Municipal bond yields continued their ascent, following U.S. Treasuries higher, as markets adjust to rising rates and an improving economy that created an environment in which stocks sold off not because of economic uncertainty but stabilization.

The atypical relationship — falling stocks and rising USTs — is likely temporary as global markets essentially recalibrate, moving away from COVID-impacted investments, such as technology companies, and back into traditional investments that were put on the wayside during the pandemic.

Municipal triple-A benchmarks rose another three to six basis points, with the largest cuts longer out the curve. Munis are correcting after sitting idle for well over a month as its taxable counterparty moved into higher-yield territory since the beginning of the year.

A lot of the pressure on munis is tied to U.S. Treasury and global bond markets selling off due to the perception of a stabilizing global economy with sunnier views of vaccine effectiveness and stimulus. The 10-year UST broke past 1.50% (and hit 1.60% at one point Thursday) and the 30-year climbed to 2.31% near the close on Thursday.

Municipal bond mutual funds took notice of the increases as well, with Refinitiv Lipper reporting $37 million of inflows after more than 15 weeks of multi-billion inflows. High-yield funds took a big hit with $330 million of outflows reported after a six-week run of record inflows.

This was the smallest inflow since Dec. 2 when there were $201 million of inflows; Nov. 4, 2020, was the last time the funds saw outflows, at $954 million.

The 10-year muni/UST ratio is at 76% Wednesday and the 10-year at 79%, according to Refinitiv MMD. ICE Data Services showed ratios rise one basis point to 77% in 10 years and up one basis point to 80% in 30. BVAL showed 10-year ratios rose to 78% and at 82% in 30 years.

“Munis started the upward migration in yields after Treasuries and so there may be more upside room to go,” said Jeff Lipton, head of municipal credit and market strategy and municipal capital markets at Oppenheimer & Co. “The 35-plus basis point rise in long muni yields since the beginning of February against an unrelenting sell-off in the Treasury market has created some noted institutional interest, yet we are awaiting visible retail support at these new levels.

“We think that when the market settles into a new range, the adjusted ratios will be more realistic and should draw in more investors,” he added.

A deeper dive into the interplay between equities and municipal bonds shows three pivotal periods in the past 12 months, according to Kim Olsan, senior vice president at FHN Financial.

"Dividend and municipal taxable equivalent yields have had an interesting path since last March," she said. "When muni rates sold off, the high yield in the 10-year AAA hit 2.86% which worked out to a 4.53% taxable equivalent yield (37% bracket). The S&P 500 dividend yield at that time was about 2.75%."

Olsan noted the strong muni rally through the summer of 2020 caused the 10-year AAA to fall to 0.54% in August, "for a paltry TEY of 0.85%. By contrast, the S&P 500 dividend yield was nearly 100 basis points higher."

The current correction has forced the 10-year yield up to 1.12% with a 1.77% TEY, about 20 basis points over the S&P 500 dividend yield as of Thursday.

"One possible conclusion is that either munis are oversold or equities are overbought," she said. "If the fact is that munis have overcorrected (and may still continue to sell off), higher real yields and TEYs will make muni asset allocations more appealing than has been the case over the last six months."

"If you look at the fundamentals for munis, not much has changed since the beginning of the month. We're down in supply, demand is still up, but the asset class could no longer ignore UST and broader changes in the economy," a New York trader said. "In that vein, muni rates had to rise. This much, this fast? I'm not so sure. Oversold and too quick to correct comes to mind. But this market often moves like this when it moves in either direction, so it should not come as a surprise."

Primary market

Jefferies priced $939 million of limited project revenue bonds 2021 Series Q for the Regents of the University of California (Aa3/AA-/AA-/). Bonds in 2022 with a 3% coupon yield 0.18%, 5s of 2024 yield 0.41%, 5s of 2032 at 1.46%, 4s of 2036 yield 1.90%, 4s of 2041 at 2.20%, 5s of 2046 at 2.20%, 4s of 2051 at 2.44%, 2.75s of 2056 at 2.80% and 4s of 2056 at 2.54%.

The Regents of the University of California will price $448.9 million of taxable limited project revenue bonds 2021 Series R (Aa3/AA-/AA-/), serials 2022-2041, term 2051.

BofA Securities priced $390 million of revenue bonds for the Indianapolis Local Public Improvement Bond Bank (A2//A+). Bonds in 2022 with a 5% coupon yield 0.43%, 5s of 2026 at 1.10%, 5s of 2031 at 1.86%, 4s of 2036 at 2.14% and 4s of 2041 at 2.35%. Bonds in 2036-2041 carry Assured Guaranty insurance.

