Municipals were little changed as a summer mood set in and the market ignored a weaker U.S. Treasury market while stocks were higher on better economic data.

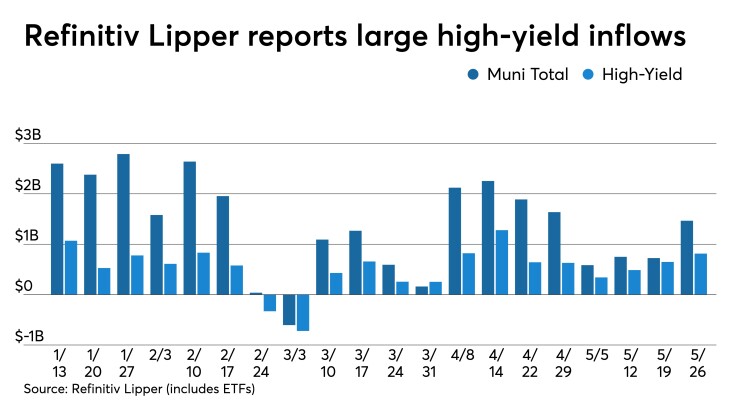

The fundamentals of the muni market have investors stuck in a low-rate environment without much of an alternative. Refinitiv Lipper reported $1.466 billion of inflows into municipal bond mutual funds. High-yield saw another week of higher inflows at $813.8 million.

“The way the market has been, I am not anticipating a lot of activity in the next day and a half,” a New Jersey trader said. “It’s tough getting business done,” he said, pointing to the overall lack of volume and low absolute yields. “Everyone is begging for higher rates and not getting it since the market continues to do better.”

The total potential volume for next week is not going to help the situation. Volume is estimated at $4.661 billion with $3.710 billion of negotiated deals and $950.7 million of competitives. The largest deal of the week is a $689 million AMT deal from the Metropolitan Washington Airports Authority. There are no competitive deals of $100 million or higher.

This after May volume came in 23.3% lower than 2020. Supply will be net negative, coming just as the June-July-August reinvestment season begins. Thirty-day visible supply is $9 billion.

“Municipals continue to benefit from reduced tax-exempt supply and significant inflows of cash entering the market, which is keeping prices relatively stable today,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said Thursday.

Institutional investors are begrudgingly accepting lower coupon structures, and retail investors, who prefer lower coupons in some cases, haven't been as engaged.

“A lot of deals are coming with lower coupons and it’s difficult for people to buy; institutional customers aren't really interested in 2% coupons, but that’s where deals are coming,” he said. “It’s hard to get institutional accounts too excited about these structures and prices."

“Retail has been quiet and a lot of the institutional accounts are tired of the prices, and the percentages aren’t very good compared to Treasuries” the New Jersey trader said.

Municipal to UST ratios edged lower, closing at 62% in 10 years and 66% in 30 years on Thursday, according to Refinitiv MMD. ICE Data Services saw ratios on the 10-year at 61% and the 30-year at 68%.

“I think as long as the market stays this way, it’s going to be difficult to get anyone really interested — institutions or retail,” he added.

However, that does not mean rates will rise in the near future or the market faces any real headwinds. The technicals are too strong and as much as investors may want yield, improved credit and lack of supply simply cannot be ignored.

Secondary trading and scales

Minimal secondary trading gave little direction for benchmark scales.

Oregon 5s of 2022 traded at 0.08% versus 0.10% Wednesday. Montgomery County, Maryland, 4s of 2023 traded at 0.17% while 5s of 2023 at 0.16%. Maryland Department of Transportation 5s of 2023 at 0.13%-0.11%. Loudoun County, Virginia, 5s of 2023 at 0.16% versus 0.17% Wednesday.

Prince George's County, Maryland, 5s of 2025 at 0.37%. Tennessee 5s of 2025 at 0.37%. Frisco, Texas, ISD 4s of 2024 at 0.25%-0.17% versus 0.21% original. Frisco ISD 5s of 2025 at 0.39%-0.32% versus original 0.36%.

New York Dorm PIT 5s of 2027 at 0.68%.

New York City TFA 5s of 2041 at 1.61%. Washington 5s of 2043 at 1.50% versus 1.54% Tuesday. West Virginia 5s of 2043 at 1.59%.

New York City water 5s of 2051 at 1.72%. Tampa, Florida, 5s of 2054 at 1.62%.

On Refinitiv MMD’s AAA benchmark scale, yields were fell one basis point to 0.08% in 2022 and steady at 0.11% in 2023, the 10-year fell remained at 1.00% and the 30-year stayed at 1.53%.

