-

Senator Joni Ernest has reintroduced the Modernizing Agricultural and Manufacturing Bonds Act, long- simmering bipartisan legislation backed by the CDFA and BDA.

June 26 -

The privately placed taxable bonds to be issued through Bernalillo County will help finance a manufacturing facility for Ebon Solar.

September 26 -

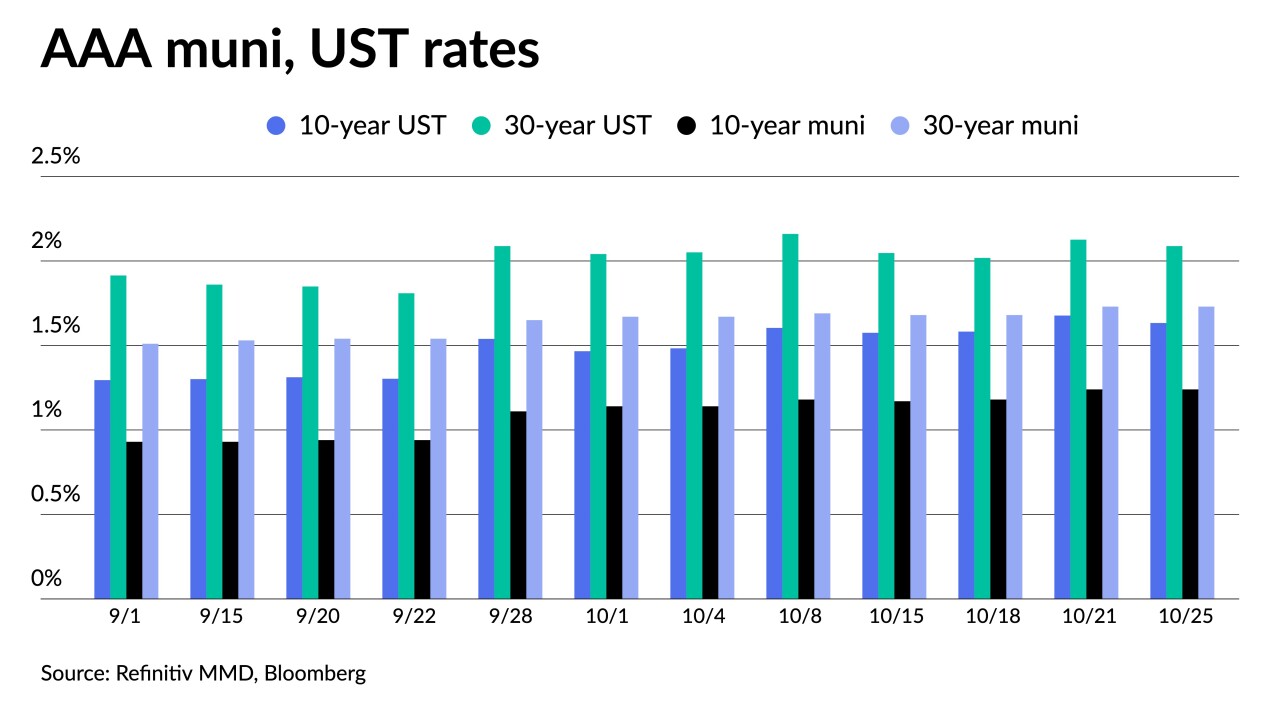

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

The broader market awaits Friday’s nonfarm payrolls report, but Thursday brought some helpful labor news — unemployment claims dropped to the lowest since before the pandemic-caused economic shutdowns and layoffs plunged in June.

July 1 -

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

June 17 -

Tuesday’s data may not be indicative of where the economy is going and will likely be written off by the Federal Open Market Committee at its meeting, analysts say.

June 15 -

The fundamentals of the muni market have investors stuck in a low-rate environment without much of an alternative. Refinitiv Lipper reported $1.466 billion of inflows into municipal bond mutual funds with $813.8 million into high-yield.

May 27 -

Analysts are taking the view that muni investors expect higher taxes and are brushing off inflation concerns. U.S. Treasuries are another story.

May 20 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

March 18 -

Institutional pricing of New York City and competitive deals from Baltimore and Cambridge, Mass., should help give a sense of where yields are heading, while Ohio offers up GOs for a market that's been little changed for three days after a large sell-off.

March 2 -

The sell-off in the back half of February brought negative 1.59% returns for the month and a negative 0.96% return for the year so far. Taxables and high-yields fared slightly better.

March 1 -

Data released Monday showed economic strength with further improvement ahead. U.S. Treasuries were off by five basis points but municipals saw aggressive eight to 10 basis point swings to higher yields across the curve.

February 22 -

Rich ratios focus buyers' eyes on a primary market that simply doesn't have enough supply to keep up with demand.

February 2 -

High-yield continues to be sought after as high-grade paper is yielding about 0.70% in 10 years and 1.40% or lower in 30 years and credit spreads continue to tighten in nearly every sector. Ratios are near 20-year record lows.

February 1 -

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

January 28 -

New issues priced with ease with high-grade issuers tight to triple-A benchmarks. It was the first time the municipal yield curve saw such noticeable movement, following little changed secondary activity for nearly the past two weeks.

January 26 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

Friday’s data showed economic weakness. Consumers, the drivers of the economy, pulled back during the holiday season and have exhibited weakening sentiment.

January 15 -

With sparse economic data available, market participants will likely be focused on news from Washington and the continued effects of COVID-19, according to the economists at Deutsche Bank.

December 28 -

The Federal Reserve Bank of Philadelphia's manufacturing index fell to a seventh- month low, while jobless claims hit a three-month high.

December 17