Municipals were little changed Monday as U.S. Treasuries rose slightly and equities rebounded from losses last week, but the damage was done in the back half of February for munis, as rising yields pushed returns into negative territory for the month.

The Bloomberg Barclays Municipal Index posted a -1.59% return in February, bringing the year-to-date total return to -0.96%. Munis outperformed the U.S. Treasury Index, which returned -1.82% during the month.

High-yield saw 1.1% losses but total year-to-date returns are positive at 1.0%.

"Returns were driven by negative performance in the special tax and high-yield tobacco sectors," according to a Barclays report. "Excluding Puerto Rico credits, the index generated total returns of -0.84%, bringing year-to-date returns to 1.2%."

The taxable municipal index generated an excess return of 0.89%, but underperformed the U.S. credit long index by 0.33%, according to Barclays. Spreads for taxable munis were 7.9 basis points tighter month-over-month, while the long credit index was 8.3 basis points tighter month-over-month.

"Total return performance was negative across the curve, with the long end underperforming," Barclays said. "The biggest underperformers were the +22-year (-2.41%) and 20-year (-2.09%) indices. On the opposite side of the ledger, the +1-year muni index performed the best in relative total return terms (-0.03%), with the 3-year (-0.36%) index also outperforming."

With very little movement in both the municipal and Treasury markets, it was a typical slow, stable, and uneventful Monday to kick off the beginning of March, municipal sources said.

“It’s a Monday and it’s pretty much flat today in terms of not much of any change in the [generic triple-A] scale,” John Farawell, executive vice president and head of municipal trading at Roosevelt & Cross said Monday. “You saw some fun and excitement last week and the 10-year Treasury hit that 1.60%, but today it’s down to 1.44% and the equity market is getting strong again,” he said.

After last week, he said, investors are going to take notice of the municipal market, especially with over $1 billion of New York City general obligation bonds on the docket.

“Supply continues to not be a problem,” Farawell said, noting the market is flush with cash and awaiting the NYC deal.

BofA Securities priced for retail investors $1.25 billion New York City (Aa2/AA/AA-/) general obligation offering. The $900 million Fiscal 2021 Series F and Subseries F-1 saw bonds in 2023 with a 3% coupon yield 0.37%, 5s of 2026 at 0.89%, 3s of 2035 at 2.28%, bonds in 2036 were not offered to retail, 3s of 2041 at 2.62%, 4s of 2047 at 2.63% and 3s of 2051 at 2.85%. The $240 million Fiscal 2021 Series 1 reoffering had 5s of 2028 at 1.21%, 5s of 2031 at 1.65% and 5s of 2035 at 2.00%. The $109.1 million Fiscal 2008 Series L Subseries L-5 reoffering were not offered for retail.

“That deal’s going to be a bellwether, and I don’t think there will be any problems getting this thing done,” he added. “It’s not like years ago … a billion and a half is not that much.”

He said the deal and other large offerings slated for this week could bring some investors off the sidelines.

“When they know there’s a cut in the scale and the market is starting to fall, they will wait a little bit until they are assured, when the market settles down and they come back in and feel more comfortable,” Farawell said.

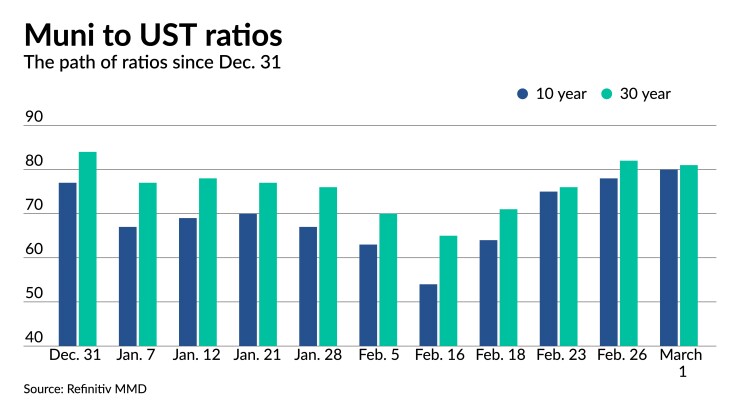

In addition, Farawell said investors could also be incentivized by the improvement in the municipal to Treasuries ratios in the intermediate part of the curve. “There have been big changes in the belly of the curve,” he said.

