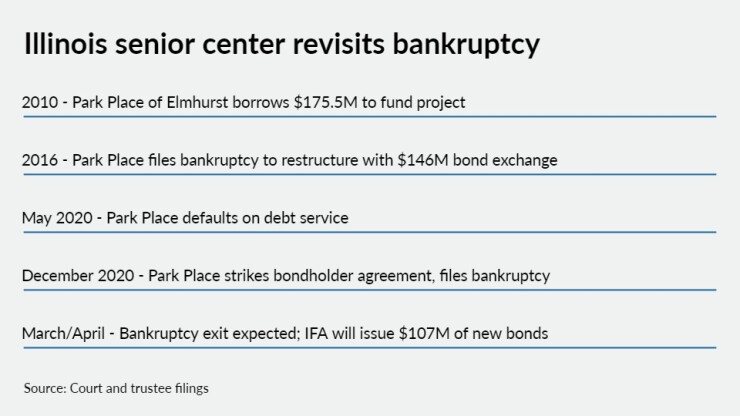

A suburban Chicago senior living retirement facility is on track to exit bankruptcy next month — for the second time — with creditor voting now underway and conduit issuer approval for its restructuring bonds in hand.

The restructuring gives the facility more breathing room by

The Park Place of Elmhurst, in the western Chicago suburb of Elmhurst, filed for Chapter 11 bankruptcy in December after reaching agreement on a restructuring with holders of a majority of principal from the $141 million remaining from $146 million of bonds issued in 2016 through the Illinois Finance Authority.

The COVID-19 pandemic, which has hit many retirement communities hard, hasn’t helped the facility’s fiscal woes but it’s not blamed for the restructuring, its second since opening in 2012. Park Place, which has 300 residents, has fared well compared to many peers.

The 2016 bonds were issued to exit its previous bankruptcy in exchange for the remaining principal from the initial $175.5 million unrated 2010 issue.

The court approved the facility’s disclosure statement at a hearing late last month and the IFA signed off on the restructuring bonds at its monthly meeting earlier this month.

Holders of more than 84% of the 2016 A Bonds, more than 83% of the 2016 B Bonds and more than 62% of the 2016 C Bonds, previously agreed to the new restructuring.

“The proposed refinancing will reduce the borrower’s total debt outstanding, while lowering coupon rates and extending the maturity date of the new series 2021 Bonds, resulting in lower debt service payments,” IFA executive director Christopher Meister wrote in his

The bonds have recently traded at 73 cents to 76 cents on the dollar, according to data on the Municipal Securities Rulemaking Board’s EMMA website.

The replacement bonds are expected to be sold in early April. The restructuring will cut debt to $107.27 million from $141.11 million “significantly deleveraging the project” with annual debt service dropping by $1.2 million, according to IFA documents.

The holders of $103.7 million Series 2016A and $15.5 million Series 2016B Bonds will receive a settlement of approximately $107.27 million, a 90% payout of their remaining principal. Accrued and unpaid interest on the Series 2016A and Series 2016B Bonds will be paid by the Series 2016 bond trustee out of funds related to the Series 2016 bonds.

The restructuring extends the maturity date to 2060 from 2055 and lowers interest rates with the new coupon rates set at 5.125 % compared to rates ranging from 5.625% to 6.44% on the existing bonds.

The payments will be interest only for the first three years and the principal will then be amortized over the next 37 years with the first annual principal payment to bondholders occurring on May 15, 2024.

The Series 2016C Bonds will be repaid by the sponsor in a pro-rata share of $725,700 which amounts to a meager 3% of the approximately $21.92 million of outstanding principal plus 3% of the accrued but unpaid compounded interest.

The Series 2016C Bonds were issued as a “hope” note approved in connection with the Series 2016 Restructuring, payable only from excess cash and to date only one payment of approximately $24,000 in interest has been triggered and paid, IFA documents said.

Park Place’s sponsor is Rest Haven Illiana Christian Convalescent Home which does business as Providence Life Services.

The 2016 restructuring was blamed on the real estate market, leading to struggles to fill units, and the facility now says it fell short of fixing its structural financial problems. The 2016 C bonds mature in 2055 and represented a 15% principal payment of the 2010 bonds while the original 2010 holders received 85% of principal in the 2016 A and B series. The primary benefit of the 2016 restructuring for the facility was that it eased payment demands by extending the maturity to 2055 from 2045.

Park Place turned to a consultant in 2019 to review appropriate estimates on morbidity and concluded residents at Park Place “were living longer than expected, which is an altogether good thing which happened to have a negative impact on Park Place’s cash flow” as new entrance fees fall short of expectations, court filings say. Park Place currently has a waiting list.

That led to a May payment default reported by bond trustee UMB Bank. Bondholders granted the facility a forbearance against action on the defaults in May and it was later

Park Place is a not-for-profit established to construct, own and operate the continuing care retirement community. The facility operates 181 units of varying sizes for independent living, 46 assisted living suites, 20 memory support assisted living units, and 37 nursing beds in its health center.

Park Place is represented by Dopkelaw LLC. UMB is represented by Mintz Levin PC and Burke Law.

The number of retirement projects defaulting for the first time last year increased by 150% to 30 from 12 in 2019, according to a Municipal Market Analytics default report published this week. The 30 first-time defaulters in 2020 represented 2.95% of all outstanding senior living sector par as of Jan. 1, 2020. In 2019, the 12 defaulters accounted for 2.22% of outstanding par on Jan. 1, 2019. There have been nine first-time defaults so far this year.