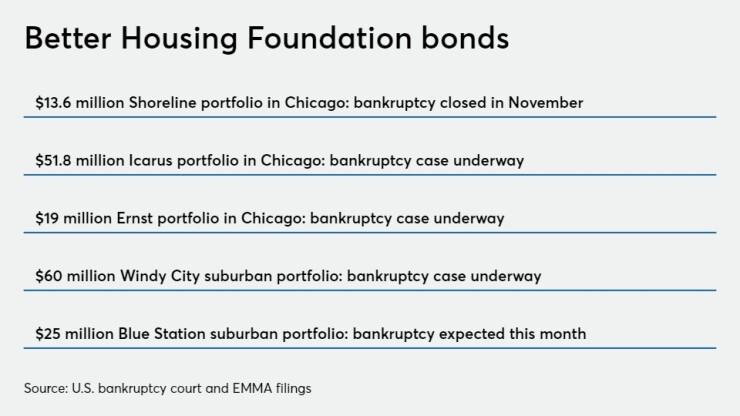

A troubled, bond-financed Chicago-area affordable housing portfolio will this month become the last of five Better Housing Foundation portfolios to file for bankruptcy, setting the stage for final bondholder payouts on $170 million of defaulted debt over the coming year.

Deep losses are expected but they will differ among the portfolios. The level of haircut will depend on each portfolio's condition, other secured debts that have piled up, and competition for the properties at auction. The two suburban portfolios will fare the best with the prospect of more than 50% recovery. Holders of the three Chicago portfolios will take a steeper hit.

So far, four of the portfolios have filed Chapter 11 under section 363 of the code that allows for the sale of assets free and clear of liens, claims and interests. Three auctions have been held and approved by the court and one

A stalking horse bidder has been identified for the Blue Station portfolio and bankruptcy is imminent, according to a trustee filing and sources following the cases that are being heard by U.S. Bankruptcy Court Judge Jack B. Schmetterer, who presides in the Northern District’s Eastern Division in Chicago.

A final distribution schedule has been signed off on only one of the portfolios, the Shoreline group of housing units that was

The pending stalking horse bid on the final Blue Station portfolio, along with final auction results on the other four, totals $88.4 million. That's what's left for holders of the $170 million of bonds, though that will get even smaller after other secured debts and costs are deducted. Trustee UMB Bank NA inherited the mess from Wilmington Trust NA at bondholders’ request.

“It’s the best that could be done for bondholders under the circumstances given the condition of the Chicago portfolios and the liens, taxes, and other mounting debts,” said one source following the cases.

While Shoreline didn’t see any auction competition, the other portfolios drew more interest, driving up the bids. One source following the cases believes COVID-19 hurt the Shoreline sale because it was conducted as the pandemic was worsening and the economy shut down with travel at a near standstill, so it didn’t draw much attention. An improved marketing campaign also helped the subsequent auctions.

All of the sale agreements call for the new buyers to invest funds for repairs and in the cases of the three Chicago portfolios, city officials signed off.

The bonds were sold between 2016 and 2018 on behalf of Ohio-based Better Housing Foundation through the Illinois Finance Authority with many of the series garnering ratings in the triple-B to single-A category from S&P Global Ratings. Mostly tax-exempt proceeds financed the acquisition and some rehabilitation costs for the dozens of buildings with about 2,000 units across the five portfolios.

By last year, all the multi-family housing bonds were in default with the properties transferred to a reconstituted version of the original borrower, leaving bondholders questioning how their investment had so quickly unraveled. The

The Chicago-based Shoreline, Icarus, and Ernst portfolios were in such dilapidated condition, with many units uninhabitable, that the city government moved in housing court to place the properties under a receiver. The Chicago bonds defaulted in June 2019.

The two suburban portfolios were in better shape with healthy occupancy rates but they too were dragged into BHF’s financial struggles as the borrower now lacks tax-exempt status so must pay some taxes. The

The trustee could have pursued foreclosure as permitted under the bond indenture but that’s a time-consuming process and could result in a weaker recovery given the poor condition of the properties and mounting liens.

“The asset sale is the best option for bondholders from a menu of poor options,” bond trustee lawyer James Kapp, a partner at McDermott, Will & Emery LLP, told the court at a hearing on the Shoreline case earlier this year.

As a not-for-profit, BHF couldn’t be forced to file bankruptcy. BHF initially sought help from investors to raise capital to finance repairs but with little interest the borrower eventually turned its sights on finding stalking horse bidders as part of a Chapter 11 process. The trustee last year pressed for such plans as overdue taxes, liens, and housing court receiver fees mounted further threatening the prospects for bondholder recovery.

“With the options available, the sale and bankruptcies provided the best way to get any recovery for the holders,” said one source following the cases.

Shoreline

BHF borrowed $13.6 million for the portfolio. The trustee is receiving $1.6 million based on a court-approved distribution plan after an auction earlier this year.

