-

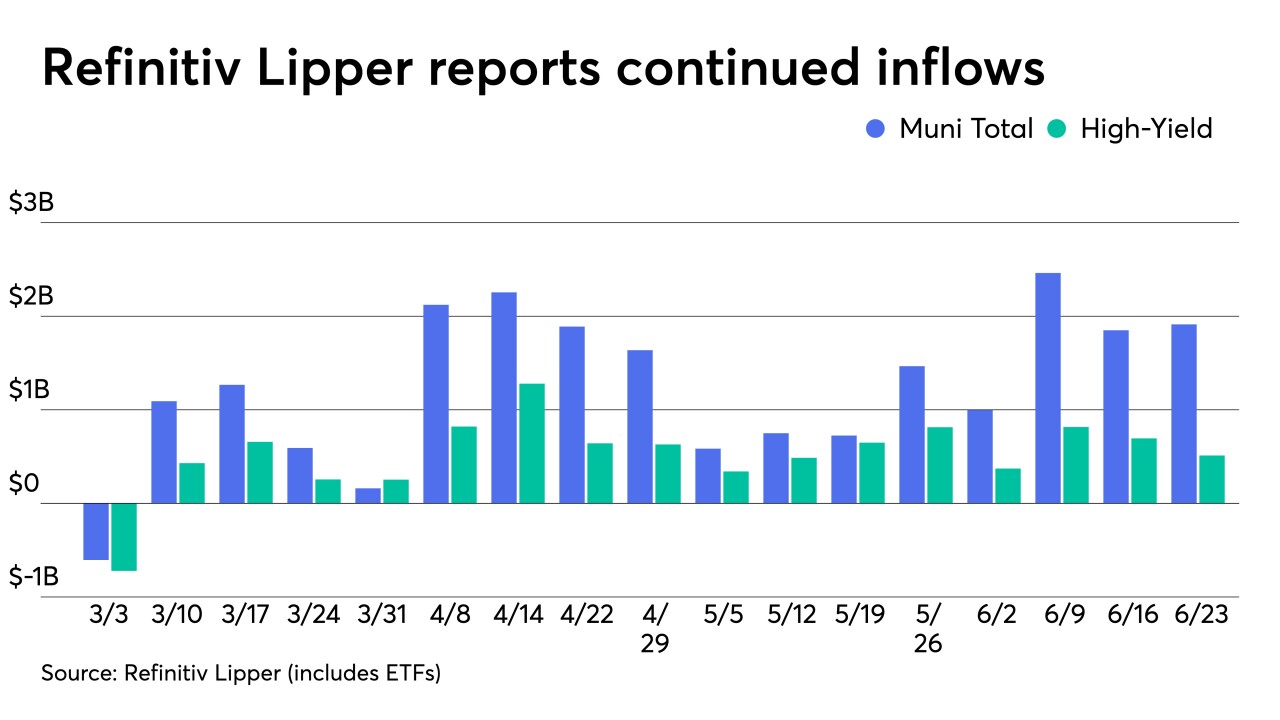

Investors poured $1.094 billion into municipal bond mutual funds in the latest week, versus the $236.491 million of inflows the week prior. It marks only the second time this year inflows eclipsed $1 billion.

August 4 -

For 31 consecutive weeks investors put cash into municipal bond mutual funds but saw just $36.87 million of inflows in the latest reporting period while high-yield funds saw $460 million of outflows after $103 million of outflows a week prior.

October 7 -

The lower inflows and high-yield outflows can be tied to the correction over the past week and may point to uncertainty from retail investors over broader market volatility.

September 30 -

Refinitiv Lipper reported $1.1 billion of inflows into municipal bond mutual funds, with high-yield falling to $144 million. Even with the lower reported inflows, funds still raked in record billions so far in 2021.