The ICE AAA municipal yield curve showed yields fall one basis point to 0.09% in 2022 and to 0.12% in 2023, the 10-year stayed at 0.99% while the 30 was steady at 1.54%.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.09% in 2022 and 0.12% in 2023, the 10-year was also steady at 0.97% and the 30-year stayed at 1.54%.

The Bloomberg BVAL AAA curve showed yields steady at 0.07% in 2022 and 0.09% in 2023, steady at 0.96% in the 10-year and the 30-year remained at 1.54%.

The 10-year Treasury was yielding 1.61% and the 30-year Treasury was yielding 2.28% near the close. Equities were up with the Dow gaining 138 points, the S&P 500 rose 0.12% and the Nasdaq gained 0.01% near the close.

Refinitiv Lipper reports $1.5B inflow

In the week ended May 26, weekly reporting tax-exempt mutual funds saw $1.466 billion of inflows. It followed an inflow of $724.510 million in the previous week.

Exchange-traded muni funds reported inflows of $180.068 million, after inflows of $70.436 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.286 billion after inflows of $654.075 million in the prior week.

The four-week moving average remained positive at $881.288 million, after being in the green at $924.001 million in the previous week.

Long-term muni bond funds had inflows of $1.295 million in the latest week after inflows of $1.219 billion in the previous week.

Intermediate-term funds had outflows of $79.795 million after inflows of $101.940 million in the prior week.

National funds had inflows of $1.377 billion after inflows of $650.879 million while high-yield muni funds reported inflows of $813.818 million in the latest week, after inflows of $648.791 million the previous week.

Economic indicators

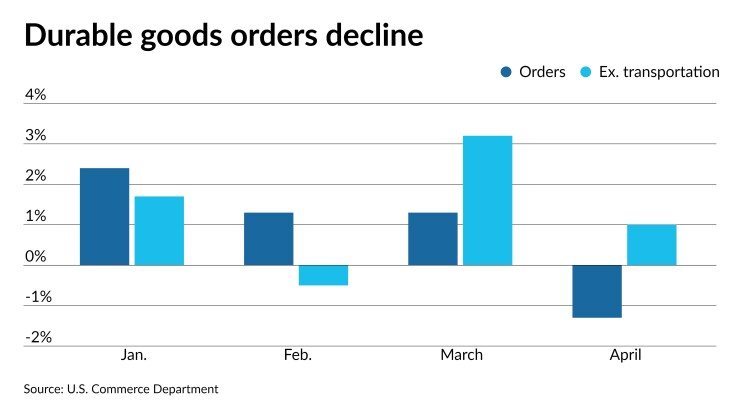

Thursday’s data confirmed economic recovery, analysts said.

Durable goods fell 1.3% in April, after rising a revised 1.3% in March, first reported as a 0.5% gain.

Excluding transportation, new orders gained 1.0% after a 3.2% increase a month earlier, and excluding defense, new orders were flat following a 2.2% February gain.

Economists surveyed anticipated a gain of 0.7% in April for the headline number, and a 0.7% rise excluding transportation.

“Core capital spending is not only stronger than expected, it also comes on the heels of upward revisions signaling strength in the outlook for capital spending despite supply chain problems,” noted Tim Quinlan and Sarah House, senior economists at Wells Fargo Securities. “That could take the edge off some recent inflationary pressures and support the Fed's view that the current pace of inflation is temporary, and that the supply side of the economy will adjust to meet the impressive demand environment.”

“New orders for nondefense durable capital goods excluding aircraft, a reliable indicator of business investment in equipment and software, was very strong, rising 2.3% following a 1.6% rise in March, lifting its level 11.4% higher than its pre-pandemic level,” according to Berenberg chief economist for the U.S., Americas and Asia Mickey Levy.

“We can make a case that spending on major purchases by consumers and businesses remains robust,” said Steve Sosnick, chief strategist at Interactive Brokers.

Separately, initial jobless claims fell to a pandemic low of 406,000 on a seasonally adjusted annual basis in the week ended May 22 from an unrevised 444,000 the prior week.

Economists polled by IFR Markets expected 425,000 claims in the week.

Continued claims dropped to 3.642 million in the week ended May 15 from a downwardly revised 3.738 million a week earlier, initially reported as 3.751 million.

The “report acts as another indication of continued underlying strength in the labor market,” said Stifel Chief Economist Lindsey Piegza. “While week-to-week or month-to-month volatility remains, the U.S. jobs market continues to replace lost employment with more than 500,000 jobs created on average each month."

In other data, gross domestic product climbed 6.4% in the preliminary first quarter read on a seasonally adjusted annual basis, unchanged from the advance report. In the fourth quarter of 2020, GDP gained 4.3%.

Economists surveyed had expected a gain of 6.5%.

