Triple-A benchmarks held steady Tuesday even as U.S. Treasuries lost ground and equities saw their biggest one-day gain since early November.

The simple answer to why munis won't budge is buyers are hesitant because of just how rich municipal to U.S. Treasury ratios have become, there is just too much money on the sidelines, and all eyes are on a primary market that doesn't have enough supply to keep up with demand.

Those ratios: municipals as a percentage of Treasuries stayed at 66% in 10 years and fell a basis point to 74% in 30 years on Tuesday, according to Refinitiv MMD. ICE Data Services reported ratios even lower at 63% in 10 years and 75% in 30.

Already a historically low-supply month, CreditSights reports expected redemptions in February of about $28 billion, $2.2 billion of which are taxables. That total, they said, nearly equals the supply average for the month since 2012.

The demand for tax-exempts can be broken down into three groups, according to Eric Kazatsky of Bloomberg Intelligence: investors who need the tax-exemption, those who want the tax-exemption and those who see a relative-value opportunity vs. cross-asset ratios that seem out of the norm.

"For much of 2020, the municipal space had the attention of that third group, as AA muni ratios vs. corporates looked attractive on a relative basis," he wrote. "Now that the ratio is almost back at multiyear lows and 20 ratios richer than average, the third bucket of demand should start to wane."

Kazatsky and others said the sweet spot for municipals to keep the strong streak of fund flows alive is to simply replace that third demand piece with more bonds.

This is becoming a pattern: fueled by overwhelming demand versus supply, tax-exempts have been breaking loose from the discipline of Treasuries, Municipal Market Analytics noted in its weekly outlook report. Triple-A munis have reversed all losses year-to-date while UST are still as much as about 20 basis points weaker, as of Monday. Treasury losses Tuesday affirm that figure.

MMA noted inflows are "not likely a mistake," partially a result of partisan political turmoil in Washington that makes it more likely the Democratic-controlled federal government will rely more heavily on a budget reconciliation process to advance their policy goals (i.e. higher taxes, which should drive tax-exempt demand and outperformance). MMA said tax-exempt refundings could return within the first quarter.

The prospect of increased federal income tax rates appears to have added to demand for exempts through separately managed accounts (directly) or through mutual and exchange traded funds (indirectly) "enough so that some tax-exempt yields may no longer be compelling to individual investors unless they are subject to both the maximum federal income tax rate and a high state or local tax as well," according to CreditSights.

Primary market

Wells Fargo Securities priced for retail for the second day $900 million of future tax-secured subordinate refunding bonds for the New York City Transitional Finance Authority (Aa1/AAA/AAA/). Bonds in 2023 with a 5% coupon yield 0.16%, 4s of 2026 yield 0.35%, 5s of 2034 yield 1.21%, 5s of 2036 at 1.37%, 5s of 2041 at 1.58%, 4s of 2046 at 1.88% and 2.25s of 2051 yield 2.31%. Bonds in 2037 with a 5% yield 1.42% (4s of 2037 traded at 1.60%-1.59% Tuesday). Bonds in 2038 with a 5 handle yield 1.46% as 4s of 2038 traded at 1.64% Tuesday.

Broward County, Florida, School District (/AA-//) sold $221.6 million of unlimited tax general obligation bonds to Citigroup Global Markets. Bonds in 2022 with a 5% coupon yield 0.12%, 5s of 2026 at 0.34%, 5s of 2031 at 0.86%, 5s of 2036 at 1.13%, 5s of 2041 at 1.34%, 5s of 2046 at 1.50% and 5s of 2050 at 1.55%.

The Tarrant Regional Water District, Texas, (/AAA/AA+/) sold $300 million of taxable revenue bonds to Morgan Stanley & Co. Pricing details were not yet available.

The Tarrant Regional Water District, Texas, (/AAA/AA+/) also sold $243 million of exempt revenue bonds to BofA Securities. Bonds in 2022 with a 4% coupon yield 0.095%, 4s of 2026 at 0.31%, 4s of 2031 at 0.84%, 2s of 2036 at 1.59%, 2s of 2041 at 1.80%, 2s of 2045 at 2.00%, 2s of 2048 at 2.07% and 2s of 2051 at 2.09%.

Secondary market

Secondary trading saw large blocks of New York City GO 5s of 2024 trading at 0.25%. Florida PECO 5s of 2029 at 0.60%. Maryland GO 5s of 2029 at 0.62%. Columbus, Ohio, GOs 5s of 2031 at 0.77%; on Jan. 25 they traded at 0.87%-0.84% and originally priced at 0.92%.

Washington GO 5s of 2034 traded at 1.00%. Fairfax County, Virginia, 4s of 2034 at 1.28%-1.26%. New York City TFA subordinate 4s of 2037 traded at 1.60%-1.59%. University of Michigan 4s of 2038 at 1.17%. They traded at 1.20%-1.16% Thursday. NYC TFA sub 4s of 2038 traded at 1.64%.

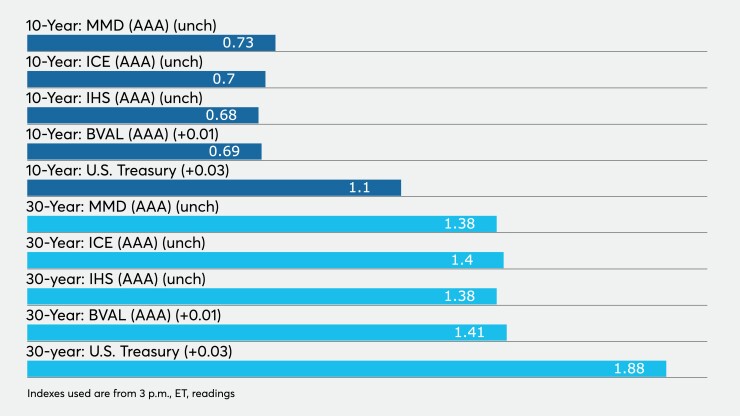

High-grade municipals were steady, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.09% in 2022 and 0.10% in 2023. The 10-year stayed at 0.73% and the 30-year was flat at 1.38%.

