Economic data released Thursday was weaker than expected, as the restrictions put in place to combat spread of the coronavirus continue to cause economic hardship.

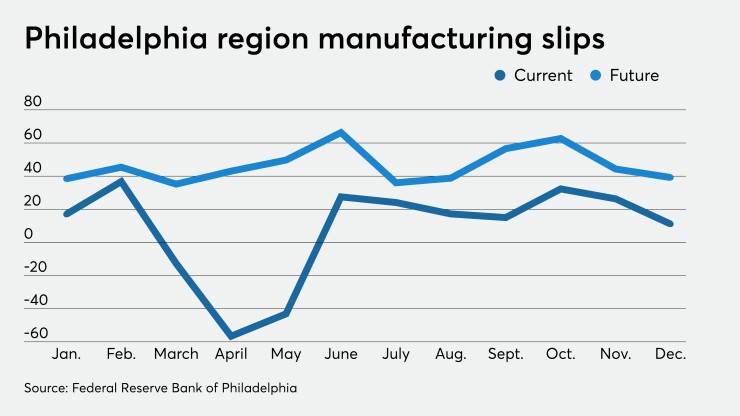

The manufacturing sector in the Philadelphia region showed “growth was less widespread” in December, according to the Federal Reserve Bank of Philadelphia's manufacturing Business Outlook Survey, released Thursday.

“The Philly Fed index plummeted to the lowest level since May, with all the components showing significant declines,” said Ed Moya, senior market analyst at OANDA. “The current indicators are positive but the loss of momentum in the region is worrisome.”

The general activity index sank to 11.1 in December from 26.3 last month.

Economists polled by IFR Markets predicted a drop to 19.0.

The new orders index plunged to 2.3 from 37.9 the prior month. Shipments decreased to 14.4 from 24.9 and unfilled orders dropped to 1.4 from 22.2.

Delivery times gained to 18.5 from 18.0, inventories climbed to 10.3 from 1.8.

Prices paid decreased to 27.1 from 38.9, while prices received slipped to 18.0 from 25.4.

The number of employees index fell to 8.5 from 27.2 and the average employee workweek index dropped to 18.0 from 25.7.

The future general business activity index for the region fell to 39.2 from 44.3.

The forward-looking new orders index slid to 41.5 from 48.1 the prior month. Shipments gained to 45.3 from 43.1 and unfilled orders inched up to 13.3 from 13.2.

Delivery times gained to 7.7 from 4.7, inventories plunged to 7.4 from 20.3.

Prices paid fell to 46.6 from 49.4, while prices received slipped to 35.5 from 37.2.

The number of employees index rose to 41.0 from 36.2, the average employee workweek index declined to 17.0 from 20.9 and the capital expenditures index decreased to 23.8 from 25.5.

Jobless claims

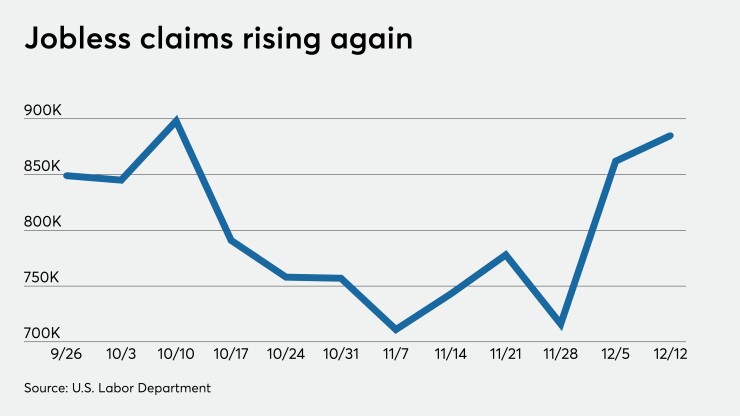

Initial jobless claims climbed to 885,000 on a seasonally adjusted annual basis in the week ended Dec. 12 from an upwardly revised 862,000 a week earlier, the Labor Department reported Thursday.

The Dec. 5 read was first reported as 853,000.

Economists polled expected 800,000 claims in the week.

Continued claims decreased to 5.508 million in the week ended Dec. 5 from an upwardly revised 5.781 million a week earlier, initially reported as 5.757 million.

The four-week moving average grew to 812,500 in the week ended Dec. 12 from 778,250 a week earlier.

“U.S. weekly jobless claims continue to head in the wrong direction, as the labor market outlook is bleak as the winter wave of the virus is going to lead to more shutdowns,” Moya said. “Jobless claims climbed to a three-month high, much worse than the consensus estimate. Continuing claims remain elevated but improved, but that might be mainly due to the expiring of benefits. The total number of Americans participating in any of the unemployment insurance programs rose 1.6 million to 20.6 million.”

Housing starts

Housing starts climbed 1.2% to a seasonally adjusted 1.547 million annual rate in November, from a downwardly revised October pace of 1.528 million, first reported as 1.530 million, while building permits rose 6.2% to a seasonally adjusted 1.639 million annual rate, from October’s 1.544 million pace, the Commerce Department said on Thursday.

Economists estimated 1.530 million starts and 1.550 million permits in the month.

Year-over-year starts are up 12.8% from the 1.371 million pace in November 2019, while permits are 8.5% above the 1.510 million in the same time frame.

“It’s not surprising to me that housing starts are at the highest level since 2007, with housing stock at an all-time low and housing demand amid the pandemic near peak levels, you can see an entrepreneurial American homebuilder community rising up to meet an unprecedented supply/demand imbalance,” according to Ryan Craft, the founder of Saluda Grade. “This is great for the American economy, and a great signal for 2021 housing amid all-time low mortgage rates. We are over 3 million homes away from creating enough supply to meet current demand, so these new housing starts are just a drop in the bucket. Over a trillion dollars of investment is needed to fill in this gap, it will take many years."

Kansas City Fed manufacturing

Manufacturing activity in the Kansas City region “expanded further” in December, but at a slower pace than last year, while "expectations for future activity were positive” according to the Federal Reserve Bank of Kansas City.

The composite index gained to 14 in December from 11 in November, while the six-month, forward-looking composite index slipped to 17 from 20 last month.

“Regional factories reported another month of solid growth, but activity continues to lag pre-COVID levels,” said Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “The recent wave of COVID-19 has negatively affected manufacturers, but many firms still indicated significant capital spending plans for the coming year."