Stimulus couldn't have come at a better time, economists said, as Wednesday's mixed data suggested the economic recovery is slowing.

"Today’s economic data was decidedly mixed, making it clearer that the pace of economic recovery has slowed in the fourth quarter amid rising virus cases and declining stimulus from the CARES Act," according to Scott Ruesterholz, portfolio manager at Insight Investment. "This underlines the importance of the recently passed $900 billion COVID relief bill, which we believe can effectively bridge the economy through the first quarter and to mass vaccination when economic activity can return more strongly."

The bill has the potential to boost personal income by at least $450 billion over the next three months, he said, offsetting pandemic-related declines.

"With the relief bill patching over near-term weakness and a vaccine on the horizon, we continue to expect growth of about 4.5% in 2021."

Initial claims

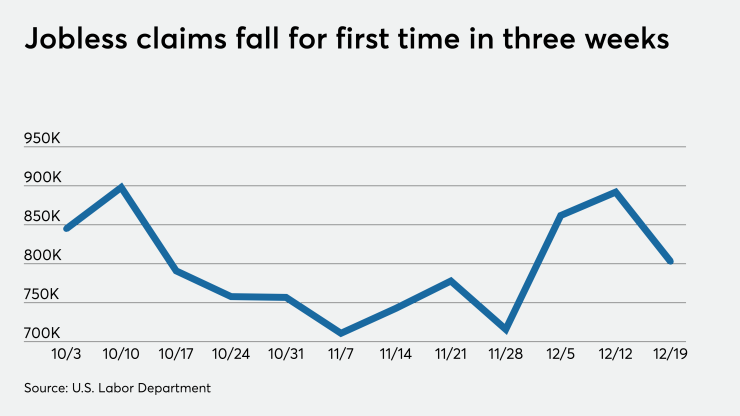

Initial jobless claims fell to a seasonally adjusted 803,000 in the week ended Dec. 19 from the previous week's upwardly revised level of 892,000, originally reported as 885,000, the Labor Department said Wednesday.

Economists polled by IFR Markets projected 900,000 claims in the week.

Continuing claims dropped to 5.337 million in the week ended Dec. 12, from a downwardly revised level of 5.507 million a week earlier, first reported as 5.508 million.

The four-week moving average rose to 818,250 in the week ended Dec. 19 from 814,250 a week earlier, originally reported as 812,500.

"For the first time this month, new unemployment claims have declined week over week,” said Mark Hamrick, senior economic analyst for Bankrate. “The decline of 89,000 in seasonally adjusted new claims puts them at about four times higher than what was seen a year ago.”

There were 398,000 newly added claims under the Pandemic Unemployment Assistance program, he added.

With “more than 20 million individuals on some form of unemployment assistance as of the latest week, we’re still seeing a historically elevated number of requests for help,” Hamrick said. "Despite the hopes associated with the availability of vaccines and the reopening of the economy, the outlook is for only slow improvement in the job market in the year ahead.”

President Trump’s “apparent refusal” to immediately sign the $900 billion dollar stimulus legislation has brought “uncertainty or worse” into the equation, he added.

"As with most things legislative, the stimulus package was imperfect, very late, but better late than never and far better than nothing," Hamrick said. "It would make the difference between an economy that could contract in the first quarter, versus remaining above water. All of this as we get to the better place where a substantial number of Americans will have been vaccinated."

While the decline in claims is "encouraging," Ruesterholz noted, due to seasonal volatility, claims data should be viewed "skeptically" around Christmas time.

"While increased public health restrictions have not caused nearly as much labor market damage as in April, labor market momentum has clearly slowed," he said. "This is especially true in the leisure and hospitality sector where 3 million workers remain unemployed. As activity is likely to persist at subdued levels until the vaccine, the labor market’s recovery will be slow in the first of 2021, which is why Congress’s ability to extend enhanced unemployment into Q1 was such a positive for the outlook."