Lindran Properties LLC, an affiliate of BHF that served as owner of the Shoreline portfolio, filed Chapter 11 January 31 after reaching agreement with stalking horse bidder PRE Holdings 14 LLC, which offered $3.9 million for the 13 buildings with 260 units.

The court approved the spring auction in June. No other bidders stepped forward. The court approved a distribution plan in September and the case closed Nov. 9. Secured creditors with claims against the portfolio totaled $16.2 million and they are splitting $3.3 million of available sale proceeds.

While the trustee is receiving $1.6 million it’s unclear how much will go to bondholders as the trustee must cover legal and other fees.

The bonds traded in October at 13 cents on the dollar, according to trade data on EMMA.

Icarus

BHF borrowed $51.8 million for the Icarus portfolio in Chicago that includes a 45 buildings with 545 units portfolio. BHF’s Chicago Housing Group B LLC’s Icarus portfolio filed for Chapter 11 June 15 after reaching a real estate purchase and sale agreement May 26 with Saybrook Municipal Opportunity Fund VI to serve as the stalking horse bidder with a bid of $15.15 million.

The portfolio fared better than Shoreline as it drew other offers at an Oct. 2 auction including a top bid of $18.6 million from Longwood Development Corp. and Atlas Asset Management Services Corp. The court approved the sale Oct. 28 but a distribution plan and bankruptcy exit is not yet set.

The bonds traded this month at 10 cents on the dollar.

Ernst

BHF borrowed $19 million for the Ernst portfolio that includes 17 buildings with 182 units in Chicago. BHF reached a sale agreement with PRE Holdings 15 LLC to serve as a stalking horse with a $4.5 million bid and Chapter 11 was filed Sept. 1.

At the Nov. 5 auction, five bids were received with the top one for $8.75 million submitted by BHF Acquisition LLC. The court approved the sale Nov. 17.

The bonds traded last month at 17 cents on the dollar.

Windy City

BHF sold $60 million of bonds for the suburban Chicago Windy City portfolio of more than 500 units in various western suburbs with properties lumped into several individual groups managed by BHF. The various entities filed Chapter 11 Oct. 7.

BHF reported a stalking horse bid of $39 million from ACG Iowa Acquisitions LLC, according to a Sept. 25

At a Dec. 4 auction, a top bid of $42 million came from the firm Second City. The court is expected to approve the sale as soon as this month, according to sources.

The bonds most recently traded this month at 66 cents on the dollar.

The properties have solid occupancy rates of between 70% and 90% and the repairs needed are less burdensome but BHF acknowledges in the court filings that the rents can’t keep up with bond payments and required repairs.

“The debtors believe that by consummating this transaction they will be able to transfer ownership of the Property to new owners who are better capitalized, without the existing bond debt, thus stabilizing the Property for the community and existing tenants,” BHF president Andrew Belew writes in his declaration in support of the bankruptcy case.

Blue Station

BHF sold $25 million for the 345 unit Blue Station portfolio in south suburban Blue Island. BHF struck a sale agreement Nov. 19 with Kinzie Assets LLC that paves the way for a Chapter 11 bankruptcy filing this month, according to a Nov. 19

“The asset purchase agreement has a 21-day due diligence period, after which a bankruptcy filing by the Borrower is contemplated,” according to the trustee notice. “This will be the starting bid in the bankruptcy sale process for the collateral securing the bonds. Other interested parties will be given a chance to better this bid after a marketing process designed to maximize the value of those assets.”

The bonds traded at 55 cents to 59 cents on the dollar in June.

Early Trouble

The Chicago-based portfolios stumbled out of the gate with reports of code violations, dwindling occupancy, and the loss of Chicago Housing Authority voucher payments. Ownership and management of the properties traded hands on several occasions.

The brewing problems on the Chicago ones were detailed in an August 2018

Despite new leadership at the Ohio-based foundation, efforts to solve poor conditions faltered. Belew blames his predecessors. Several lawsuits related to the projects are pending.

BHF lawyers disclosed the receipt of a SEC subpoena related to the not-for-profit’s past managers in a court filing earlier this year and Chicago’s law department confirmed that a meeting about BHF was held with Attorney General Kwame Raoul’s office.

Some frustrated bondholders during investor calls held by UMB have questioned whether fraud occurred and some said bond underwriter Stifel Financial Corp. should be pursued legally. The trustee has told investors on the calls that such action would need to be pursued on a separate track from resolution of the defaults and initiated by original bondholders. Stifel funded recent condition reports of the properties.

The IFA has also voiced frustration about the stigma associated with serving as the conduit issuer saying it relied on the investment-grade rating reports and support from local authorities.

The bankruptcy case numbers are Shoreline 20-02834, Icarus 20-12453, Ernst 20-16567, and the lead Windy City case which groups within the portfolio is 20-18377. Blue Station has not yet filed.