-

The University of Chicago went to market this week, as the Trump administration has targeted higher education and faculty criticize budget and program cuts.

August 22 -

The University of Chicago embarked on the Illinois Finance Authority's largest financing ever to transform its capital structure and fund major projects.

November 20 -

The Bond Buyer's Deal of the Year awards will mark the 23rd year it has recognized outstanding achievement in municipal finance. The event, to be held Dec. 3 in New York City, will also include the presentation of the Freda Johnson Awards for Trailblazing Women in Public Finance.

November 7 -

S&P Global Ratings revised the outlook on bonds issued for the University of Chicago Medical Center to negative from stable.

May 29 -

The authority approved $1.3 billion in conduit financings at its meeting Tuesday.

September 13 -

The state, through its established conduit issuer, is eyeing new financing products to promote climate goals as its pursues $1.2 billion of federal funds.

March 28 -

Governance decisions and rapidly escalating deficits contributed to Moody's decision to cut Illinois Tech's rating two notches to speculative grade.

March 10 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

Commercial PACE loans facilitated through the Illinois Finance Authority and Cook County supported hotels, a historic theater, an indoor vertical farm, and rental kitchens.

May 17 -

The Illinois Finance Authority signed off on the financing cementing NorthShore University HealthSystem’s recently closed merger with Edward-Elmhurst Health.

March 8 -

A lawsuit accusing underwriter Stifel of negligence on one bond issue is pending and broader claims related to the financings are being considered.

October 5 -

The prominent Chicago health system's refunding will simplify its debt structure, cut interest rates, and provide longer-term fixed financing.

July 20 -

Final payouts are approaching for $170 million of defaulted BHF bonds with haircuts ranging from less than 10% to more than 50%.

April 27 -

The Illinois-based health system, with a balance sheet helped by its insurance arm, will sell $600 million of AA-minus rated debt over the next month.

