Munis were little changed as a massive snowstorm pummeled the Northeast triggering states of emergency and vaccine cancelations. Trading was quiet and triple-A benchmarks were unmoved even as U.S. Treasuries faded and equities rebounded from losses and volatility last week.

In the primary, a lone competitive deal of size got done as Worcester, Massachusetts, (Aa3/AA-//) sold $125.5 million of limited tax GOs to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.14%, 5s of 2026 are at 0.34%, 3s of 2031 at 1.00%, 2s of 2036 at 1.64%, 2s of 2041 at 1.89%, 2s of 2046 at 2.08% and 2s of 2050 at 2.12%.

Municipals as a percentage of Treasuries dipped a basis point to 66% in 10 years and held at 75% in 30 years on Monday, according to Refinitiv MMD. Ratios stayed at 65% in 10 years and 77% in 30, according to ICE Data Services data.

High-yield

Chicago Public Schools’

Munis in January largely ignored volatility in other fixed income markets and equities. Low yields and ratios have most of the market stuck looking for value, where the better yield opportunities are outside of mainstream names, said Kim Olsan, senior vice president at FHN Financial.

February’s business is set up to be a little different from January, with tax-exempt supply coming via smaller par-value deals. "That is the very mix that can cause distraction to secondary bidsides — and with rates/ratios where they are, some pullback might be expected to find distribution," Olsan said.

Secondary market

Trading was quiet but a few names of note traded hands. Texas transportation rev 5s of 2022 traded at 0.08%-0.07%, New York State EFC 5s of 2023 traded at 0.14%-0.12%. Maryland Department of Transportation rev 5s of 2026 traded at 0.31%. Utah GO 5s of 2026 traded at 0.29%.

California GO 5s of 2028 traded at 0.57% and 0.55% Thursday while 5s of 2029 traded at 0.67% versus 0.68% Friday.

Dallas, Texas, ISD 4s of 2032 traded at 0.92%-0.91% from 1.01% original. Columbus, Ohio, GO 5s of 2033 traded at 0.91%. A week ago they traded at 0.97%-0.96% from 1.05% original.

Washington GOs 5s of 2038 at 1.19%-1.18%.

Out longer, Friendswood Texas ISD 2s of 2046 traded at 1.92%-1.89% down from 1.97% original. Massachusetts GO 5s of 2048 traded at 1.58%. Triborough Bridge and Tunnel Authority MTA bridges and tunnels 5s of 2049 traded at 1.68%. On 1/20 they traded at 1.81%-1.80%. New York City water 5s of 2050 traded at 1.64%.

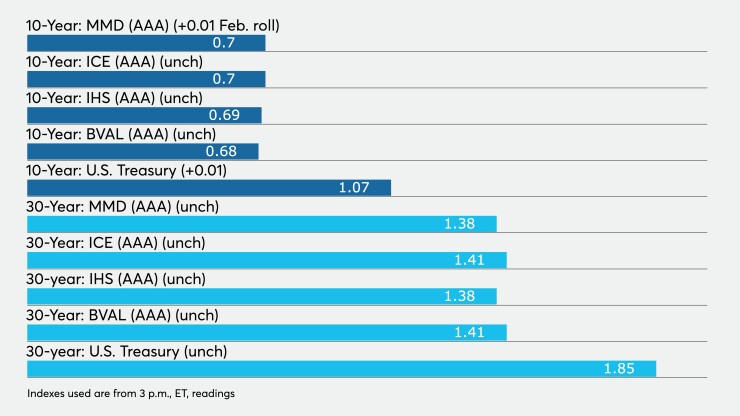

High-grade municipals were steady, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were at 0.09% in 2022 and 0.10% in 2023. The 10-year rose to 0.71% and the 30-year was flat at 1.38%.

The ICE AAA municipal yield curve showed short maturities steady at 0.09% in 2022 and 0.10% in 2023. The 10-year was at 0.70% while the 30-year yield sat at 1.41%.

The IHS Markit municipal analytics AAA curve showed yields at 0.11% in 2022 and 0.12% in 2023 while the 10-year remained at 0.69% and the 30-year yield at 1.38%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and 0.10% in 2023, while the 10-year was at 0.68%, and the 30-year yield at 1.40%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.07% and the 30-year Treasury was yielding 1.85% near the close. Equities saw gains with the Dow up 262 points, the S&P 500 rose 1.68% and the Nasdaq rose 2.59%.

Economic data

Limited data was released on Monday. The Institute for Supply Management’s PMI slid to 58.7 in January from 60.5 in December.

