-

The Philadelphia Fed president said there can be as few as no cuts or as many as two this year, but if his projections are accurate, one decrease would be appropriate this year.

June 17 -

"It's important that we start to move rates down," Harker said Wednesday in a local radio interview. "We don't have to do it too fast, and we're not going to do it right away."

December 20 -

"We actually are increasing the odds — we can get a soft landing. That doesn't mean we're out of the woods," Harker said.

February 10 -

"I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed," Harker said.

January 12 -

“We have to be careful in removing accommodation so that we don’t create any kind of ‘taper tantrum,’ ” Philadelphia Fed President Patrick Harker said.

June 2 -

The Federal Reserve should get a conversation going on tapering its bond-purchase program “sooner rather than later,” Philadelphia Fed President Patrick Harker said.

May 21 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

It was inevitable that muni yields would need to rise somewhat as the UST 10-year broke above 1%, however participants said the supply/demand imbalance will keep munis from rising as quickly as Treasuries. More than $1 billion inflows reported.

January 7 -

The resurgence of the coronavirus led to a larger than expected drop in consumer confidence.

December 22 -

The Federal Reserve Bank of Philadelphia's manufacturing index fell to a seventh- month low, while jobless claims hit a three-month high.

December 17 -

The consumer confidence index suggested expectations have slipped, and the Richmond Fed's services survey also offered a dim view ahead.

November 24 -

Housing starts and building permits both rose in September, as the housing market remains the "best part of the U.S. economy."

October 20 -

Initial jobless claims rose in the latest week, while the Empire State manufacturing index slipped, and the Philadelphia Fed's rose.

October 15 -

The housing market continues to lead all sectors in recovery, althoough a manufacturing and two services surveys also showed signs of recovery.

September 22 -

Jobless claims declined, but remain elevated, housing starts and building permits also slid, while manufacturing in the Philadelphia region expanded at a slower pace.

September 17 -

Consumer confidence sputtered even as new home sales surged, highlighting an uneven economic recovery.

August 25 -

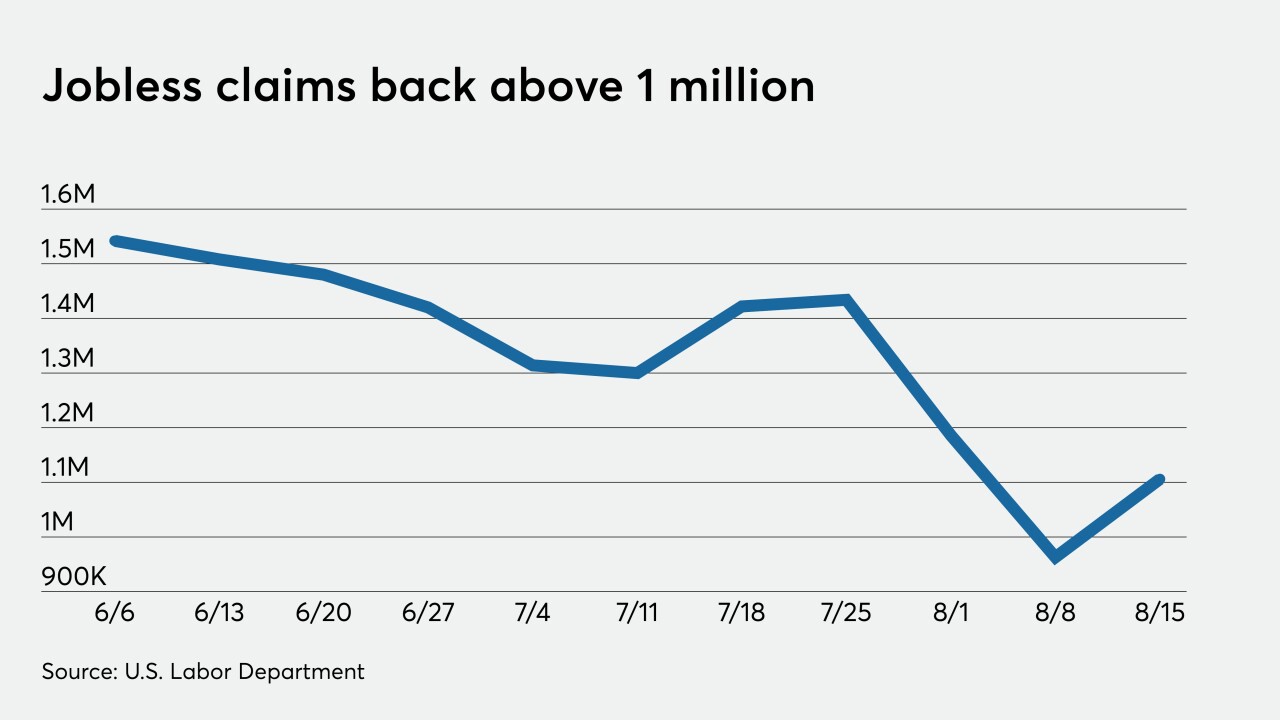

Jobless claims grew, manufacturing expansion weakened and leading indicators grew less than last month.

August 20 -

The nominations, essentially along party lines, move to the full Senate.

July 21 -

A handful of economic indicators offered no clarity about the economy, which appears to be improving marginally, but remains fragile.

July 16 -

The U.S. central bank should consider holding off on raising interest rates until inflation is above its 2% target, Philadelphia Fed President Patrick Harker said.

July 15