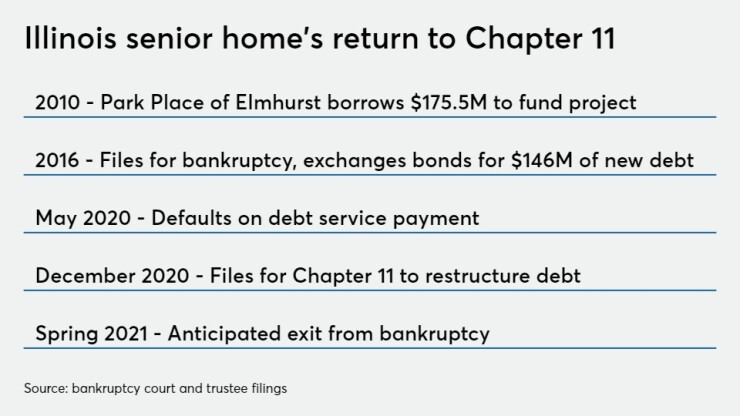

A suburban Chicago senior living retirement facility is back in bankruptcy court where it wants to restructure debt it issued to exit its previous Chapter 11 five years ago.

The Park Place of Elmhurst, in the western Chicago suburb of Elmhurst, filed for Chapter 11 bankruptcy in December after reaching agreement with holders of a majority of principal from the $141 million remaining due from $146 million of bonds issued in 2016 through the Illinois Finance Authority. Those bonds were issued to exit the previous bankruptcy in exchange for the remaining principal from the initial $175.5 million unrated 2010 issue.

The restructuring would give the facility more breathing room by requiring bondholders to take a haircut and wait longer to recoup their investment.

The COVID-19 pandemic, which has hit many retirement communities hard, hasn’t helped the facility’s fiscal woes but it’s not blamed for the restructuring. Park Place has fared well compared to many. It has seen four residents and 30 staff infected by the virus that causes COVID-19 resulting the death of one resident, according to the Dec. 15 Chapter 11 filing. The facility has 300 residents.

The 2016 restructuring was blamed on the real estate market, leading to struggles to fill units, and the facility now says it fell short of fixing its structural financial problems. The facility's residents are living longer, therefore turnover and the resulting entrance fees have fallen short of expectations, leading to a May payment default reported by bond trustee UMB Bank.

“In the four years since the debtors completed their 2016 bankruptcy cases, it has become clear that the balance sheet restructure achieved through the 2016 plan did not go far enough to address the essential economic fact which led to the filing of the 2016 cases,” say filings related to the bankruptcy case in the United States Bankruptcy Court for the Northern District of Illinois, Eastern Division.

The holders of $103.7 million of 2016 A and $15.5 million remaining on the B series would receive a pro rata share of $107.3 million of bonds, representing 90% of their current principal.

The 2021 bonds would pay a 5.125% interest rate with interest-only payments for the first three years and the principal then amortized over the next 37 years. The 40-year schedule is five years past the 2016 maturity. “The 2021 Bonds will be secured with liens on substantially all property of the debtors,” bankruptcy documents say.

The 2016A bonds paid rates between 6.20% and 6.44% with a final 2055 maturity and the B bonds that were supposed to mature last May paid a 5.625% rate.

The bonds have recently traded at 74 cents to 77 cents on the dollar, according to trade data on the Municipal Securities Rulemaking Board’s EMMA website.

The restructuring calls for the $22 million of 2016 C bonds to be redeemed with a pro-rata cash payment of $657,562, a meager 3% of the principal amount, plus 3% of the accrued but unpaid interest for a total payment of $725,741.

Park Place’s sponsor, Rest Haven Illiana Christian Convalescent Home which does business as Providence Life Services, will cover the redemption payment and provide liquidity support for the facility through a $3 million, non-interest bearing line of credit after its emergence from Chapter 11.

The 2016 C bonds matured in 2055 and represented a 15% principal payment of the 2010 bonds while the original 2010 holders received 85% of principal in the 2016 A and B series. The primary benefit of the 2016 restructuring for the facility was that it eased payment demands by extending the maturity to 2055 from 2045.

