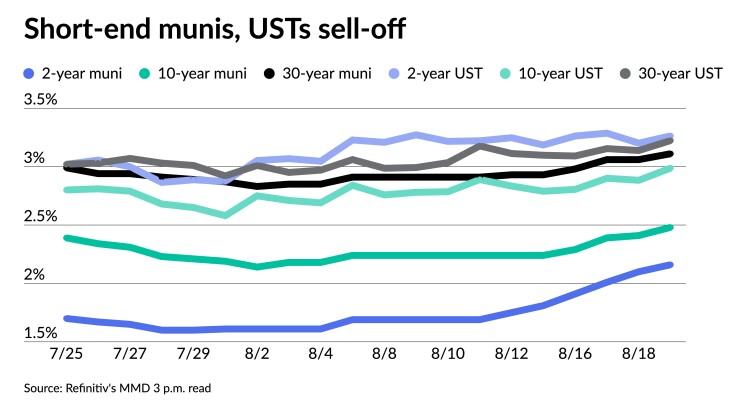

Municipals closed out the week with more weakness with yields rising up to 10 basis points on the short end of the yield curve, following U.S. Treasuries to higher yields while equities ended down.

The one-year triple-A benchmark saw smaller cuts with yields rising up to four basis points, depending on the scale, while two-, five- and 10-years saw yields rise five to 10 basis points.

Since Aug. 11, the one-year yield has risen more than 50 basis points on triple-A yield curves and short ratios have risen from just about 50% then to the high 60s currently.

Short muni-UST ratios on Friday rose with the two- and three-year ratios, reaching around 67%. The five-year was at 71%, the 10-year at 83% and the 30-year at 97%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 70%, the 10 at 85% and the 30 at 94% at a 3:30 p.m. read.

"The muni market held up amazingly well for the past two weeks," until Wednesday when the triple-A curve bear flattened, reversing some strong ratio gains, said BofA strategists Yingchen Li and Ian Rogow.

The back end ratio, as it approaches 100%, looks cheap again, according to BofA.

"We expect the AAA rates backup to be contained as long as 10- to 30-year Treasury yields do not break to newer high levels versus those attained in mid-June," they said. "That should be the case given the Fed's hawkishness and peaking inflation are playing out. The theme of "economic strength" likely will take a back seat in 4Q22."

Along with the whipsaw nature of USTs this week, Li and Rogow noted, "this week's choppy bond action may also have reasons in somewhat evolving supply/demand dynamics."

While issuance clocked in at over $10 billion this week, they said that "principal redemptions for August are mostly done after the mid-month timing point," while "large inflows to mutual funds have not materialized."

Supply is growing with Bond Buyer 30-day visible supply sitting at $12.53 billion.

Additionally, while the new corporate AMT tax under the

Secondary trading on Friday was once again concentrated on the front end of the curve:

DC 5s of 2023 at 2.15% versus 2.14% Thursday and 1.72% on 8/11. North Carolina 5s of 2023 at 2.10% versus 1.90% Tuesday 1.73% on 8/5. California 5s of 2024 at 2.25%-2.24% versus 1.66% on 8/10 and 1.68%-1.66% on 8/9. Georgia 5s of 2024 at 2.18% versus 2.07%-2.15% Thursday and 1.98% Monday.

Maryland 5s of 2025 at 2.26%. Maryland 5s of 2026 at 2.22% versus 2.02% Wednesday. Georgia 5s of 2027 at 2.22% versus 2.11%-2.10% Thursday.

Maryland 4s of 2029 at 2.43%. Washington 5s of 2030 at 2.47% versus 2.45% Thursday. Triborough Bridge and Tunnel Authority 5s of 2031 at 2.54%-2.53% versus 2.35%-2.36% Tuesday.

Out long, DC 5s of 2036 at 2.95% versus 2.76%-2.75% on 8/12 and 2.77% on 8/11. Minnesota 5s of 2037 at 2.88% versus 2.64% original on 8/10. Minnesota 5s of 2038 at 2.90%.

Smaller calendar

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

There are $5.622 billion of negotiated deals on tap and $1.090 billion on the competitive calendar.

The primary is led by the $987 million of tax-exempt future tax-secured subordinate bonds from the New York City Transitional Finance Authority, followed by $467 million of water and sewer revenue bonds from Charlotte, North Carolina, and $386 million of revenue bonds from the Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota.

The Indiana Finance Authority leads the competitive calendar with $250 million of green revenue bonds, followed by the Delaware Transportation Authority with $229 million of revenue bonds and Suffolk County, New York, with $143 million of GOs.

Looking ahead

A rocky year so far in the municipal market has created some queasiness among investors, but looking ahead there could be some opportunities from increased supply.

"This year the market has experienced anxiety over inflation adjusted yields, resulting in a continuum of outflows from the funds that are just now beginning to abate," said Peter Delahunt, director of municipals at StoneX.

Some of that anxiety was displayed when a good deal of money recently headed toward the front end of the curve as a safe haven, driving ratios to below 50% of Treasuries, Delahunt noted.

"As investors felt safe to look up from their foxholes, they realized that the tax-equivalent yield advantage no longer favored short munis" between mid-July and a week ago, he said. "This led to adjusted levels resulting in the unusual inversion in muni yields out to five years," he added.

Much of the investor worry is Fed-driven, Delahunt noted.

"There's an old adage that is apt here: "Don't fight the fed," he said, adding the Fed is "the central player in our market."

The good news is that the market has passed the seasonal peak in principle and interest rollover and reinvestments, Delahunt noted, adding that supply is expected to pick up as summer winds down.

"The big question is whether the fear has subsided enough to see monies move out along the yield curve to meet the supply," he said.

