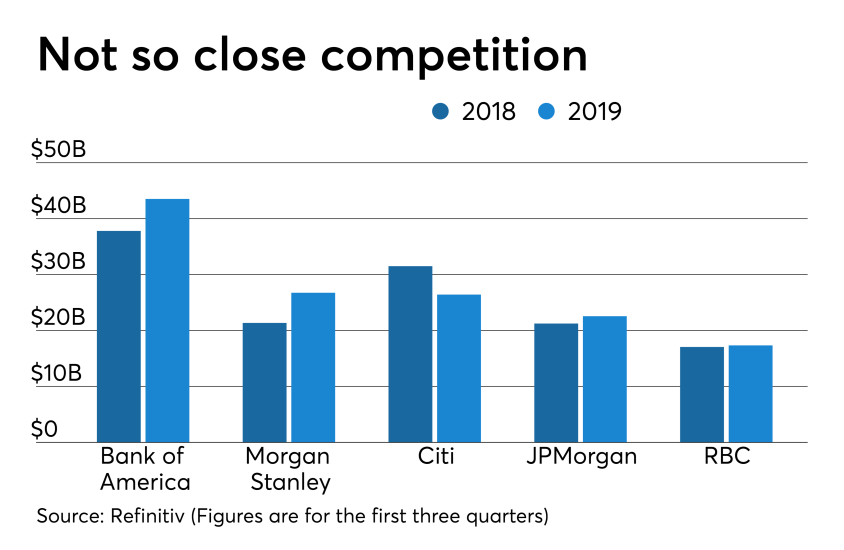

Municipal underwriters saw increased business, as demand for muni bonds jumped in through the roof.

Top muni underwriters accounted for $267.51 billion in 7,310 deals, up from $239.33 billion in 6,406 transactions in the first nine months of 2018. There was only one change in the top five but places eight through 15 were jumbled.