The

The term sheet lays out various occupancy and financial thresholds that must be met with the requirement that a management consultant be hired if violations are triggered. The terms also require monthly bondholder updates for the first post-bankruptcy year and then quarterly reports.

The restructuring would not impact residential agreements, residents, employees, or future residents with reservation deposits.

The U.S. bankruptcy trustee filed an objection over the redaction of “consenting” bondholders.

“The U.S. Trustee submits that the motion — which seeks the court’s approval of an agreement between the debtors and anonymous creditor parties — should be denied due to the unauthorized concealment of the creditors’ identities alone,” reads the filing.

The new bankruptcy lays out the facility’s troubles dating back to its 2012 opening.

“The debtors’ financial health was negatively affected by the real estate market not having rebounded from the 2008 recession so as to enable the debtors to service their debt under the 2010 bonds,” because prospective residents struggled to sell their homes.

Eventually, Park Place defaulted under the 2010 bond indentures leading to the January 2016 Chapter 11 filing under a bond restructuring agreed to by holders of 74% of bonds. Timely payments were made under the restructuring agreement until May. The C bonds received little payment but those bonds were payable only from “excess cash” and the facility has “never generated enough “excess cash” to trigger further payments of principal or interest” beyond a 2017 payment, according to the court filings.

The 2016B bonds were to be paid from the proceeds of the then-remaining first-generation entrance fees and second-generation entrance fees as apartment units at the campus were reoccupied. “However, since the completion of the 2016 Cases, second generation entrance fees have not been available in sufficient amounts to pay the principal amount of the 2016B Bonds mostly due to slower than expected turnover in occupancy,” the bankruptcy documents say.

Entrance fees that go to cover operating expenses, certain project costs, and retire debt run from $375,000 to $950,000, depending upon the residency agreement and unit selected.

Park Place turned to a consultant in 2019 to review appropriate estimates on morbidity and concluded residents at Park Place “were living longer than expected, which is an altogether good thing which happened to have a negative impact on Park Place’s cash flow,” court filings say. Park Place currently has a waiting list.

Park Place redeemed $5 million of the 2016B bonds last May as scheduled but fell short of the full payment due leading to a default on the remaining $15.5 of principal. Other non-payment related defaults had also occurred by then as the facility failed to hire a consultant when certain financial thresholds were violated.

In May, Park Place requested a $1.4 million loan under the CARES Act Paycheck Protection Program. Park Place held those funds separate, which also triggered a technical default under its master trust indenture requiring it to transfer gross revenues to the bond trustee. Last month, Wintrust Bank and the Small Business Administration notified Park Place that the loan was being forgiven.

“While the PPP Loan will assist the borrowers in a time of crisis by helping them pay for payroll, which has increased due to the Covid-19 crisis, the borrowers still anticipate they may experience reduced occupancy levels at the Facility for at least the next few months, because of normal attrition, potential additional attrition caused by the virus, and an inability to have new residents move into the Facility at this time,” a trustee filing says.

Bondholders granted the facility a forbearance against action on the defaults in May and it was later

The senior living sector saw 29 first-time defaults in 2020, up from 12 in 2019, 13 in 2018 and 10 in 2017 and about $2.3 billion of senior living sector bonds remain default-impaired, according to data from Municipal Market Analytics.

“That's a function of the pandemic and how horribly it has impacted” the sector, said MMA partner Matt Fabian.

The sector is prone to repeat bankruptcies, especially when, as appears to be the case for Park Place, “the borrower was being too optimistic” in the first one, Fabian said.

Park Place is a not-for-profit established to construct, own and operate the continuing care retirement community. The 2010 bonds were underwritten by Ziegler. The Illinois Finance Authority would again serve as issuer for the new bonds pending the IFA board’s future approval.

The facility operates 181 units of varying sizes for independent living, 46 assisted living suites, 20 memory support assisted living units, and 37 nursing beds in its health center.

A hearing is expected on Jan. 26 to consider any timely objections filed by stakeholders and confirmation of the restructuring and exit from bankruptcy is anticipated in about three months, according to a trustee filing.

Park Place is represented by Dopkelaw LLC. UMB is represented by Mintz Levin PC and Burke Law.