Investors' concerns, according to Delahunt, are justified as real rates are still negative throughout the curve, yet the 10-year municipal rate has moved lower by over 70 basis points from mid-May.

"This enigma perpetuates a dual anxiety — whether to avoid investing in negative real rates or be faced with investing at potentially lower rates," he suggested.

At the same time, he noted, the front end of the yield curve recently got a little more attractive for those who prefer to stay on the sidelines.

AAA scales

Refinitiv MMD's scale was cut two years and out a 3 p.m. read: the one-year at 2.15% (unch) and 2.16% (+6) in two years. The five-year at 2.20% (+8), the 10-year at 2.48% (+7) and the 30-year at 3.11% (+5).

The ICE AAA yield curve was cut three to 10 basis points: 2.18% (+3) in 2023 and 2.19% (+10) in 2024. The five-year at 2.21% (+10), the 10-year was at 2.51% (+7) and the 30-year yield was at 3.05% (+4) at a 3:30 p.m. read.

The IHS Markit municipal curve saw cuts: 2.13% (unch) in 2023 and 2.16% (+7) in 2024. The five-year was at 2.19% (+7), the 10-year was at 2.47% (+6) and the 30-year yield was at 3.12% (+6) at a 3 p.m. read.

Bloomberg BVAL was cut four to six basis points: 2.16% (+4) in 2023 and 2.16% (+5) in 2024. The five-year at 2.16% (+6), the 10-year at 2.45% (+5) and the 30-year at 3.13% (+4) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 3.250% (+5), the three-year was at 3.279% (+5), the five-year at 3.101% (+7), the seven-year 3.059% (+9), the 10-year yielding 2.979% (+10), the 20-year at 3.453% (+9) and the 30-year Treasury was yielding 3.220% (+8) at the close.

Primary on Thursday

In the primary Thursday, J.P. Morgan Securities priced for the Oklahoma Development Finance Authority (Aaa//AAA/) $1.354 billion of taxable ratepayer-backed Oklahoma Natural Gas Company bonds, with all bonds pricing at par: 3.877s of 5/2037, 4.38s of 11/2045 and 4.714s of 5/2052, noncall.

Primary to come:

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $987.250 million of tax-exempt future tax secured subordinate bonds, consisting of $980.340 million of Fiscal 2023 Series B, Subseries B-1 serials 2023-2038 and $6.910 million, Fiscal 2023 Series C, Subseries C-1, serial 2022. Ramirez & Co.

Charlotte, North Carolina, (Aaa/AAA/AAA/) is set to price Wednesday $467.030 million of water and sewer system revenue bonds, consisting of 451.075 million of exempts, Series 2022A, serials 2023-2042, terms 2047 and 2052 and $15.995 million of taxable, Series 2022B, serials 2023-2025. Wells Fargo Bank.

The Minneapolis-St. Paul Metropolitan Airports Commission, Minnesota, (/A+/A+/) is set to price Thursday $385.595 million of subordinate airport revenue bonds, consisting of $149.405 million of governmental/non-AMT bonds, Series 2022A, serials 2023-2031, terms 2047 and 2052 and $236.190 million of private activity/AMT bonds, Series 2022B, serials 2023-2042, term 2047. Wells Fargo Bank.

The Del Valle Independent School District, Texas, (/AAA//) is set to price Wednesday $280 million of PSF-guaranteed unlimited tax school building bonds, Series 2022, serials 2024-2042, term 2047. Siebert Williams Shank & Co.

The Alamo Community College District, Texas, (Aaa/AAA//) is set to price Thursday $244.170 million of maintenance tax notes, Series 2022, serials 2023-2030. Siebert Williams Shank & Co.

The Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Wednesday (retail order on Tuesday) $201.945 million of single-family mortgage revenue bonds, consisting of $178.675 million of non-AMT social bonds, Series 2022-140A, terms 2042, 2047, 2050 and 2052 and $23.270 million of taxable, Series 2022-140B, term 2042. Barclays Capital.

The South Carolina State Housing Finance and Development Authority (Aaa///) is set to price Tuesday $160 million of non-AMT mortgage revenue bonds, Series 2022 B, serials 2024-2034, terms 2037, 2042, 2047, 2052 and 2052. Citigroup Global Markets.

The Economic Development Authority of Loudoun County, Virginia, (Aaa/AAA//) is set to price Tuesday $160 million of Howard Hughes Medical Institute Issue revenue bonds, Series 2022A. J.P. Morgan Securities.

Richmond, Virginia, (/AA-//) is set to price Thursday $156.285 million of taxable pension refunding bonds, Series 2022, serials 2026-2037, term 2044. Loop Capital Markets.

The County of Sacramento Metro Air Park Community Facilities District No. 2000-1, California, is set to price Wednesday $121.210 million of Special Tax Bonds, Series 2022, serials 2023-2037, terms 2042 and 2047. Stifel, Nicolaus & Co.

The Dormitory Authority of the State of New York (Aa3//AA-/) is set to price Thursday $111.795 million of school district revenue bond financing program revenue bonds, Series 2022C, serials 2023-2041. RBC Capital Markets.

Competitive:

The Delaware Transportation Authority is set to sell $228.910 million of transportation system senior revenue bonds, Series 2022, at 10:30 a.m. eastern Tuesday.

Suffolk County, New York, is set to sell $143.100 million of public improvement serial bonds, 2022 Series C, at 11:45 a.m. Tuesday.

The Indiana Finance Authority (Aaa/AAA/AAA/) is set to $250 million of green state revolving fund program bonds, Series 2022B, at 11:15 a.m. eastern Wednesday.