The ICE AAA municipal yield curve showed short maturities steady at 0.09% in 2022 and 0.11% in 2023. The 10-year was at 0.70% while the 30-year yield sat at 1.40%.

The IHS Markit municipal analytics AAA curve showed yields at 0.11% in 2022 and 0.12% in 2023 while the 10-year remained at 0.69% and the 30-year yield at 1.38%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and 0.10% in 2023, while the 10-year rose one basis point to 0.69%, and the 30-year yield rose one basis point to 1.41%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.10% and the 30-year Treasury was yielding 1.88% near the close. Equities saw gains for a second day with the Dow up 558 points, the S&P 500 rose 1.63% and the Nasdaq rose 1.70%.

Economic indicators

Not much in the way of data on Tuesday, but at least two voices suggest the Federal Reserve will keep rates at the zero lower bound despite inflationary threats.

The manufacturing sector in the New York region took a hit in January, according to the Institute for Supply Management-New York’s Report on Business, with the current business conditions index dropping to 51.2 from 61.3 in December. A year ago, the index was 45.8.

The six-month outlook index declined to 53.3 from 70.7. A year ago it was 57.3. The prices paid index climbed to 71.4 from 65.4, while the current revenues sank to 35.7 from 57.7, and the expected revenues index slipped to 57.1 from 58.3.

Separately, BCA Research sees inflation rising, but the Fed keeping rates near zero unless employment levels grow in tandem with inflation. “Large fiscal stimulus is clearly leading to bottlenecks in certain industries that were not negatively impacted by the pandemic, and this could cause consumer price inflation to rise during the next few months.”

But, without average monthly payroll gains of about 500,000, BCA says, the Fed will not consider inflation sustainable. As a result, they say, don’t expect tightening until later next year or the first half of 2023.

Accommodative monetary policy and fiscal stimulus should “bridge the gap” until the vaccines are widely used so the economy can fully reopen, according to Verdence Capital Advisors CEO Leo Kelly and Director of Portfolio Strategy Megan Horneman.

“However, the first half of 2021 is likely to present the economy the biggest headwinds of the year as we absorb the negative impacts of the most recent wave of COVID cases,” they write in an outlook note. “We expect a much brighter second half but acknowledge the battle we are still fighting and warn of the challenges we expect in the coming months.”

Primary issues still to come this week

The Nassau County Interim Finance Authority (/AAA/AAA/) is set to price $577.65 million of sales tax-secured bonds and $561.75 million of taxable sales tax-secured bonds on Wednesday. Goldman, Sachs & Co. LLC is lead underwriter on both deals.

Seattle Children’s Hospital (Aa2//AA/) is set to price $405 million of corporate CUSIP green refunding bonds on Thursday. J.P. Morgan Securities is head underwriter.

Willis-Knighton Medical Center (/A/AA-/) is set to price $400 million of taxable bonds on Wednesday. Goldman is head underwriter.

Wake County, North Carolina, (Aa1/AA+/AA+/) is set to price $304 million of limited general obligation bonds on Wednesday. J.P. Morgan is bookrunner.

The Massachusetts Port Authority (Aa2/AA-/AA/) is set to price $227 million of taxable revenue refunding bonds on Wednesday. BofA Securities is lead underwriter.

The Community Development Administration of the Maryland Department of Housing and Community Development (Aa1//AA/) is set to price $197 million of residential revenue bonds on Tuesday. J.P. Morgan is head underwriter.

New Orleans, Louisiana, (/AA//) is set to price $191.6 million of taxable water revenue refunding bonds insured by Assured Guaranty on Thursday. J.P. Morgan is bookrunner.

New Orleans will also issue $185 million of taxable sewerage service revenue refunding bonds Thursday. J.P. Morgan is head underwriter.

Detroit (Ba3/BB-//) is set to price $175 million of unlimited tax exempt ($135 million) and taxable ($40 million) social bonds on Thursday. BofA is lead underwriter.

The Arlington Independent School District, Texas, (Aaa/AAA//) PSF guaranteed, is set to price $172.6 million of unlimited tax school building bonds. Serials 2021-2023, 2025-2041; term, 2046. Siebert Williams Shank & Co. LLC is head underwriter.

The Industrial Development Authority of the County of Maricopa, California, (A2//A+/) is set to price $171 million of Honor Health hospital revenue refunding bonds Wednesday. Serials 2023-2028, 2031-2037, 2039; term, 2051. RBC Capital Markets will run the books.

The state of Louisiana (A1/A+//) is set to price $135.9 million of taxable unclaimed property special revenue refunding bonds, $64.78 million Series 2021 (I-49 North Project) and $71.1 million Series 2021 (I-49 South Project) serials, 2021-2033, serials 2021-2035, respectively. TD Securities LLC is lead underwriter.

Bethel School District No. 52, Lane County, Oregon, (Aa1///) is set to price $107.5 million of general obligation bonds in three series on Tuesday. Insured by Oregon School Bond Guaranty Act. Piper Sandler & Co. is head underwriter.

Waco Independent School District, Texas, (/AAA//) is set to price $106.5 million of unlimited tax taxable refunding bonds, insured by the PSF. Serials 2021-2038. Oppenheimer & Co. is bookrunner.

The city of Monterey Park, California, (/AA//) is set to price $106.3 million of taxable pension obligation bonds, serials 2022-2036; term, 2043, on Tuesday. Ramirez & Co. Inc. is head underwriter.