Personal consumption expenditures rose 3.7% in the first quarter, first reported as a 3.5% gain after an increase of 1.5% in Q4. Core PCE, which excludes food and energy, increased 2.5%, originally reported as 2.3%, after a 1.3% rise in the prior quarter.

Economists predicted core PCE to climb 2.3%.

“Most economic indicators suggest that real GDP will easily surge past its previous peak in the current quarter,” said Wells Fargo Securities chief economist Jay Bryson and economist Shannon Seery, economist.

And while PCE and its core were “slightly above consensus,” Interactive’s Sosnick said, “not high enough to upend the Fed’s contention that inflation pressures are transitory.”

Meanwhile, pending home sales fell 4.4% in April, missing the 1.1% gain economists anticipated. This follows a revised gain of 1.7% in March, first reported as a 1.9% gain.

Year-over-year pending sales were up 51.7%.

“It appears that markets are willing to overlook” the report “because the number is volatile and the pace has been blistering until now,” said Sosnick.

Finally, the Kansas City region manufacturing sector “continued to expand at a strong pace.”

The composite index slipped to 26 in May from 31 in April.

The number of employees index fell to 20 from 29 and the average employee workweek index decreased to 20 from 27. Prices received for finished product index jumped to 51 from 41, while prices paid for raw materials increased to 86 from 73.

Volume of new orders index gained to 35 from 29, while backlog of orders fell to 25 from 35.

Primary market to come

Main Street Natural Gas, Inc. (//AA/) is on the day-to-day calendar with $771.6 million of gas supply revenue bonds, Series 2021A, serials 2022-2028, term 2051, puts due 12/01/2028. RBC Capital Markets is head underwriter.

The Metropolitan Washington Airports Authority (Aa3/A+/AA-/) is set to price $689.5 million of AMT airport system revenue and refunding bonds, Series 2021A, serials 2021-2051. Citigroup Global Markets Inc. is head underwriter.

The CSCDA Community Improvement Authority (////) is set to price on Wednesday $364.3 million of senior and mezzanine essential housing revenue refunding bonds (Pasadena Portfolio) (social bonds). Goldman Sachs & Co. LLC is lead underwriter.

The Michigan State Housing Development Authority (/AA//) is set to price on Thursday $321 million of rental housing revenue bonds, Series 2021 A (non-AMT) and Series B taxables. BofA Securities is bookrunner.

The West Contra Costa Unified School District, California, is set to price on Thursday $149.3 million of general obligation refunding bonds, Series A and Series B taxable refunding bonds. J.P. Morgan Securities LLC is head underwriter.

Bell County, Texas, (/AA+//) is set to price on Wednesday $138 million of combination tax and revenue certificates of obligation, serials 2022-2041. Raymond James & Associates, Inc. is head underwriter.

The Chicago Transit Authority is set to price on Wednesday $127.2 million of capital grant receipts revenue bonds in two series, consisting of $104.5 million of Series 5307 (/A/BBB//) and $22.7 million of Series 5337 (/A+/BBB/). BofA Securities is lead underwriter.

The Rhode Island Health and Educational Building Corp. (/AA//) is set to price $127.1 million of public schools social revenue refunding bonds, Series 2021 F (

The Fresno Unified School District (Aa3///) Is set to price on Thursday $125 million of general obligation bonds, $45 million Series D and $80 million Series A. Stifel, Nicolaus & Company, Inc. is lead underwriter.

Wake Forest University (Aa3/AA//) is set to price on Thursday $125 million of taxable Series 2021 bonds, term 2051. Wells Fargo Securities, LLC is head underwriter.

The Spokane Public Facilities District (Aa1/AA+//) is set to price on Wednesday $121.4 million of taxable sales and lodging tax refunding bonds. Barclays Capital Inc. will run the books. Indications of interest Tuesday afternoon.

The Contra Costa Transportation Authority (/AA+/AAA/) is set to price on Wednesday $103.6 million of limited tax sales tax revenue refunding bonds Wells Fargo Securities is the lead underwriter.

The Indiana Housing and Community Development Authority (Aaa/AAA/) is set to price on Wednesday $98.8 million of single-family mortgage revenue social bonds. J.P. Morgan Securities LLC is head underwriter.

The Arlington Higher Education Finance Corp. (/AAA//) is set to price on Thursday $96.6 million of Lifeschool of Dallas taxable variable rate education revenue refunding bonds, insured by the Permanent School Fund Guarantee Program. D.A. Davidson & Co. is bookrunner.

The Water Authority of Western Nassau County, New York, (A1//AA-/) is set to price on Thursday $96.4 million of water system revenue exempt and taxable green bonds. BofA Securities is head underwriter.