The ratio in the five-year slope, for instance, is currently at 73.7%, up more than 30 basis points compared to the minimum average of 39.2% hit between December 7 and February 26, according to MMD. “That’s going to bring people back in,” Farawell said.

Ratios rose slightly again with the 10-year muni/UST at 80% and the 30-year at 81%, according to Refinitiv MMD. ICE Data Services showed ratios at 77% in 10 years and 82% in 30.

Secondary trading showed a steady tone.

Delaware general obligation bond 5s of 2026 traded at 0.62%. Frederick, Maryland, 5s of 2029 traded at 0.97%-0.96%. Baltimore County, Maryland, 5s of 2030 traded at 1.11% (the issuer sells competitively Wednesday).

Maryland GO 5s of 2033 traded at 1.30%-1.29%. Washington GO 5s of 2033 at 1.43%. Washington GO 5s of 2039 at 1.65%-1.60%, near where they traded Friday at 1.67%-1.60%.

New York City GO 5s of 2043 traded at 2.25%. Texas water 4s of 2045 traded at 1.81%-1.75%, the same as Wednesday.

Economy

“Common-sense reforms” should be implemented to address “unresolved structural vulnerabilities in nonbank financial intermediation and short-term funding markets,” Federal Reserve Board Gov. Lael Brainard said Monday.

“Regulators and international standard-setting bodies have an opportunity to draw important lessons from the COVID shock about where fragilities remain, such as in prime MMFs and other vehicles with structural funding risk,” she said, according to prepared text of a speech webcast to the Institute of International Bankers.

Among the markets Brainard addressed were money market funds and Treasuries. “For the second time in 12 years, a run on MMFs triggered the need for policy intervention to mitigate the effect on financial conditions and the wider economy,” she said.

This, she said, suggests “the need for reforms to reduce the risk of runs on prime money market funds that create stresses in short-term funding markets.”

Among the possible fixes are a Fed standing facility to backstop repos, “possibly creating a domestic standing facility or converting the temporary Foreign and International Monetary Authorities (FIMA) Repo Facility to a standing facility.” Another strategy would be “wider access to platforms that promote forms of ‘all to all’ trading less dependent on dealers and, relatedly, greater use of central clearing in Treasury cash markets.”

There are tradeoffs with these, and they would “merit thoughtful analysis.”

The manufacturing sector continues to impress, with the Institute for Supply Management’s manufacturing index surpassing expectations and hitting its highest level in three years.

The ISM index rose to 60.8 in February from 58.7 in January. This was the highest since the same number was hit in February 2018, ISM said.

Economists polled by IFR Markets expected a 58.8 level.

The indexes for new orders, production and employment also rose. The prices index also gained.

“Were it not for the fact that inventories are so tight, the number would have been even higher,” said Well Fargo economists Sarah House and Tim Quinlan. “Businesses are having such a difficult time getting their hands on materials they are unable to add to inventories.”

While the report was “very strong,” Edward Moya, senior market analyst at OANDA, noted, “Supply shortages, higher commodity prices, and higher prices paid, explain while managers are still conservative with hiring new people.”

Backlog of orders soared to 64.0, its highest level since April 2004, from 59.7 “while the inventories index declined into contraction territory, implying future gains in manufacturing production are on the horizon,” said Scott Anderson, chief economist at Bank of the West. “But with more growth and increasing bottlenecks comes more price inflation.”

“The U.S. economy looks strong, with virus mutations being the main risk to the outlook,” said OANDA’s Moya. “If the next few months do not provide a major reversal in the reopening of the economy, the manufacturing sector could run hot.”

Also released Monday, construction spending climbed 1.7% in January after 1.1% growth in December.

Economists expected a 0.8% increase.

“Construction spending started off 2021 on a high note with all components expanding during the first month, according to Grant Thornton economist Yelena Maleyev. “Those gains will likely ebb in February when we will see the impact from the severe winter weather that hit the nation’s largest region for construction, the South.”

Secondary market

High-grade municipals were little changed, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.12% in 2022 and 0.19% in 2023. The 10-year sat at 1.15% and the 30-year at 1.81%.

The ICE AAA municipal yield curve showed short maturities at 0.13% in 2022 and 0.20% in 2023. The 10-year stayed at 1.11% while the 30-year yield remained at 1.82%.

The IHS Markit municipal analytics AAA curve showed yields at 0.12% in 2022 and at 0.16% in 2023 while the 10-year stayed at 1.09% and to 30-year at 1.77%.

