Triple-A municipal benchmark curves held steady to firmer in spots Thursday as short yields were at record lows, traders took a breather and only one large competitive deal out of Maryland priced. Equities pared back recent record gains and U.S. Treasuries rose as weekly jobless claims fell, but not as much as expected.

The funds keep flowing in as Refinitiv Lipper reported another week of multi-billion inflows into municipal bond mutual funds to the tune of $2.64 billion as of Feb. 10, 14 weeks in a row.

Rich valuations continue as municipal to U.S. Treasury ratios fell a basis point to 59% in 10 years and 69% in 30 years, according to Refinitiv MMD. ICE Data Services showed ratios fell a basis point to 58% in 10 years and fell a basis point to 70% in 30. BVAL showed 10-year ratios flat at 60% and steady at 74% in 30 years.

The overwhelming demand for the large deals priced this week demonstrates the flood of available investor cash that supports (albeit begrudgingly) strong market activity.

“Deals coming out are blowing out,” a New York underwriter said on Thursday, a day after Goldman, Sachs & Co. priced the $507.8 million New York City Industrial Development Agency refunding for the Queens baseball stadium project.

“It doesn’t seem like you can stop new issues,” the underwriter said. “The percentages and nominal yields are not great, but we keep chugging along,” he said, noting that the stadium deal was 15 times oversubscribed.

The deal, which was insured by Assured Guaranty Municipal Corp., was repriced as much as 17 basis points lower in yield from the preliminary scale.

“Everyone was putting in for the bonds and it was attractively priced on the long end,” which is what drew the strong demand among retail investors participating in the deal, he said.

The short end of many new issues are priced with yields below 0.10%, he noted.

“For retail, they are not coming in on those levels on the front end,” he said.

Overall, going forward the municipal market should remain strong and steady — despite some credit concerns — even in the pandemic climate.

“It does look like long term, with COVID, things are going to improve, but I’m not sure if it will be later this year or in early 2022,” he said.

There are some question marks, the underwriter noted, with respect to weaker credits, such as bonds associated with the travel and tourism sector, like convention centers, and education credits, such as secondary schools without endowments.

He said investors should proceed with caution regarding these credits due to the uncertainty over how they will fare in the recovery.

“But, those credits aside, the market seems strong, and there is so much money out there — not only for the equity market, but for the bond market too,” he said.

The Maryland University System sold $230 million of auxiliary facility and tuition tax-exempt refunding revenue bonds to J.P. Morgan Securities. Bonds in 2022 with a 5% coupon yield 0.06%, 5s of 2026 at 0.26%, 5s of 2031 at 0.78%, 4s of 2036 at 1.08%, 4s of 2041 at 1.31%, 4s of 2047 at 1.50%, and 4s of 2050 at 1.54%.

The issuer also sold $108 million of auxiliary facility and tuition taxable refunding revenue bonds to Jefferies LLC. Details were not available.

Secondary market

Trading was mostly quiet but some high-grade blocks showed a steady tone with some firmness in spots.

California GO 5s of 2022 traded at 0.08% versus 0.09% Wednesday. University of Washington forward delivery 5s of 2024 traded at 0.13% versus 0.14% original. Arlington County, Virginia, 5s of 2027 at 0.36%. Delaware GOs, 5s of 2028 at 0.38%.

Washington Suburban Sanitation District 5s of 2029 at 0.59%-0.56%. Montgomery County, Maryland 4s of 2029 at 0.59% versus 0.63% Wednesday. San Francisco rapid transit green bond 5s of 2029 at 0.46%. Harford County, Maryland, 5s of 2029 at 0.60%-0.58%. Wisconsin 5s of 2029 at 0.56%.

Harvard 5s of 2030 at 0.67%. Maryland 5s of 2031 at 0.73%. NYC GO 5s of 2031 at 0.96%-0.94%.

Maryland Department of Transportation 5s of 2035 at 0.95%-0.94%.

Recent deals traded up.

New York City Transitional Finance Authority 5s of 2032 traded at 0.86% versus 0.89% Tuesday and 0.94% original, 4s of 2049 traded at 1.83%-1.75% versus 1.96% original, 4s of 2038 traded at 1.54% versus 1.56% Tuesday and 1.60% original. TFA 3s of 2051 traded at 2.14%-2.08% versus 2.22% original and 2.25s of 2051 at 2.30%-2.29% versus 2.35% original.

Washington GO 5s of 2037 traded at 1.10%-0.92% versus 1.13% original, 4s of 2044, at 1.35% versus 1.43%-1.42% Wednesday and 1.46% original.