September 9 -

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

August 12 -

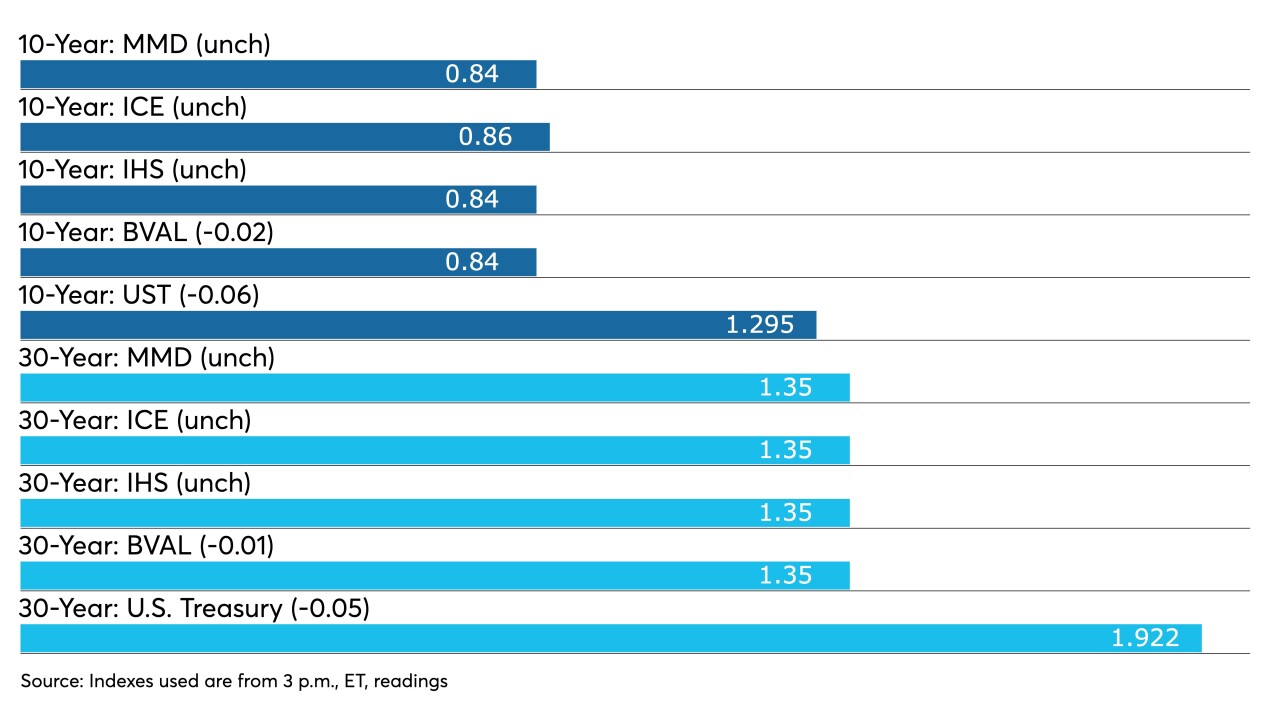

Secondary trading petered off into Thursday afternoon, holding triple-A benchmarks steady as most participants await Friday's nonfarm payrolls.

August 5 -

U.S. Treasuries have been volatile the past five sessions, with municipals largely ignoring the ride. Participants mostly have accepted current rates and ratios as large amounts of cash slosh around a market with strong technicals.

July 15 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8 -

The broader market awaits Friday’s nonfarm payrolls report, but Thursday brought some helpful labor news — unemployment claims dropped to the lowest since before the pandemic-caused economic shutdowns and layoffs plunged in June.

July 1 -

The final new issues of the week close with some bumps in repricings while the secondary was quiet.

June 24 -

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

June 17 -

Analysts are taking the view that muni investors expect higher taxes and are brushing off inflation concerns. U.S. Treasuries are another story.

May 20 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

March 18 -

Municipal bond mutual funds took notice of rate movements with Refinitiv Lipper reporting $37 million of inflows after 15 weeks of multi-billion inflows, the lowest since Dec. 2. High-yield funds took a big hit with $330 million of outflows.

February 25 -

Refinitiv Lipper reported $2.64 billion of inflows into municipal bond mutual funds. The overwhelming demand for the large deals priced this week demonstrates the flood of available cash that continues to support a strong market.

February 11 -

No rate hikes in sight as employment continues to struggle and inflation should rise this year, but not enough to force the Fed to raise rates.

February 4 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

Jobless claims decreased in the latest week, while new home sales fell 11%.

December 23 -

The Federal Reserve Bank of Philadelphia's manufacturing index fell to a seventh- month low, while jobless claims hit a three-month high.

December 17 -

With rising COVID-19 cases and increasing local restrictions, jobless claims can be expected to continue rising, economists said.

December 10