110.173 million, after inflows of $255.920 million in the previous week. Ex-ETFs, muni funds saw inflows of $501.787 million after inflows of $749.229 million in the prior week.

The four-week moving average remained positive at $693.105 million, after being in the green at $998.105 billion in the previous week.

Long-term muni bond funds had inflows of $64.307 million in the latest week after outflows of $323.049 million in the previous week. Intermediate-term funds had inflows of $116.210 million after inflows of $160.658 million in the prior week.

National funds had inflows of $545.570 million after inflows of $907.011 million while high-yield muni funds reported inflows of $60.885 million in the latest week, after outflows of $88.169 million the previous week.

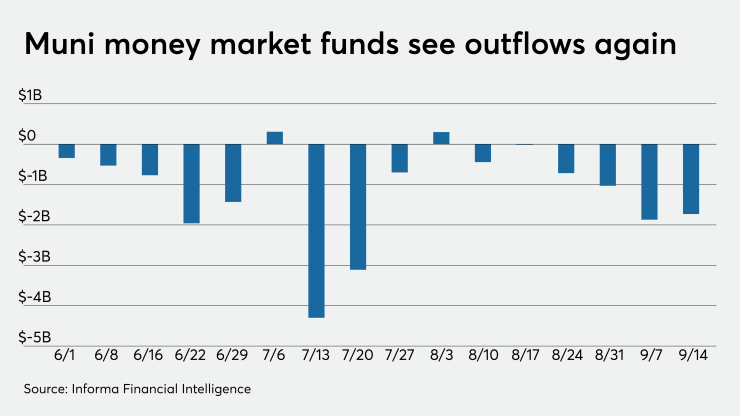

Money market muni funds fall $1.7B

Tax-exempt municipal money market fund assets fell $1.73 billion, bringing total net assets to $116.4820 billion in the week ended Sept. 14, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds was unchanged at 0.01% from the previous week.

Total U.S. money-market fund assets fell $58.40 billion for the reporting week ending

Taxable money-fund assets decreased $56.67 billion in the week ended Sept. 15, bringing total net assets to $4.243 trillion.

The average, seven-day simple yield for the 775 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 962 reporting money funds fell $58.40 billion in the week ended Sept. 15.

Secondary market

Some notable trades Thursday:

Charleston County, South Carolina 5s of 2021 traded at 0.19%. Loudoun County, Virigina 5s of 2021 at 0.17%. Bellwhether Wake County, North Carolina GOs, 5s of 2022, at 0.13%-0.12%.

Seattle 5s of 2027 at 0.53%.

Harvard 5s of 2029 at 0.72%.

Johnson County, Kentucky USD 3s of 2031 traded at 1.28% to 1.20%. Maryland GOs, 5s of 2033, traded at 1.12%.

New York City TFAs, 5s of 2034, traded at 1.68% their original selling level.

Washington GOs, 5s of 2043 traded at 1.61% to 1.57%.

Texas waters, 4s of 2044 at 1.74% while Texas waters 4s of 2049 traded at 1.98% to 1.97%.

High-grade municipals were changed on Thursday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were flat in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was steady at 0.84% while the 30-year yield remained at 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 122.4% while the 30-year muni-to-Treasury ratio stood at 110.5%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity steady at 0.12% and the 2022 maturity flat at 0.12%. The 10-year maturity was unchanged at 0.80% and the 30-year was flat at 1.59%.

The 10-year muni-to-Treasury ratio was calculated at 123% while the 30-year muni-to-Treasury ratio stood at 109%, according to ICE.

The IHS Markit municipal analytics AAA curve showed prices unchanged with the 2021 maturity yielding 0.13%, the 2022 maturity at 0.14%, the 10-year muni at 0.83% and the 30-year at 1.57%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity down one basis point to 0.13%, the 10-year down one basis point to 0.80% and the 30-year unchanged at 1.58%.

Treasuries were stgronger as stock prices traded down.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.69% and the 30-year Treasury was yielding 1.43%.

The Dow fell 0.90%, the S&P 500 decreased 1.35% and the Nasdaq lost 1.84%.

Lynne Funk contributed to this report.