Yield curves

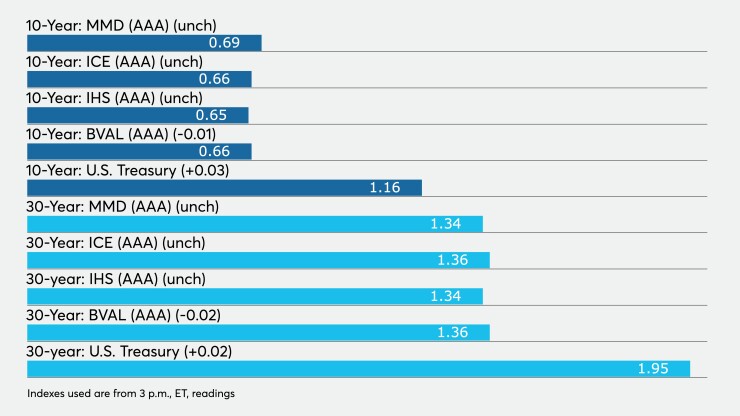

High-grade municipals were unchanged, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.06% in 2022 and 0.08% in 2023. The 10-year at 0.69% and the 30-year at 1.34%.

The ICE AAA municipal yield curve showed short maturities steady at 0.07% in 2022 and 0.09% in 2023. The 10-year fell one basis point to 0.66% while the 30-year yield stayed at 1.36%.

The IHS Markit municipal analytics AAA curve showed yields at 0.06% in 2022 and 0.07% in 2023 while the 10-year was at 0.65% and to 30-year at 1.34%.

The Bloomberg BVAL AAA curve showed yields at 0.06% in 2022 and 0.07% in 2023, while the 10-year fell one basis point to 0.66%, and the 30-year yield fell two bps to 1.36%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.16% and the 30-year Treasury was yielding 1.95% near the close. Equities were mixed with the Dow down 31 points, the S&P 500 rose 0.03% and the Nasdaq rose 0.22%.

Muni, corporate CUSIP requests fall

CUSIP Global Services reported that overall volumes for both municipal securities and corporate securities fell in January compared to December levels but munis were still roughly flat compared to 2020 levels.

The aggregate total of all municipal securities, including municipal bonds, long-term and short-term notes, and commercial paper, fell 22.4% versus December totals. On an annualized basis, municipal CUSIP identifier request volumes were up 0.6% through January. For bonds specifically, there was a 21.9% decrease month-over-month but on a year-over-year basis, bonds were still up 3.4%, the report said.

CUSIP identifier requests for the broad category of U.S. and Canadian corporate equity and debt totaled 2,322 in January, down 44.4% from December.

"Overall CUSIP request volumes tend to be muted in January, but the marked declines we’re seeing in domestic corporate debt and equity identifier request volume is significant beyond the seasonal trend," said Gerard Faulkner, director of operations for CGS. "With so much uncertainty persisting in the broad economy, it appears that corporate issuers are approaching 2021 with caution.”

Economy

Initial jobless claims fell, but not as much as expected. Claims in the week ended Feb. 6 fell to 793,000 from an upwardly revised 812,000 the week before.

Economists polled by IFR Markets expected a drop to 750,000 from the initially announced 779,000 level.

The four-week moving average fell to 823,000 from 856,500.

The number of continuing claims slipped to 4.545 million in the week ended Jan. 30 from 4.690 million a week earlier.

This is the lowest level of initial claims since the beginning of the year, but labor market progress remains slow with initial claims still nearly three times higher than their pre-pandemic level,” said Scott Anderson, chief economist at Bank of the West. “The still-elevated level of claims suggests the unemployed are having a difficult time reentering the labor force and highlights the need for additional federal aid.”

Separately, Joseph F. Kalish, chief global macro strategist at Ned Davis Research, said while central bank bond purchases have buoyed the financial markets, if they keep purchasing at this rate, the bond ,market could face a downturn in the last quarter of the year.

When securities growth, “represented by the Bloomberg Barclays Global Aggregate … has exceeded 17%, bonds have gained over 5.2% per annum,” he wrote in a note. “Below that level, the index has gained just 1.1% per annum. … Assuming the current rate of securities purchases continues, the growth rate should fall below the 17% threshold for bonds sometime in Q4.”

And if the Fed cuts its purchases, it “could present stock market challenges next year,” Kalish said.

“The big story for fixed income is that the Fed remains on hold,” according to Karissa McDonough, senior vice president and chief fixed income strategist at People’s United Advisors. “The Fed wants to be consistent with their messaging, as they’ve learned from previous cycles when they reduced accommodative policy too rapidly. Policy shift is something they’re very cautious around.”

Gary Siegel contributed to this report.