Florence County, South Carolina, (Aa2/AA-//) sold $120 million of general obligation bonds to Morgan Stanley & Co. Bonds in 2022 with a 5% coupon yield 0.13%, 5s of 2026 at 0.66% and 5s of 2028 0.92%. Not callable. Bonds in 2022-2027 were all away.

The economy

Thursday’s data was mostly good news, but two Federal Reserve Bank presidents warned the health crisis hasn’t ended, although they expect a big rebound after uncertainties are cleared.

Although “downside risks remain,” Federal Reserve Bank of St. Louis President James Bullard noted monetary and fiscal policy have allowed the economy to rebound from the COVID-19 pandemic.

“The backstop programs stemmed an incipient financial crisis during March and April 2020, to the point where current levels of financial stress are at pre-pandemic levels,” he said.

The labor market has improved faster than predicted, suggesting many layoffs were temporary, Bullard added. Also, he expects labor indicators to “be more robust going forward as the pandemic wanes.”

Federal Reserve Bank of Kansas City President Esther George agreed about downside risks. “Many of those risks and uncertainties are tied to the national economic outlook.”

Pointing to the rising number of cases as 2020 ended, she said, it “remains clear that we are not out of the woods yet, with the risk that infections could pick up once again, perhaps aided by new variants of the virus.”

While “policy can help mitigate the economic effects of the virus,” George said, “it is almost impossible to imagine a full economic recovery until the virus no longer impinges on the day-to-day decision making of households and businesses.”

The recovery will depend on three things, she said: “first, the pace and effectiveness of vaccination; second, the outlook for further fiscal stimulus; and third, whether and to what degree households run down the savings that they have accumulated so far through the crisis.”

She noted the highly accommodative stance of the Fed will remain in place for “some time,” while the economy recovers. Recent gains in long-term interest rates, she said, don’t require a monetary policy response since the lion’s share of the increase in the 10-year Treasury reflects “an increase in the real yield, that is the interest rate controlling for inflation compensation.”

Optimism about the recovery could be a large part of the gain, George said. “If this is indeed the reason that yields are increasing, they are unlikely to rise to the point of smothering the optimism that led to their increase in the first place, and measures of real yields remain deeply negative and only a touch off all-time lows.”

Any more stimulus “could exacerbate the unevenness that has been the defining characteristic of the pandemic downturn.” Low rates have helped interest-rate-sensitive sectors, she said. Since the service sector was most affected. “In this situation, further monetary stimulus seems unlikely to help close gaps in the most virus-afflicted sectors while simultaneously running the risk of exacerbating imbalances and shortages in interest-sensitive sectors.”

Finally, no monetary policy action is needed since she expects “a strong bounce back in activity as vaccination proceeds.” And since monetary policy works with a lag, any action now, George said, “could easily be mistimed.”

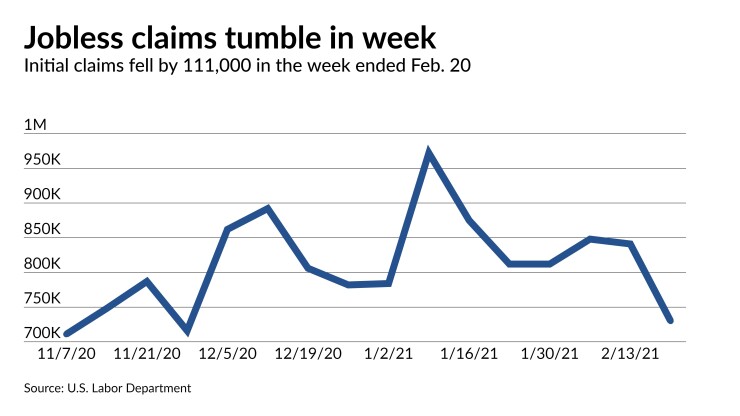

In economic numbers, initial jobless claims declined to 730,000 in the week ended Feb. 20 from 841,000 a week earlier, much below the 843,000 predicted in a poll of economists by IFR Markets.

Continuing claims fell to 4.419 million in the week ended Feb. 13 from 4.520 million a week earlier.

Despite the large decline in initial claims, the number is still well above pre-pandemic levels.

Gross domestic product rose at a 4.1% annualized rate in the preliminary fourth quarter estimate, up from 4.0% in the advance estimate. In the third quarter GDP soared 33.4%.

Economists expected the tick up in GDP.

With stimulus “highly likely” by mid-March, even if President Biden’s $1.9 trillion package is cut by as much as $700 billion in reconciliation, “GDP will eclipse pre-COVID levels by mid-year and grow over 5.4% in 2021,” said Scott Ruesterholz, a portfolio manager at Insight Investment.