New home sales

New homes sales dropped 11% to a seasonally adjusted 841,000 level in November, from an downwardly revised October pace of 945,000 million, first reported as 999,000, the Commerce Department said.

Economists expected 990,000 sales in the month.

Despite the decline, Ralph McLaughlin, chief economic advisor at Kukun, said underlying healthy demand for new homes remains.

"New homes fill the gap between existing home sales and building permits and we have seen a huge surge this year, because of pandemic and demographics, and it should continue for the next 5 to 10 years," he said.

Year-over-year, sales are up 20.8% from the pace of 696,000 in November 2019.

"The YTD numbers are important, as seasonally adjustment numbers are going crazy from July through November, as those numbers are going to look awesome because everything got pushed out three months due to the pandemic," he said. "There is rising demand for new homes, partly because there are few existing homes on the market."

The report also suggests "buyers are picking out a lot and building a house on the land," McLaughlin said. "It is a broader reflection of housing inventory."

Sameer Samana, senior global market strategist at Wells Fargo Investment Institute, added that housing activity remains "strong."

"Although there are some early indications that higher rates might be crimping demand, as mortgage applications for purchase have started to slow,” he said.

Ruesterholz noted Tuesday’s existing home sales report showed inventory at a record low of 2.3 months.

“The recent rise in housing starts takes several months to feed through into the end housing market but should support new home sales in 2021," he said. "Tight supply combined with the resilience of labor income and a surge of demand to move out of cities have significantly buoyed home prices. We expect 2021 to have a strong housing market with firm pricing and increased construction activity, especially as mortgages rates are likely to remains low thanks to easy Fed policy.”

Consumer sentiment

The University of Michigan’s final consumer sentiment index for December climbed to 80.7 from 76.9 November.

Economists anticipated an 81.4 read.

The current conditions index increased to 90.0 from 87.0 the prior month, while expectations climbed to 74.6 from 70.5.

“Michigan sentiment index climbed past 80, showing increased consumer confidence as we have more fully embraced and understand the new normal and the uncertainty around November elections has waned,” said Erin Sykes, chief economist with Nest Seekers International. “In contrast, however, new unemployment filings and enhanced restrictions and shutdowns may have a detrimental effect on outlook come January 2021.”

All three indexes are down year-over-year. The main index is 18.7% below where it was 12 months ago, while the current conditions fell by 22.1% and expectations dipped 16.1%.

Personal income

Personal income fell 1.1% in November after a 0.6% decrease a month earlier, the Commerce Department reported. Personal spending dropped 0.4% in the month after a 0.3% rise in October.

Economists predicted income would dip 0.3% and spending would slip 0.2%.

“Personal income and outlays suggest that the consumer/consumption is losing steam as existing benefits are starting to wind down and new ones have yet to start going out and consumer confidence has also weakened recently,” Samana said. “These series show the unevenness of the recovery and the possibility that the economy could downshift without additional help to keep income flowing to consumers.”

Ruesterholz noted that the 1.1% drop off was led by a decline in business owner income, which can be more volatile.

“Importantly, labor income continued its rebound and is only 0.3% below February levels,” he said. “The resilience of labor income, despite 10 million lost jobs, bodes well for the recovery over 2021.”

Durable goods

Durable goods orders gained 0.9% in November, after an upwardly revised 1.8% increase in October, originally reported as a 1.3% increase, the Commerce Department said Wednesday.

Excluding transportation, orders grew 0.4% in the month, after a 1.9% jump a month earlier.

Economists polled estimated orders would be up 0.6% and 0.5% excluding transportation orders.

"Consumption has slowed here in the fourth quarter and much of this decline has been concentrated in durable goods, which have been a standout performer this year as consumers purchase home office furniture and have moved out to the suburbs," Ruesterholz said. "Recent declines may point to this demand fading and been capped by residual supply chain issues, particularly in the automotive sector, which have limited supply. Today’s durable goods report showed significant strength in the auto sector, with orders and shipments both up over 2% in November. As the supply chain normalizes and inventories rebuild, auto sales are likely to be a source of strength in coming months."