Economists polled by IFR Markets expected a decline to 60.0.

“The manufacturing economy continued its recovery in January,” noted Timothy Fiore, chair of ISM’s manufacturing business survey committee. “Survey committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are continuing to cause strains that limit manufacturing growth potential. However, panel sentiment remains optimistic.”

The new orders index fell to 61.1 from 67.5, production declined to 60.7 from 64.7, employment gained to 52.6 from 51.7, and the prices index climbed to 82.1 from 77.6.

Also released Monday, construction spending grew 1.0% in December after a 1.1% rise in November. Year-over-year spending climbed 5.7%.

Economists expected a 0.9% gain.

Primary market to come this week

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price $900 million of future tax-secured subordinate refunding bonds on Wednesday. Serials 2023-2028, 2034-2041; terms 2046, 2051. Wells Fargo Securities will run the books.

The TFA will also price $90 million of future tax-secured subordinate bonds, Fiscal 2010 Subseries F-5 (remarketing) serials 2029-2033. Wells will run the books.

The Nassau County Interim Finance Authority (/AAA/AAA/) is set to price $577.65 million of sales tax-secured bonds and $561.75 million of taxable sales tax-secured bonds on Wednesday. Goldman, Sachs & Co. LLC is lead underwriter on both deals.

Seattle Children’s Hospital (Aa2//AA/) is set to price $405 million of corporate CUSIP green refunding bonds on Thursday. J.P. Morgan Securities is head underwriter.

Willis-Knighton Medical Center (/A/AA-/) is set to price $400 million of taxable bonds on Wednesday. Goldman is head underwriter.

Wake County, North Carolina, (Aa1/AA+/AA+/) is set to price $304 million of limited general obligation bonds on Wednesday. J.P. Morgan is bookrunner.

The Tarrant Regional Water District, Texas, (/AAA//) is set to sell $299.4 million of taxable revenue bonds by competitive bid at 11 a.m. on Tuesday.

The Massachusetts Port Authority (Aa2/AA-/AA/) is set to price $227 million of taxable revenue refunding bonds on Wednesday. BofA Securities is lead underwriter.

Broward County, Florida, School District (/AA-//) is set to sell $221.6 million of unlimited tax general obligation bonds at 11 a.m. Tuesday.

The Community Development Administration of the Maryland Department of Housing and Community Development (Aa1//AA/) is set to price $197 million of residential revenue bonds on Tuesday. J.P. Morgan is head underwriter.

New Orleans, Louisiana, (/AA//) is set to price $191.6 million of taxable water revenue refunding bonds insured by Assured Guaranty on Thursday. J.P. Morgan is bookrunner.

New Orleans will also issue $185 million of taxable sewerage service revenue refunding bonds Thursday. J.P. Morgan is head underwriter.

Detroit (Ba3/BB-//) is set to price $175 million of unlimited tax exempt ($135 million) and taxable ($40 million) social bonds on Thursday. BofA is lead underwriter.

The Arlington Independent School District, Texas, (Aaa/AAA//) PSF guaranteed, is set to price $172.6 million of unlimited tax school building bonds. Serials 2021-2023, 2025-2041; term, 2046. Siebert Williams Shank & Co. LLC is head underwriter.

The Industrial Development Authority of the County of Maricopa, California, (A2//A+/) is set to price $171 million of Honor Health hospital revenue refunding bonds Wednesday. Serials 2023-2028, 2031-2037, 2039; term, 2051. RBC Capital Markets will run the books.

The state of Louisiana (A1/A+//) is set to price $135.9 million of taxable unclaimed property special revenue refunding bonds, $64.78 million Series 2021 (I-49 North Project) and $71.1 million Series 2021 (I-49 South Project) serials, 2021-2033, serials 2021-2035, respectively. TD Securities LLC is lead underwriter.

Bethel School District No. 52, Lane County, Oregon, (Aa1///) is set to price $107.5 million of general obligation bonds in three series on Tuesday. Insured by Oregon School Bond Guaranty Act. Piper Sandler & Co. is head underwriter.

Waco Independent School District, Texas, (/AAA//) is set to price $106.5 million of unlimited tax taxable refunding bonds, insured by the PSF. Serials 2021-2038. Oppenheimer & Co. is bookrunner.

The city of Monterey Park, California, (/AA//) is set to price $106.3 million of taxable pension obligation bonds, serials 2022-2036; term, 2043, on Tuesday. Ramirez & Co. Inc. is head underwriter.

Gary Siegel contributed to this report.