Bank of America

Bank of America

Bank of America Corp is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets.

-

The Texas Attorney General will end reviews of Bank of America, Morgan Stanley and JP Morgan after the banks recently left the Net-Zero Banking Alliance.

January 8 -

BofA and Morgan Stanley left the Net-Zero Banking Alliance, but there was no word from the Texas attorney general on their status as bond underwriters in the state.

January 3 -

-

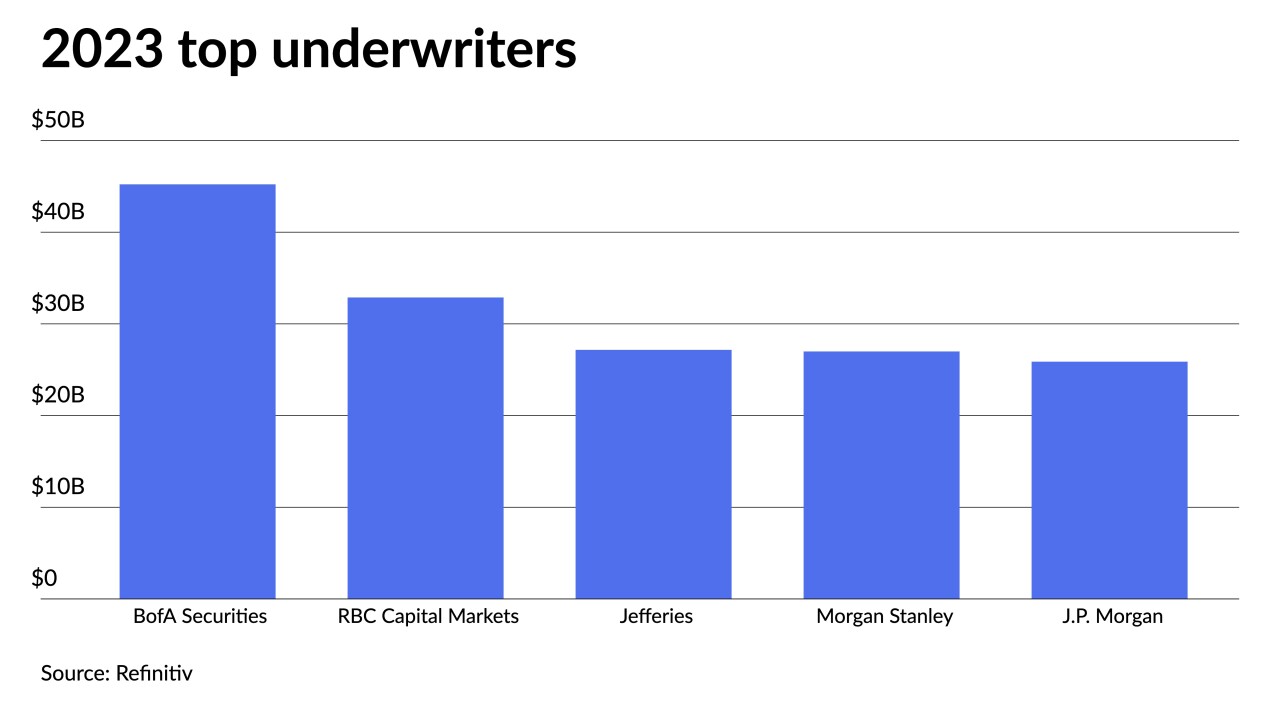

RBC ramped up business to land at second place and Jefferies rose to third while Raymond James entered the top 10, knocking Barclays to 11th. Citi, which exited the business, closed at sixth place.

January 8 -

The office of Rob Bonta filed its objection to the dismissal with a California appellate court in San Francisco May 19.

May 20 -

Bank of America, JPMorgan, Goldman Sachs, Citigroup, UBS, Morgan Stanley, RBC, and Santander are defendants.

June 4 -

Texas moved closer to enacting a law that would ban government work with Wall Street banks whose policies restrict the firearms industry, marking a pushback from Republicans in the gun-friendly state against corporations taking sides in America’s political fights.

May 13 -

Bank of America and Citigroup, the top two underwriters in the $3.9 trillion municipal bond market, are at risk of getting shut out of Texas because of a push by Republican state lawmakers to punish the banks for their restrictive gun policies.

April 29 -

The top municipal bond underwriters of the first quarter of 2021 are well ahead of last year's record pace, as the country is starting to finally see the light at the end of the COVID-19 pandemic tunnel.

