-

Compensation played a role in the departures, sources said.

April 30 -

The departures happened around the time Barclays handed out companywide bonuses and coincided with the firm in the process of shrinking its muni footprint in the regions, according to sources.

March 27 -

Barclays joins UBS and Citigroup in being prohibited from underwriting state and local government bonds under Texas laws aimed at protecting the fossil fuel and firearms industries.

January 26 -

The Puerto Rico Oversight Board is seeking the return of fees connected with Puerto Rico bonds and swaps.

September 21 -

The office of Rob Bonta filed its objection to the dismissal with a California appellate court in San Francisco May 19.

May 20 -

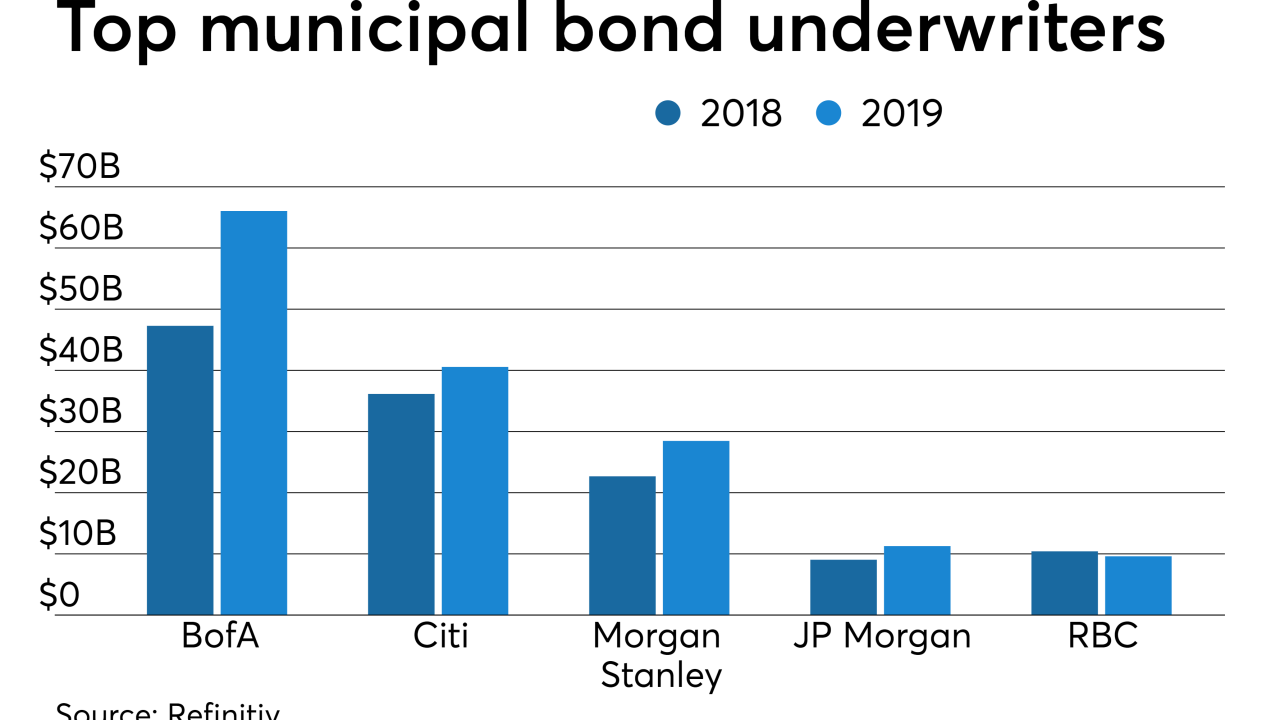

The top muni underwriters accounted for $406.51 billion in 10,582 transactions in 2019 compared to $320.35 billion in 8,549 deals in 2018. There was only one change in the top five year-over-year but spots six through 10 saw three changes. Barclays and Stifel both had big improvements in the rankings, while Raymond James dropped the most.

