Tax-exempt yields fell one to two basis points Thursday, the first time in a week there was movement in triple-A generic benchmark scales, as the imbalance of supply versus the pent-up demand persisted and Refinitiv Lipper reported another multi-billion week of inflows, the 11th consecutive week of inflows.

The Port Authority of New York and New Jersey saw yields on its exempt and alternative minimum tax bonds bumped in institutional pricing from Wednesday's retail offering by as much as 10 basis points in some maturities.

Florida Board of Education took its gilt-edged credit off the day-to-day calendar and competitively sold $134 million to BofA Securities at attractive levels.

Municipals as a percentage of Treasuries were at 70% in 10 years and 77% in 30 years on Monday, according to Refinitiv MMD. Ratios dipped below 70% to 68% in 10 years and 79% in 30, according to ICE Data Services.

Refinitiv Lipper reported $2.38 billion of inflows into municipal bond mutual funds for the week ending Jan. 20.

“There still seems to be good interest for bonds across the board, and certainly all coupon structures seem to be seeing good activity,” a Charlotte, North Carolina-based trader said Thursday.

Credit spreads continue to tighten and bid-asked spreads remained tight.

“Depending on the coupon structure, as the week has progressed the amount of opportunity was very limited,” and bid-wanted activity in the secondary market has slowed, the trader said.

“Anyone looking to put money to work has pretty much held the market in check,” he said. Any new issuance that has come to market has been sold with little effort, as unspent January redemptions from coupon and maturity payments are flush in investors’ accounts.

Secondary inventory absorption has been more methodical despite the fundamental bias in place, said Kim Olsan, senior vice president at FHN Financial. Structure has become even more relevant with flatter curve slopes.

"In addition to optionality and couponing playing much larger roles in allocations," the nuance of credit choices is also having an effect, she said.

Olsan noted several trends in various credits in secondary trading over the previous five days:

- The AA range captures the most activity on a percentage basis. Over the survey period, almost 55% was traded in AAs. Dealer sales to customers were 30% greater than corresponding dealer buys. Credit concerns have held the AAA range to about 20% of all volume. In the trading period shown, customers bought 44% more than they sold.

- Trading in single-A bonds reached 13% of all volume over the survey week, but customer sells to buys were more evenly matched. Yield advantages continue to slip in this range on credit compression the longer lower rates are in place.

- The non-rated category drew 5% of all volume — about the same level as the BBB range — as customers bought 46% more than they sold. Flows in this sector speak to the push in higher-yielding munis where rates are appealing on an absolute basis and recovery prospects improve for the sector later in 2021.

Olsan notes that ICI flows since the March-April 2020 selloff totals nearly $70 billion, two months' worth of new issuance. The domino effect from such strong inflows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry.

"That component, along with the share of taxable supply that has cycled through, are the drivers behind rates holding so steady and so low," she said.

Primary market

Institutional pricing for the $913 million Port Authority of New York and New Jersey (Aa3/A+/A+) AMT and non-AMT consolidated bonds, books run by BofA Securities, saw ample demand and repriced at lower yields. Exempts fell as much as 10 basis points. AMT bonds in 2021 with a 5% coupon yield 0.20%, five bps lower than retail scales, 5s of 2026 at 0.64%, 5s of 2031 at 1.35%, 4s of 2036 at 1.84%, 4s of 2040 at 1.99%, 4s of 2046 at 2.17, 4s of 2051 at 2.22%, 4s of 2051 at 2.17%, 5s of 2056 at 2.16%, 4s of 2061 at 2.48%.

Exempts were priced as 5s of 2030 at 0.95%, 5s of 2031 at 1.07%, 4s of 2036 at 1.58% (10 bps lower than retail), 4s of 2041 at 1.78%, 4s of 2051 at 2.04%, 5s of 2056 at 1.95% and 4s of 2061 at 2.25%.

Another AMT tranche, $205 million of forward delivery bonds in 2022 with a 5% coupon yield 0.54%, 5s of 2026 at 0.88%, 5s of 2031 at 1.56%, 5s of 2036 at 1.89%, 5s of 2041 at 2.09%.

J.P. Morgan Securities LLC priced $189 million of water revenue bonds for the Metropolitan Water District of Southern California (Aa1/AAA//). Bonds in 2028 with a 5% coupon yield 0.56%, 5s of 2031 at 0.84%, 5s of 2036 at 1.10%, 5s of 2041 at 1.30%, 5s of 2046 at 1.44% and 5s of 2051 at 1.49%.

In the competitive market, J.P. Morgan Securities LLC won priced $155.8 million of public health trust program general obligation bonds from Miami-Dade County, Florida (/AA/AA/). Bonds in 2021 with a 2% coupon yield 0.10%, 5s of 2026 yield 0.36%, 5s of 2031 at 0.93%, 5s of 2036 at 1.22%, 5s of 2041 at 1.43%, 5s of 2046 at 1.62% and 5s of 2049 at 1.65%.

BofA Securities won $134 million of PECOs from the Florida Board of Education (Aaa/AAA/AAA/). The deal was structured with 5% coupons from 2023 to 2032, yielding 0.17% in 2023, 0.33% in 2026, 0.87% in 2031 and 0.95% in 2032.