April 9 -

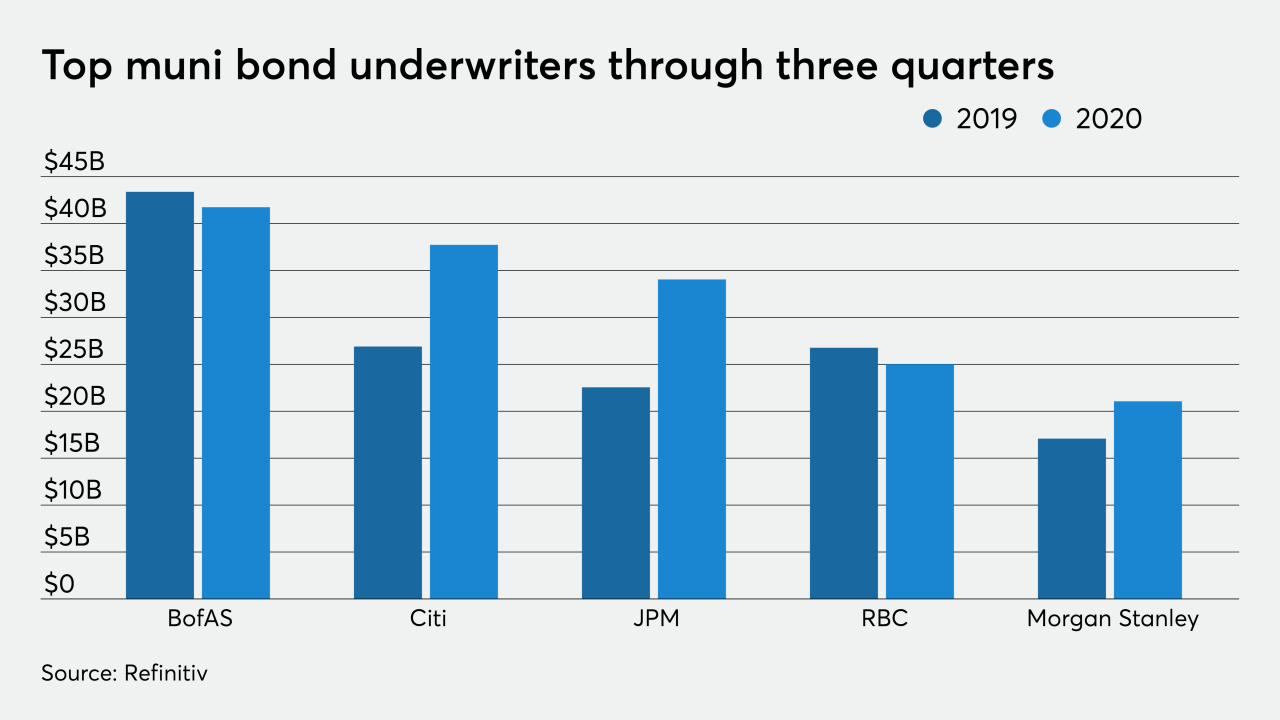

Municipal bond underwriters are on pace to easily surpass last year's total, despite the COVID-19 pandemic. Top bookrunners have accounted for a total of $328.60 billion through the first three quarters of the year, up from the $267.91 billion in the first nine months of 2019. The top five saw small changes compared to a year ago, while spots six through 10 saw more of a mix.

October 8 -

Lauren Sobel, a municipal bond analyst at Bank of America, died in a rock climbing accident in Gardiner, New York.