“While a stimulus-fueled consumption boom and favorable base effects will temporarily boost inflation, potentially as high as 3% for CPI, we expect inflation to moderate later this year and into 2022 given the output gap,” he added. “As such, the Fed will likely look through this increase in inflation and continue its accommodative policy, creating a positive environment for markets where corporate cash flow and economic activity materially improves while fears of Fed tightening are unlikely to materialize.”

Durable goods rose 3.4% in January after a 1.2% gain in December, while excluding transportation orders grew 1.4% after a 1.7% gain a month earlier.

Economists expected a 1.1% increase in the headline number and a 0.7% rise ex-transportation.

Orders for nondefense capital goods excluding aircraft were up 0.5% in the month. This number is seen as a harbinger of future business investment plans.

As has been the case in the real estate market, pending home sales slipped 2.8% in January, but were up 13.0% year-over-year.

Economists expected a 0.1% dip.

“Pending home sales fell in January because there are simply not enough homes to match the demand on the market,” according to Lawrence Yun, National Association of Realtors chief economist. “That said, there has been an increase in permits and requests to build new homes.”

Manufacturing activity in the Kansas City region improved both month-over-month and on an annual basis, while expectations also rose.

“Most businesses reported more production and shipments, despite some difficulties due to the extreme weather events recently,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “However, rising materials prices and shipping delays have negatively affected 85% of firms.”

Refinitiv Lipper reports $38M inflow

In the week ended Feb. 24, weekly reporting tax-exempt mutual funds saw $37.683 million of inflows. It followed an inflow of $1.955 billion in the previous week.

Exchange-traded muni funds reported outflows of $327.487 million, after inflows of $353.171 million in the previous week. Ex-ETFs, muni funds saw inflows of $365.170 million after inflows of $1.602 billion in the prior week.

The four-week moving average remained positive at $1.554 billion, after being in the green at $2.242 billion in the previous week.

Long-term muni bond funds had outflows of $237.902 million in the latest week after inflows of $1.374 billion in the previous week. Intermediate-term funds had inflows of $224.436 million after inflows of $332.887 million in the prior week.

National funds had inflows of $22.570 million after inflows of $1.800 million while high-yield muni funds reported outflows of $330.188 million in the latest week, after inflows of $577.723 million the previous week.

Secondary market

New York Dorm PIT 5s of 2022 traded at 0.19%. Mecklenburg County, North Carolina, 5s of 2022 at 0.13%. New York City TFA 5s of 2022 at 0.21%-0.19%. Tennessee GO 5s of 2025 at 0.46%-0.45% (on Jan. 27 at 0.18%). Maryland GO 5s of 2026 at 0.65%-0.64%. Delaware 5s of 2027 at 0.73%. Washington 5s of 2027 at 0.80%-0.79%. NYC TFA 5s of 2028 at 1.06%. Virginia 5s of 2029 at 1.00% versus 0.92%.

Massachusetts GO 5s of 2030 at 1.20% (0.69% on Feb. 16). Montgomery County, Maryland, 4s of 2031 at 1.32%-1.30%. Maryland 5s of 2032 at 1.22%-1.23% (original 1.20%).

Iowa green 5s of 2034 at 1.42%-1.40% versus 1.39% Wednesday.

Washington GO 5s of 2038 at 1.51%. NYC TFA 4s of 2039 at 2.26%-2.23% versus 2.20%-2.07% Wednesday.

Massachusetts Ports 5s of 2039 at 1.86%-1.85% (original 1.37%).

Massachusetts GO 5s of 2045 at 1.98%-1.96%.

High-grade municipals were weaker across the scale, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.12% in 2022 and 0.19% in 2023, two and three basis points higher. The 10-year rose five basis points to 1.14% and the 30-year to 1.81%, a six basis point cut.

The ICE AAA municipal yield curve showed short maturities rose to 0.13% in 2022 and 0.21% in 2023, one and two basis points higher, respectively. The 10-year rose five basis points to 1.12% while the 30-year yield rose seven to 1.82%.

The IHS Markit municipal analytics AAA curve showed yields at 0.12% in 2022 and at 0.16% in 2023 (up one bp) while the 10-year rose to 1.09% and to 30-year rose to 1.77%.

The Bloomberg BVAL AAA curve showed yields at 0.11% in 2022 and up three basis points to 0.18% in 2023, while the 10-year rose five basis points to 1.11%, and the 30-year yield rose six basis points to 1.82%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury broke past 1.50% and the 30-year Treasury was yielding 2.31% near the close. Equities sold off with the Dow down 509 points, the S&P 500 down 2.27% and the Nasdaq down 3.2%.

Christine Albano contributed to this report.