Various reads of the economy offered on Thursday suggested some economic improvement, although mostly still down from pre-pandemic levels, and on shaky ground as the number of coronavirus cases continues to rise in many states, threatening some pullback on reopenings.

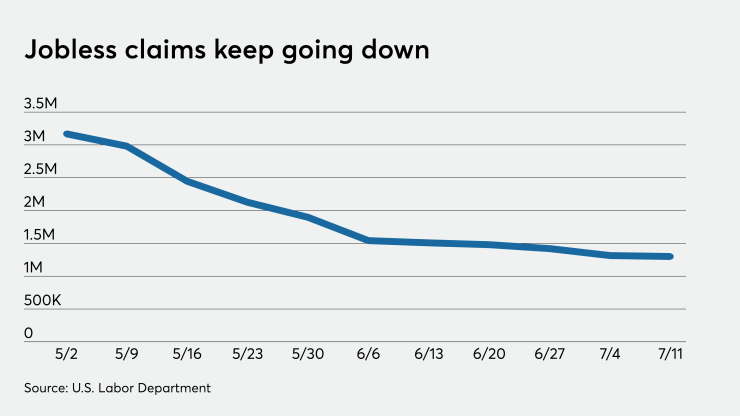

Initial jobless claims continued their trend of small decreases, dipping to a seasonally adjusted 1.300 million in the week ended July 11, from the previous week’s downwardly revised level of 1.310 million, originally reported as 1.314 million, the Labor Department said Thursday.

Economists polled by IFR Markets projected 1.250 million claims in the week.

“Seasonally adjusted new jobless claims, the closest thing we have to a government real-time report on the job market declined, but just barely,” said Mark Hamrick, senior economic analyst at Bankrate. “And if one doesn’t make the seasonal adjustment to the new unemployment claims, they actually rose, meaning that we lost ground.”

“This marks the 17th consecutive week of elevated new jobless claims," he said, noting they remain "at levels which previously would have been regarded as unthinkable on a sustained basis."

Claims have remained above one million “since exploding in late March" and "improvement has proved harder to come by in recent weeks,” Hamrick said.

The states posting the largest increases in claims in he week ended July 4 were Texas (20,506), New Jersey (19,410), Maryland (10,568), Louisiana (9,441), and New York (3,906), while the states with the largest decreases were Indiana (22,725), Florida (17,429), California (12,571), Georgia (12,325), and Oklahoma (8,982).

“After an encouraging initial start to the recovery, the dramatic re-emergence of COVID-19 risks putting the economy back on its heels” he said.

Retail sales

Retail sales climbed 7.5% in June, after an 18.2% increase in May, the Commerce Department said.

Economists predicted sales would increase 5%.

Excluding autos, sales rose 7.3% in June, after a 12.1% gain in May. Economists expected a 5.0% increase.

Sales are up 1.1% from a year ago.

Philadelphia Fed manufacturing

Manufacturing activity in the Philadelphia region “continued to expand” in July, according to the Federal Reserve Bank of Philadelphia’s manufacturing survey.

The current activity index slipped to 24.1 from 27.5 in June.

Economists expected a bigger decline, to 20.0.

New orders rose to 23.0 from 16.7, while shipments fell to 15.3 from 25.3.

Looking six months into the future, the general activity index dropped to 36.0 from 66.3.

Business inventories

Business inventories decreased 2.3% in May, after a revised 1.4% drop in April, Commerce said Thursday.

Economists projected inventories to drop 2.3% in the month.

NAHB

Builder confidence soared in July, as the National Association of Home Builders housing market index surged to 72 from 58, matching March's pre-pandemic reading, NAHB reported Thursday.

Economists expected a 60 level.

“While the housing market is clearly rebounding, challenges exist,” said Robert Dietz, NAHB chief economist. “Lumber prices are at a two-year high, and builders are reporting rising costs for other building materials while lot and skilled labor availability issues persist. Nonetheless, the important story of the changing geography of housing demand is benefiting new construction. New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

Business leaders survey

Activity in the New York region’s service sector “held fairly steady,” according to results of the Federal Reserve Bank of New York’s business leaders survey, released Thursday.

The current business activity index narrowed to negative 1.8 in July from negative 40.0 in June, while the business climate index improved to negative 75.4 from negative 82.3.

Looking six months ahead, the future business activity index declined to 7.1 from 24.8 and the future business climate index contracted to negative 8.3 from positive 13.7.