April 21 -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

April 16 -

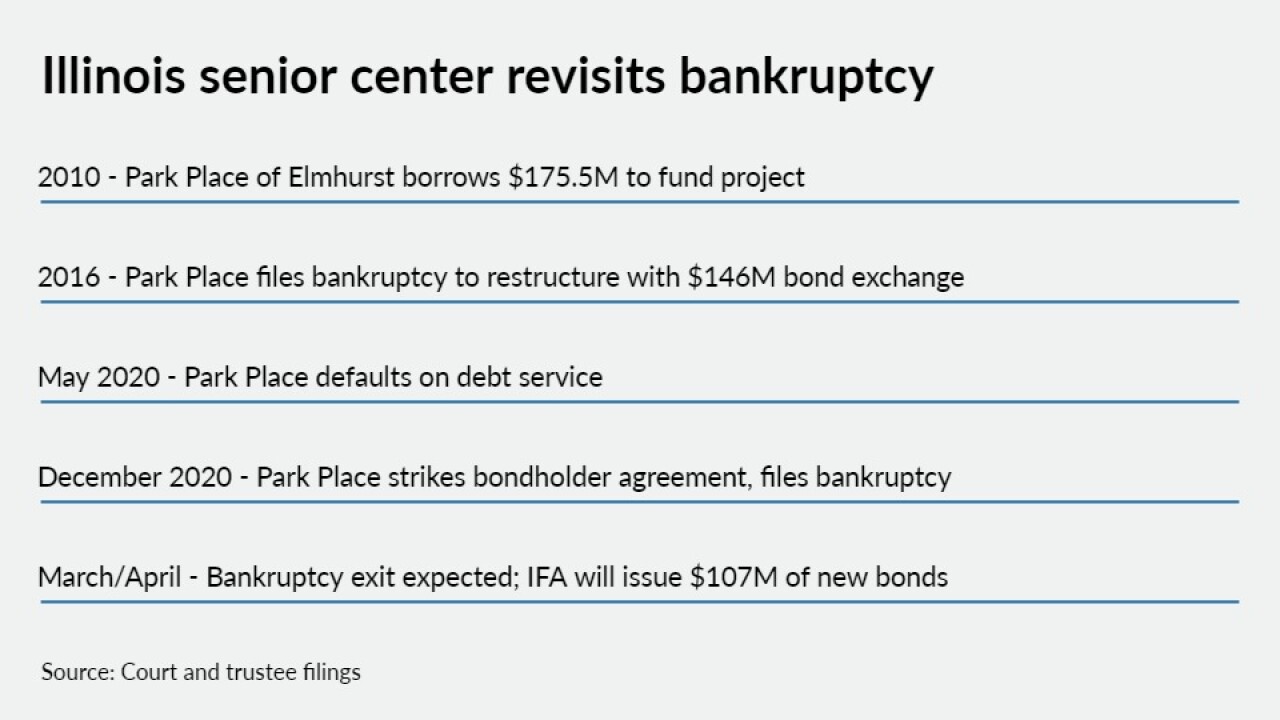

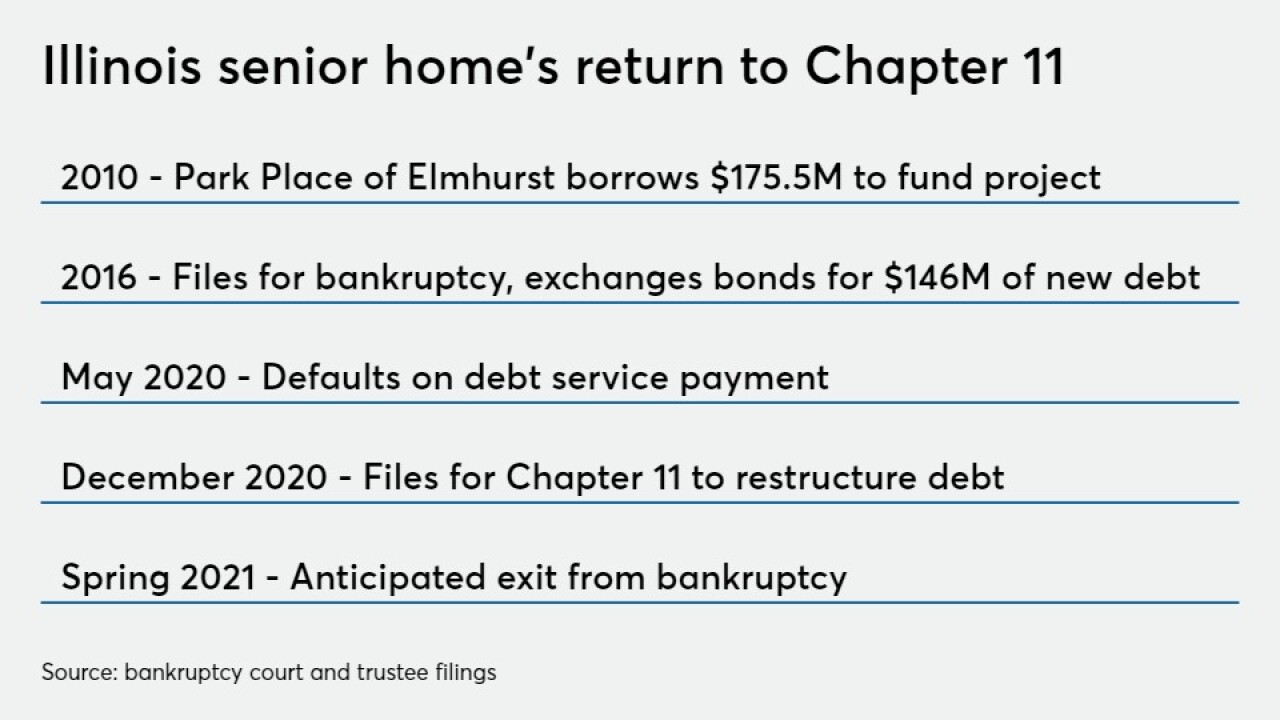

The facility and a majority of bondholders agreed to a restructuring that aims to ease repayment problems not solved by the previous bankruptcy in 2016.

February 24 -

Park Place at Elmhurst would restructure and redeem $141 million of bonds issued to exit its 2016 Chapter 11 under a plan pending before a bankruptcy court.

January 5 -

Deep bondholder losses are expected when the bonds issued for five Better Housing Foundation portfolios in and around Chicago emerge from Chapter 11.

December 8 -

The IFA is hoping to capitalize on growing investor interest in green and sustainable bonds.

November 10 -

The proposed combination of the major not-for-profit healthcare players in Illinois, Michigan, and Wisconsin encountered opposition in Michigan.

October 2