-

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

June 17 -

Analysts are taking the view that muni investors expect higher taxes and are brushing off inflation concerns. U.S. Treasuries are another story.

May 20 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

March 18 -

Municipal bond mutual funds took notice of rate movements with Refinitiv Lipper reporting $37 million of inflows after 15 weeks of multi-billion inflows, the lowest since Dec. 2. High-yield funds took a big hit with $330 million of outflows.

February 25 -

Refinitiv Lipper reported $2.64 billion of inflows into municipal bond mutual funds. The overwhelming demand for the large deals priced this week demonstrates the flood of available cash that continues to support a strong market.

February 11 -

No rate hikes in sight as employment continues to struggle and inflation should rise this year, but not enough to force the Fed to raise rates.

February 4 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

Jobless claims decreased in the latest week, while new home sales fell 11%.

December 23 -

The Federal Reserve Bank of Philadelphia's manufacturing index fell to a seventh- month low, while jobless claims hit a three-month high.

December 17 -

With rising COVID-19 cases and increasing local restrictions, jobless claims can be expected to continue rising, economists said.

December 10 -

Christopher Waller was confirmed to a seat on the Federal Reserve Board on Thursday by a 48-47 vote along party lines.

December 3 -

The flood of indicators released Wednesday were indicative of a slowing economy, analysts said.

November 25 -

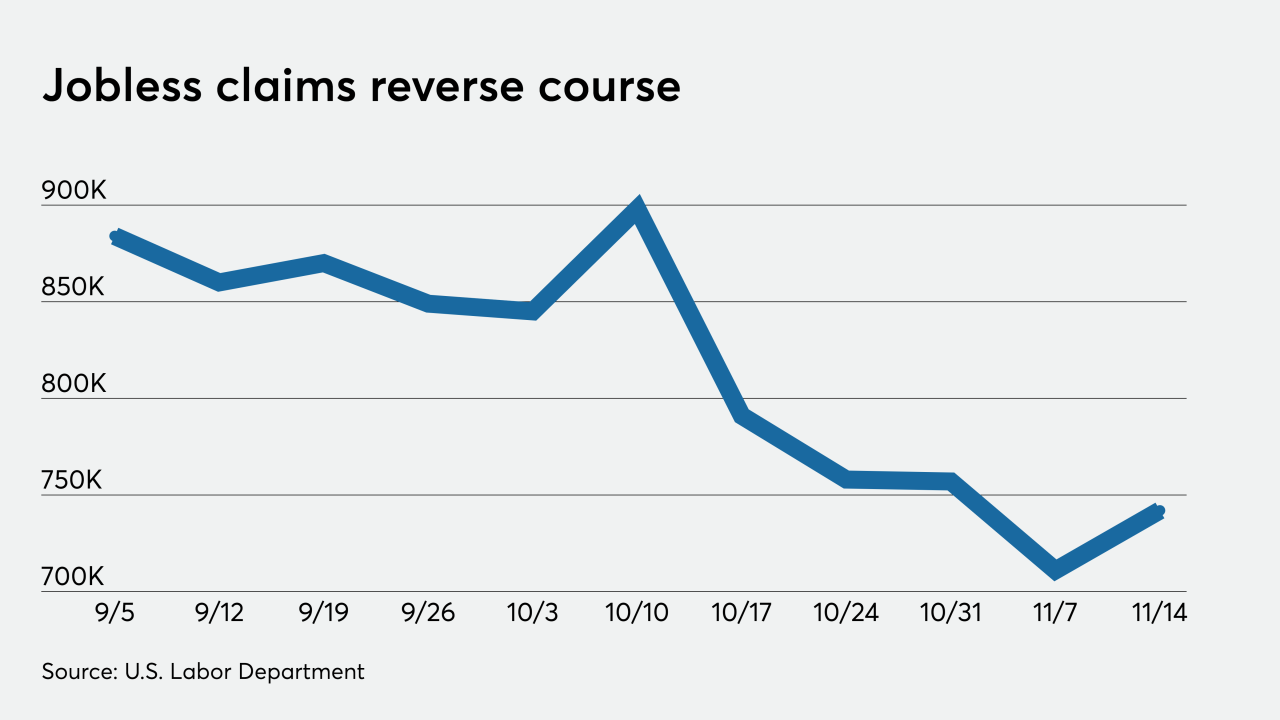

Jobless claims rose and existing home sales surged, underscoring the uneven and sporadic nature of the COVID-19 pandemic recovery.

November 19 -

Inflation remains low, while initial jobless claims continue improving, but the coronavirus pandemic looms large.

November 12 -

Gross domestic product surged in the third quarter's first read, but analysts suggest the rising number of coronavirus cases bodes ill for fourth quarter growth.

October 29 -

Jobless claims fell to below 800,000, existing home sales soared, leading indicators rose more than expected and the Kansas City Fed manufacturing index also climbed in the latest reading.

October 22 -

Initial jobless claims rose in the latest week, while the Empire State manufacturing index slipped, and the Philadelphia Fed's rose.

October 15 -

Recovery will be more difficult because rates were low before the pandemic, Federal Reserve Bank of Boston President Eric Rosengren said.

October 8 -

Months after the pandemic caused a surge in initial claims, the numbers remain elevated.

October 1 -

While not a huge gain, "claims remain staggeringly high" six months into the economic downturn, analysts say.

September 24