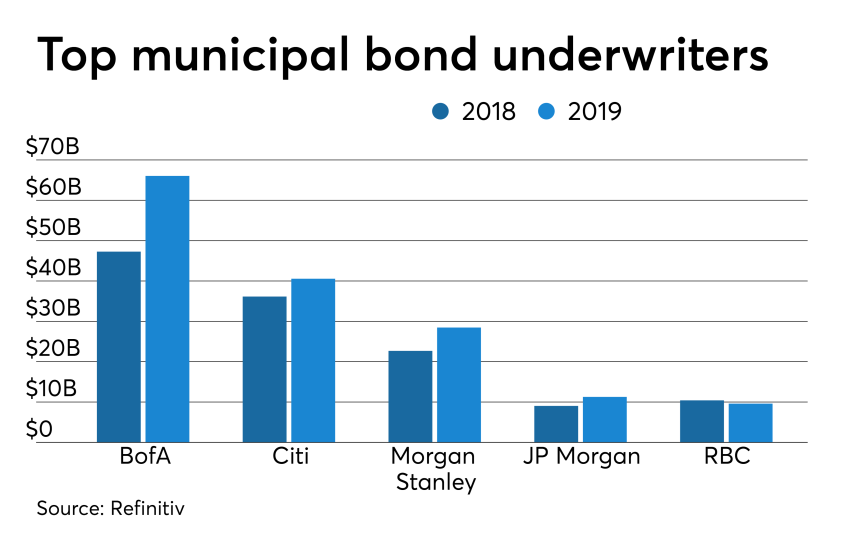

The top muni underwriters accounted for $406.51 billion in 10,582 transactions in 2019 compared to $320.35 billion in 8,549 deals in 2018. There was only one change in the top five year-over-year but spots six through 10 saw three changes. Barclays and Stifel both had big improvments in the rankings, while Raymond James dropped the most.