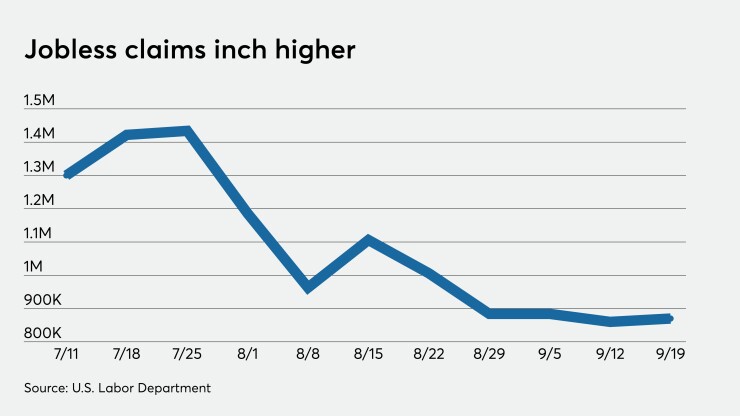

While gross domestic product is expected to soar in the third quarter, initial jobless claims remain “staggeringly high,” with another slight uptick in the latest week.

Claims rose to a seasonally adjusted 870,000 in the week ended Sept. 19, from the previous week’s upwardly revised level of 866,000, originally reported as 860,000, the Labor Department said Thursday.

Economists polled by IFR Markets projected 845,000 claims in the week.

Continuing claims dropped to 12.580 million in the week ended Sept. 12, from an upwardly revised level of 12.747 million a week earlier, first reported as 12.628 million.

“Claims remain staggeringly high and nothing can explain away the disturbing level of both regular and special pandemic [unemployment insurance] benefits gig, self-employed and furloughed workers. Bad,” said Diane Swonk, chief economist for Grant Thornton. “This is against a backdrop of what will be a large bounce — nearly 30% — in third quarter gross domestic product growth. Those gains not enough to cure what ails us or stem any consequences of potential second wave of infections this fall or slowdown seeing emerge abroad."

Mark Hamrick, senior economic analyst at Bankrate, called the report "heartbreaking." With claims rising both before and after seasonal adjustment — with more than 800,000 filing through state programs, and more than 600,000 under the Pandemic Unemployment Assistance program, "this means about 1.5 million new claims were seen in the latest week under these programs, and a total of 26 million persons receiving some type of assistance in early September."

Despite the financial “struggles” of millions, he added, there’s no indication Washington will offer more assistance.

“The provisions of the CARES Act have expired and most businesses on the receiving end of the Paycheck Protection Program now have used up those funds,” Hamrick said. "Amid extremely low expectations, it has been a somewhat positive development to see progress on the effort to keep the federal government funded. ... It would be unconscionable if elected officials were to allow a government shutdown amid the pandemic and the worst economic downturn of our lifetimes."

The states with the largest rise in claims in the week ended Sept. 12 were: Indiana (1,990), Kansas (1,928), Illinois (1,906), and Michigan (1,727), while the states with the biggest drops were: California (17,400), Texas (15,905), Louisiana (8,384), Georgia (8,235), and Washington (3,291).

New home sales

August new home sales jumped 4.8% to a seasonally adjusted 1.011 million level, from the revised July rate of 965,000, first reported as 901,000, according to the Commerce Department. This was the highest sales pace since September 2006.

Economists predicted home sales would total 900,000.

Year-over-year, home sales surged 43.2%, with all the regions showing gains from last August.

Only 282,000 homes were on the market in August, the lowest level since the series began in 1963.

"New home sales are now 15% higher on a year-to-date basis, with gains in all regions," according to NAHB Chief Economist Robert Dietz. "But with inventory at just a 3.3 months' supply, more construction is needed. The challenge will be whether materials and labor are available."

Kansas City Fed manufacturing

Regional manufacturing activity “increased at a slower pace in September and remained lower than a year ago, while expectations for future activity were positive,” according to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City.

The composite index dipped to 11 in September from 14 in the prior month.

The six-month expectations composite index slipped to 18 from 19 last month.

“Regional factory activity expanded again in September but was still below year-ago levels for the majority of firms,” he said. “Firms’ expectations for future activity continued to be relatively optimistic, although they anticipated slightly lower wage and salary growth in the year ahead.”