The Bloomberg BVAL AAA curve showed yields at 0.12% in 2022 and at 0.19% in 2023, while the 10-year stayed at 1.11%, and the 30-year yield at 1.82%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury 1.44% and the 30-year Treasury was yielding 2.22% near the close. Equities were up with the Dow up 581 points, the S&P 500 up 2.34% and the Nasdaq up 2.89%.

Primary Market

The University of Chicago (Aa2/AA-/AA+/) is set to sell $609.6 million of taxable corporate CUSIP fixed-rate bonds, serials 2044-2052, in a Citigroup-priced negotiated deal.

Ohio is slated to sell $564.2 million of GOs in two-series — new money and refunding portions — priced by BofA Securities. The new-money series includes $226.4 million of Series SCH-A bonds and $107.8 million of Series SCH-B bonds.

The refunding portion consists of $204.9 million Series HE-A and a $25 million taxable series.

The San Francisco Bay Area Toll Authority (Aa3/AA/AA/) will come to market with two separate deals — both priced by BofA Securities.

The larger of the offerings is a $372.3 million deal consisting of three series.

A term-rate Series A includes $124 million of bonds; the Series B includes $156.8 million of index-rate bonds; and Series F-1 includes $91.5 million of fixed-rate bonds.

The authority’s other deal is $354.3 million and consists of federally taxable fixed-rate bonds in a single 2021 Series F-2.

The Texas Public Finance Authority will issue $326 million of lease revenue bonds for the Texas Department of Transportation-Austin Campus Consolidation Project.

The taxable series 2021 bonds are structured to mature from 2022 to 2041 and is being priced by Barclays Capital Inc.

The City of Orange, California, will sell $285.6 million of taxable pension obligation bonds in a deal being priced by Stifel, Nicolaus & Co. Inc.

The serial bonds mature from 2022 to 2036 and the term bonds mature in 2040 and 2044.

The Illinois Finance Authority (Aa2/AA-/AA+/) will sell $218.3 million of revenue bonds for the University of Chicago in a Series 2021 A structured from 2022 to 2023; 2025; 2028; and 2031 to 2034. Citigroup Global Markets Inc. will run the books.

J.P Morgan Securities will price a Silicon Valley Clean Water (Aa2/AA//) $144.9 million of taxable wastewater refunding bonds in Series 2021 A and tax-exempt bonds in Series 2021 B wastewater refunding revenue bonds.

J.P Morgan will also price a $137.9 million East Baton Rouge Sewerage Commission (/AA-//) offering of multimodal revenue refunding bonds in Series 2021 A.

The Minnesota Housing Finance Agency is set to sell $125 million residential housing finance bonds in two series being priced by RBC Capital Markets. The Series 2021 Series A bonds are subject to the alternative minimum tax and are structured as $23.06 million serial bonds from 2022 to 2030 and $101.9 million Series 2021 B bonds maturing serially in 2022, 2025, 2026, and from 2030 to 2033 with terms in 2036, 2041, 2046, and 2051.

Columbia, South Carolina, is set to price $120 million of waterworks and sewerage system refunding revenue bonds in a taxable series 2021 B structured as serials between 2023 and 2036 and terms in 2041 and 2049. The deal will be priced by Raymond James & Associates Inc.

Mississippi (Aa2/AA/AA/) is set to price sell $119.7 million of taxable GO refunding bonds. The issue will be priced by Wells Fargo Securities.

The National Finance Authority (A2///) on behalf of the VA Birmingham Health Care Center project is set to price $106 million of taxable federal lease revenue bonds in a federally taxable deal priced by Oppenheimer & Co.

HJ Sims is set to price $102 million Town of Huntington Local Development Corporation revenue offering for the Gurwin Independent Housing Inc. Fountaingate Gardens project. The Series 2021 non-rated issue consists of Series A, B, and C.

In the competitive market, Baltimore County, Maryland, (/AAA//) is set to sell three deals, $145 million of tax-exempt unlimited tax GOs, 2022-2041, at 9:45 a.m. on Wednesday. The issuer also has $219.6 million of taxable GOs, 2021-2032 at 11 a.m. and $88 million of taxables, 2022-2041, at 11:15 a.m. on Wednesday.

New York City is set to sell $107 million of taxable GOs, 2028-2031, at 10:45 a.m. Wednesday.

Cambridge, Massachusetts, (/AAA//) is set to sell $106 million of GOs, 2022-2041, at 11 a.m. Wednesday.

Christine Albano contributed to this report.