August 14 -

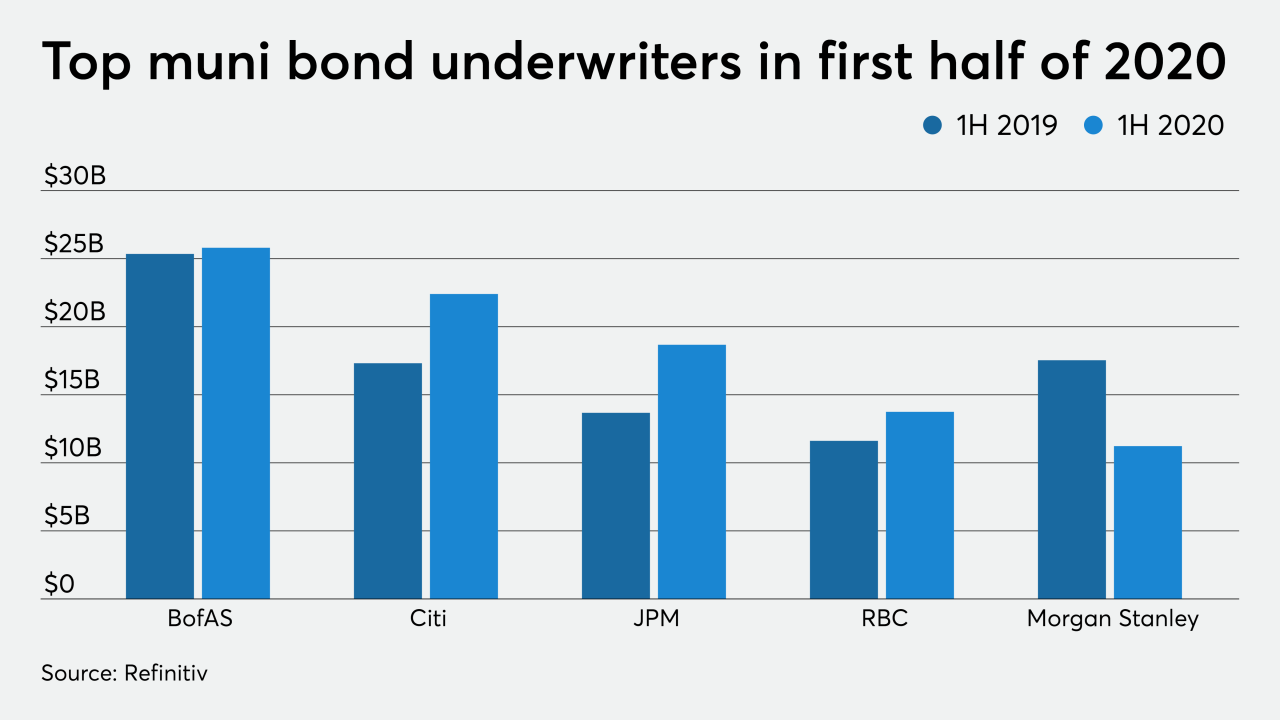

The top 10 saw three firms that were not in it last year and only one firm remained in the same position compared to the previous year's first six months.

July 8 -

Underwriters of municipal bonds did the majority of business during the first two months of the year, before COVID-19 swept the country with sickness and severe spreading. The top underwriters accounted for $87.84 billion of bonds throughout 2,119 transactions, compared to $75.84 billion in 1,809 deals in first quarter of 2019.