Secondary market

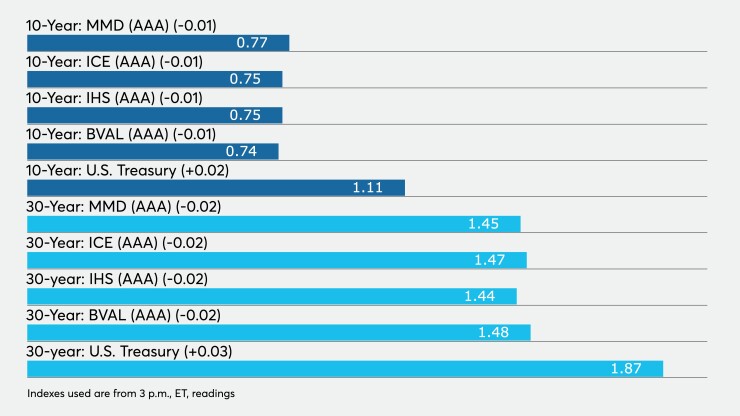

High-grade municipals fell one to two basis points, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.12% in 2022 and 0.13% in 2023. The 10-year fell to 0.76% and the 30-year fell 2 bps to 1.45%.

The ICE AAA municipal yield curve showed short maturities fell a basis point to 0.12% in 2022 and 0.14% in 2023. The 10-year fell a basis point to 0.75% while the 30-year yield fell to 1.47%.

The IHS Markit municipal analytics AAA curve showed yields at 0.14% in 2022 and 0.15% in 2023 while the 10-year fell two basis points to 0.75% and the 30-year yield at 1.44%, also two lower.

The Bloomberg BVAL AAA curve showed yields at 0.12% in 2022 and 0.14% in 2023 while the 10-year fell a basis point to 0.74% and the 30-year yield at 1.48%, two basis points lower.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.11% and the 30-year Treasury was yielding 1.87%, three basis points higher. The Dow rose 23 points, the S&P 500 rose 0.15% and the Nasdaq rose 0.66%.

Economic indicators

The housing and manufacturing sectors remained strong, while the number of people filing for unemployment benefits, despite dipping, remained quite high.

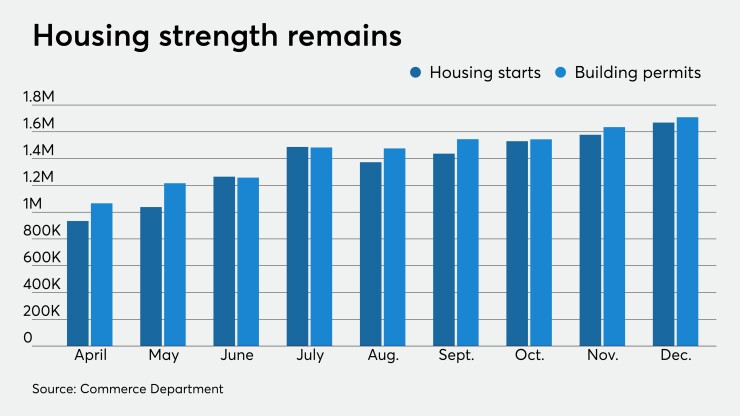

Housing starts and building permits jumped in December, as low mortgage rates fueled the growth, but experts warn regulation and the cost of lumber could become headwinds.

Housing starts gained 5.8% to a seasonally adjusted 1.669 million unit annual rate in December from 1.578 million in November, while permits rose 4.5% to 1.709 million from 1.635 million a month earlier.

Economists polled by IFR Markets expected 1.560 million starts and 1.604 million permits.

While the coronavirus throttled parts of the economy, housing has remained strong, as has manufacturing.

The rise in starts and permits will provide “much-needed housing supply to a tight market seeing record-low levels of inventory and rapidly-rising home prices,” said Joel Kan, Mortgage Bankers Association AVP of Economic and Industry Forecasting.

“Builder concerns about a changing regulatory landscape may have triggered many to move up their plans to pull permits and put shovels to the ground," said National Association of Home Builders (NAHB) chairman Chuck Fowke. "Our latest builder sentiment survey suggests somewhat softer numbers ahead due to rising building costs and an uncertain regulatory climate."

Single-family housing starts were the highest since September 2006, according to NAHB Chief Economist Robert Dietz. "And while NAHB is forecasting further production increases in 2021, the gains will be tempered by ongoing supply-side challenges related to material costs and delivery times, a dearth of buildable lots and regional labor shortages that continue to exacerbate affordability woes."

However, “the worst of the housing shortage could soon come to an end,” said National Association of Realtors Chief Economist Lawrence Yun. “More inventory is clearly needed to lessen the heat of multiple offers and the consequent frustration of multiple losing bids.”

Separately, initial jobless claims remained elevated, although slightly lower than the previous week.

The manufacturing sector continued expansion, according to the Federal Reserve Bank of Philadelphia’s Business Outlook Survey. The general business activity index surged to 26.5 in January from 9.1 in December, while the six months from now index climbed to 52.8 from 43.1.

New orders soared to 30.0 from 1.9, shipments increased to 22.7 from 12.0 and unfilled orders reversed to positive 25.6 from negative 0.1.

Prices paid rose to 45.4 from 24.9, while prices received gained to 36.6 from 16.1.

Initial claims in the week ended Jan. 16 slid to 900,000 from 926,000 a week earlier, the Labor Department reported Thursday. `Continuing claims fell to 5.054 million in the week ended Jan. 9 from 5.181 million a week prior.

Christine Albano contributed to this report.