January 8 -

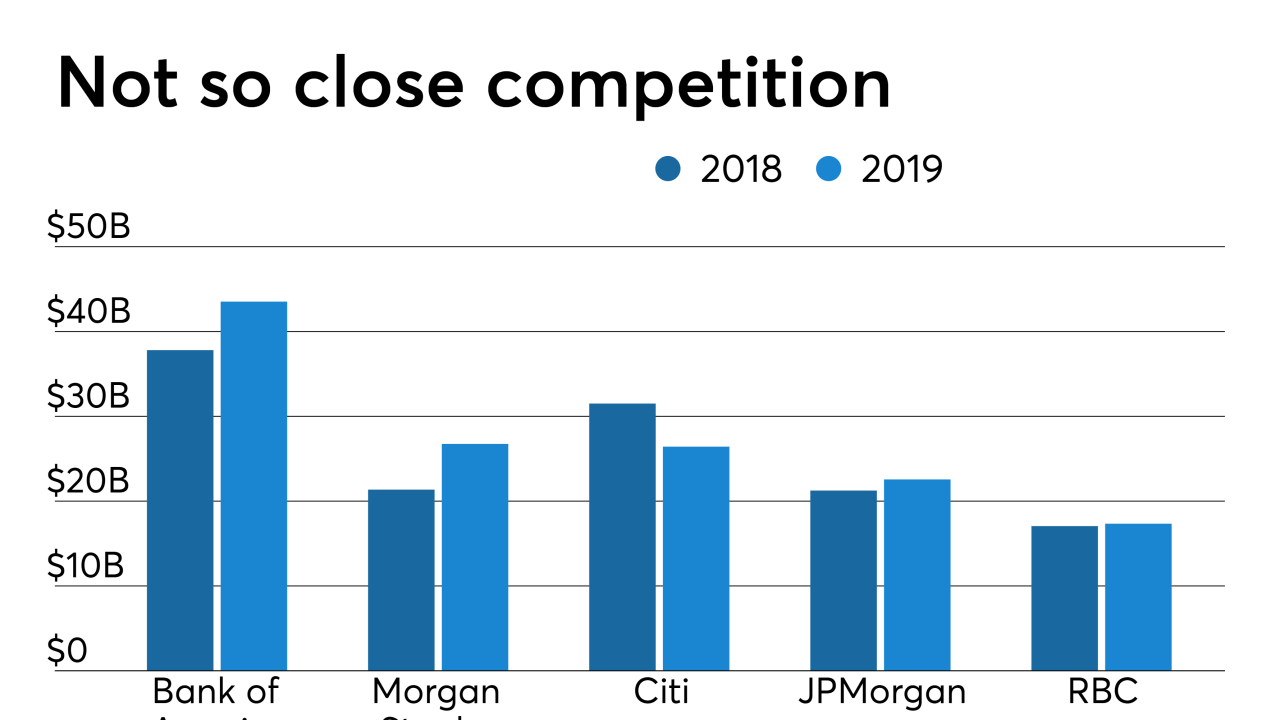

Municipal underwriters saw increased business, as demand for muni bonds jumped through the roof. Top muni underwriters accounted for $267.51 billion in 7,310 deals, up from $239.33 billion in 6,406 transactions in the first nine months of 2018.

October 7 -

The legal teams for Baltimore and Philadelphia asked the court to reject the banks’ plausibility argument as well as their claim that the suit is barred by a four-year statute of limitations.

October 1 -

Two courts have interpreted a legal question key to the VRDO lawsuits very differently.

August 29 -

The amended lawsuit references inside sources who allegedly confirm that the banks worked together in violation of antitrust law.

June 3 -

Adding $374 million alleged in New York to the three other cases also filed by Johan Rosenberg brings the total damages claimed to $1.58 billion.

May 22 -

Philadelphia awarded a $190 million general obligation deal to banks the city is suing, alleging collusion on variable-rate debt.

April 29 -

Whistleblower Johan Rosenberg has alleged that the conspiracy cost issuers over $1 billion — $719 million in California, $349 million in Illinois, and $134 million in Massachusetts.

April 4 -

Municipal underwriters jockey for position as business increased 21.9% from the first quarter of last year.

April 4 -

Twenty-three members of Congress are urging the Oversight Board to pull back the bonds' underwriting and other fees.

April 3 -

The lawsuit filed in federal court is now the second national suit alleging fraud in the variable-rate debt market.

March 27 -

The city says firms conspired to artificially raise rates resulting in unjust enrichment.

February 21 -

A lawsuit alleging fraud accusing banks and broker-dealers of fraud in the variable-rate demand obligation market will proceed, an Illinois judge ruled.

February 1 -

The San Francisco Bay Area Rapid Transit District will get its advance refunding deal done this year after accelerating its schedule.

December 8 -

Barclays is bolstering its Chicago team with three banking additions at the expense of Bank of America Merrill Lynch.

June 7