April 7 -

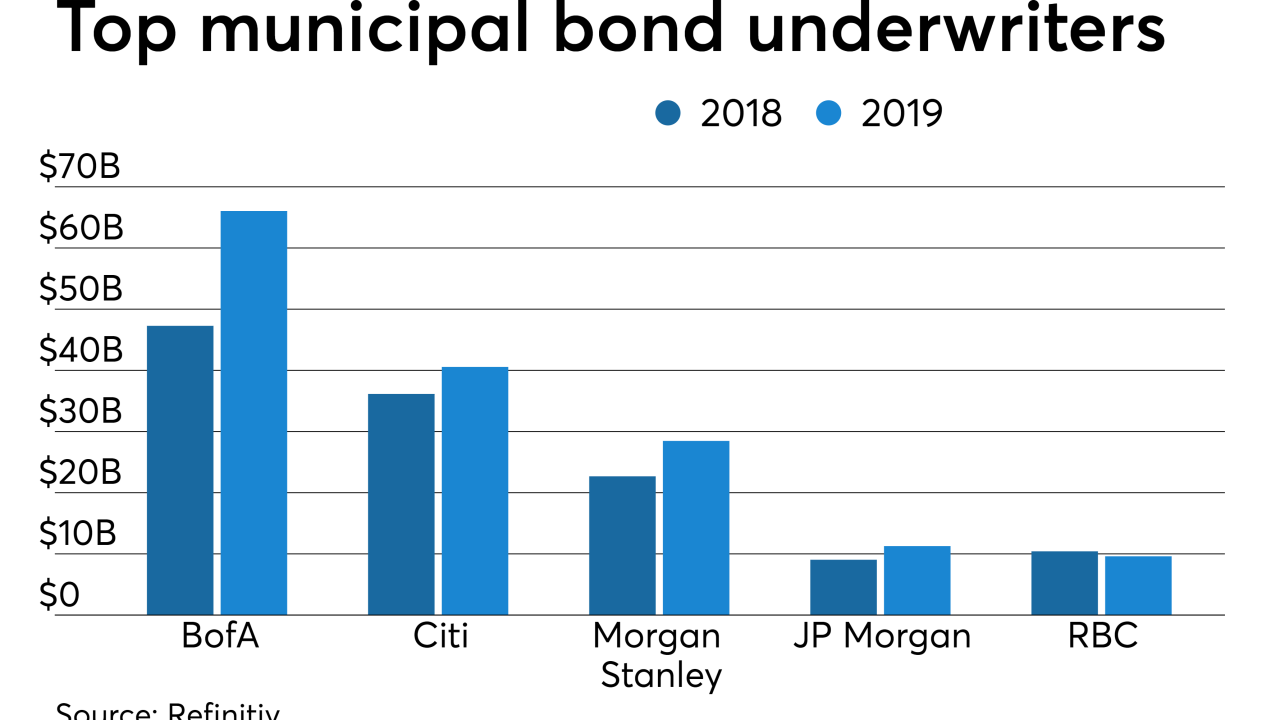

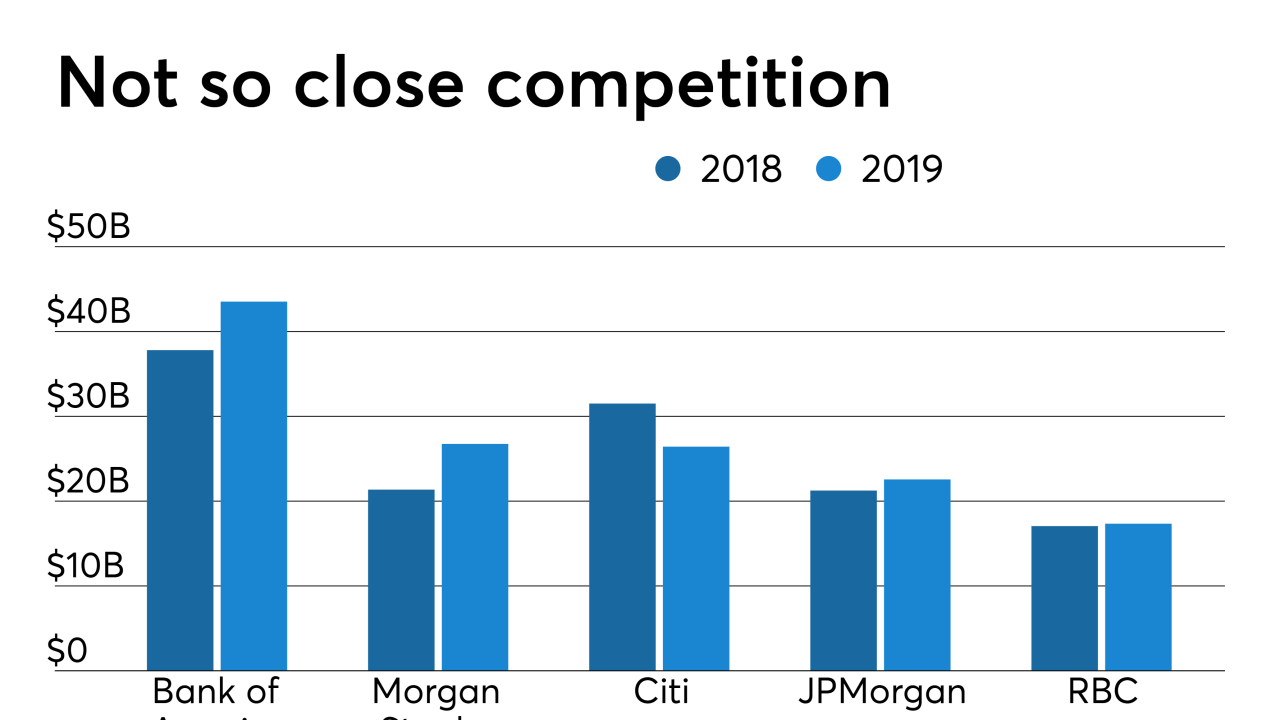

The top muni underwriters accounted for $406.51 billion in 10,582 transactions in 2019 compared to $320.35 billion in 8,549 deals in 2018. There was only one change in the top five year-over-year but spots six through 10 saw three changes. Barclays and Stifel both had big improvements in the rankings, while Raymond James dropped the most.

January 8 -

Bank of America Chief Executive Officer Brian Moynihan said the U.S. has no need for negative interest rates because its economy is strong, unlike other regions that have employed the tricky strategy.

November 21 -

The bond insurer may be seeking a more receptive audience for its claim that underwriters provided incomplete and misleading information about the bonds it insured.

October 17 -

Municipal underwriters saw increased business, as demand for muni bonds jumped through the roof. Top muni underwriters accounted for $267.51 billion in 7,310 deals, up from $239.33 billion in 6,406 transactions in the first nine months of 2018.

October 7 -

New MSRB Chair Edward Sisk will start in his new role on Oct. 1.

September 25 -

-

Bank of America’s customers spent $1.9 trillion this year through Aug. 12, an increase of 5.9% from a year earlier — a sign that the economy, driven by the consumer, remains strong, Brian Moynihan said.

August 16