The economic recovery is uneven as a third spike in COVID-19 cases ravages the country and Americans await a vaccine and additional federal support.

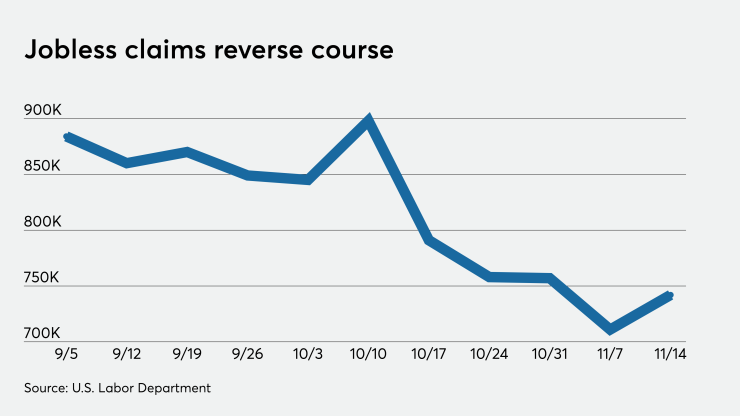

The juxtaposition of initial jobless claims, which increased for the first time since the week of October 10, while existing home sales set a record for the second consecutive month, highlights the complexity of how the U.S. economy is handling the pandemic's effects.

Jobless claims climbed to a seasonally adjusted 742,000 in the week ended Nov. 14 from the previous weeks upwardly revised level of 711,000, originally reported as 709,000, the Labor Department said Thursday.

Economists polled by IFR Markets projected 705,000 claims in the week.

Continuing claims dropped to 6.372 million in the week ended Nov. 7, from a downwardly revised level of 6.801 million a week earlier, first reported as 6.786 million.

According to KC Matthews, executive vice president and chief investment officer at UMB Bank, the economy is going through “the great plateau.”

“Going all the way back, we had the Great Recession 2008 through 2009, then we went through the great moderation for a decade, then back in March when COVID started it was the great adaptation and the great plateau commenced in the fourth quarter,” he said. “Yes, there is some light at end of tunnel but we are still in tunnel.”

He highlighted the uneven recovery process with some sectors exceling, such as housing, while others including leisure and hospitality are still struggling.

“Yes, there are lights at end of tunnel, but some of those lights are a freight train coming at you," Matthews said.

Greg Staples, head of fixed income, DWS Group, said despite the increase in claims, he still sees it within line with the continued decline in longer-term averages.

“Those averages are underscored by the significant decline in continuing claims,” he said. “We see the U.S. labor recovery as continuing in its gradual improvement, but will be watching closely over the next few weeks for early indicators of impact from recent COVID case flare up, and related business restrictions.”

Matthews added that the total number of benefits for all programs is 20.3 million.

“There continues to be so much pressure on congress to deliver another stimulus package,” he said. “The situation is improving," as the state insured unemployment rate is down to 6.4 million from 6.8 million, "but a lot of the enhanced benefits expire at end of year.”

Existing home sales

Existing-home sales surged 4.3% in October to a seasonally adjusted 6.85 million annual pace, the National Association of Realtors reported Thursday.

Economists expected a rate of 6.45 million.

“After almost a year of exceptional market performance despite the pandemic, it seems like nothing will deter buyers from finding themselves a home,” according to John Pataky, executive vice president at TIAA Bank. “So long as mortgage rates stay low, finding homes that will accommodate work-from-home capabilities remain the number one priority for buyers, who are gearing up for a long winter with a potential resurgence of shelter-in-place orders. This is evident with the continued suburban shift for home buyer preferences.”

Year-over-year sales soared 26.6%.

"Considering that we remain in a period of stubbornly high unemployment relative to pre-pandemic levels, the housing sector has performed remarkably well this year," said Lawrence Yun, NAR's chief economist. "The surge in sales in recent months has now offset the spring market losses. With news that a COVID-19 vaccine will soon be available, and with mortgage rates projected to hover around 3% in 2021, I expect the market's growth to continue into 2021."

Philadelphia Fed manufacturing

The manufacturing sector in the Philadelphia region grew in November, according to the Federal Reserve Bank of Philadelphia's manufacturing Business Outlook Survey, released Thursday.

The general activity index dipped to 26.3 from 32.3 last month, marking its sixth positive reading in a row.

Economists predicted a level of 24.0.

The new orders index dipped to 37.9 from 42.6 the prior month. Shipments decreased to 24.9 from 46.5 and unfilled orders jumped to 22.2 from 8.3.

Delivery times fell to 18.0 from 20.5, inventories gained to positive 1.8 from negative 2.5.

Prices paid increased to 38.9 from 28.5, while prices received rose to 25.4 from 14.0.

The number of employees’ index bumped up to 27.2 from 12.7 and the average employee workweek index crawled higher to 25.7 from 25.3.

The future general business activity index for the region fell to 44.3 from 62.7.

The forward six-month looking new orders index was lower to 48.1 from 51.6 the prior month. Shipments fell to 43.1 from 51.7 and unfilled orders was lower to 13.2 from 16.2.

Delivery times gained to 4.7 from 1.9, inventories moved higher to 20.3 from 16.2.

Prices paid gained to 49.4 from 42.3, while prices received slipped to 37.2 from 41.0.

The number of employees’ index dropped to 36.2 from 45.7, the average employee workweek index nudged to 20.9 from 19.8 and future capital expenditures fell to 25.5 from 36.5.

Kansas City Fed manufacturing

Regional manufacturing activity continued to grow modestly in November, as levels remained below where they were a year ago but expectations for future activity remained “solid,” according to the Federal Reserve Bank of Kansas City.

The composite index slipped to 11 from 13 in the prior month, while the six-month, forward-looking expectations composite index dipped to 20 from 21 last month.

“While regional factories reported another month of growth, activity still has not returned to pre-COVID levels,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “A sizable share of firms said they cannot find skilled workers, but low sales growth and COVID-related uncertainty also restrained their hiring plans.”