-

The Texas Attorney General will end reviews of Bank of America, Morgan Stanley and JP Morgan after the banks recently left the Net-Zero Banking Alliance.

January 8 -

BofA and Morgan Stanley left the Net-Zero Banking Alliance, but there was no word from the Texas attorney general on their status as bond underwriters in the state.

January 3 -

Three of the hires are group heads in public sector and structured finance businesses at the firm.

February 28 -

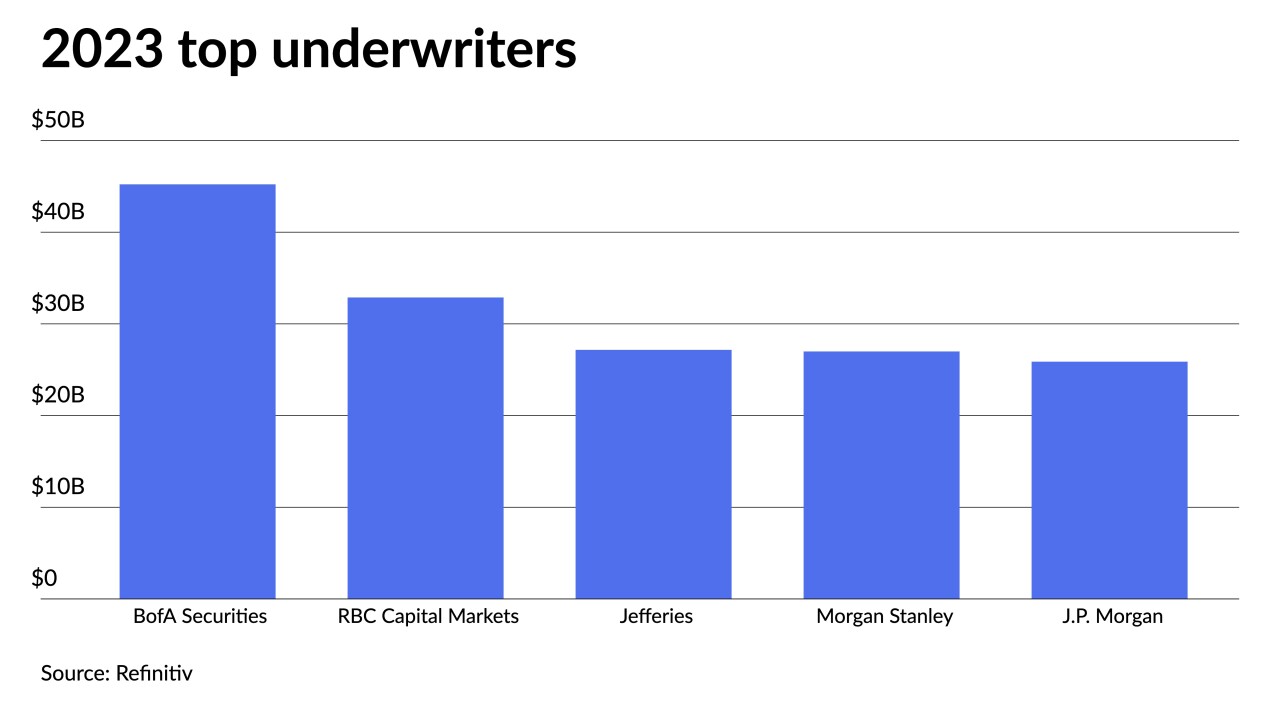

RBC ramped up business to land at second place and Jefferies rose to third while Raymond James entered the top 10, knocking Barclays to 11th. Citi, which exited the business, closed at sixth place.

January 8 -

Brian Wynne joins Jefferies as co-head of the municipal syndicate, while Morgan Stanley continues to see turnover in its muni ranks.

April 12 -

Alex Chilton is the firm's new head of municipal securities. Zach Solomon and David Gallin are co-heads of public finance.

February 1 -

The firm is expected to announce the new muni leadership team next week.

January 12 -

The Puerto Rico Oversight Board is seeking the return of fees connected with Puerto Rico bonds and swaps.

September 21 -

Morgan Stanley Chief Executive Officer James Gorman said he expects the U.S. Federal Reserve to begin tapering its bond buying toward the end of this year and start raising interest rates in early 2022, faster than the Wall Street bank’s own economists forecast.

May 25 -

Officials call it the first for any state revolving fund program in the country.

April 26 -

The top municipal bond underwriters of the first quarter of 2021 are well ahead of last year's record pace, as the country is starting to finally see the light at the end of the COVID-19 pandemic tunnel.

April 9 -

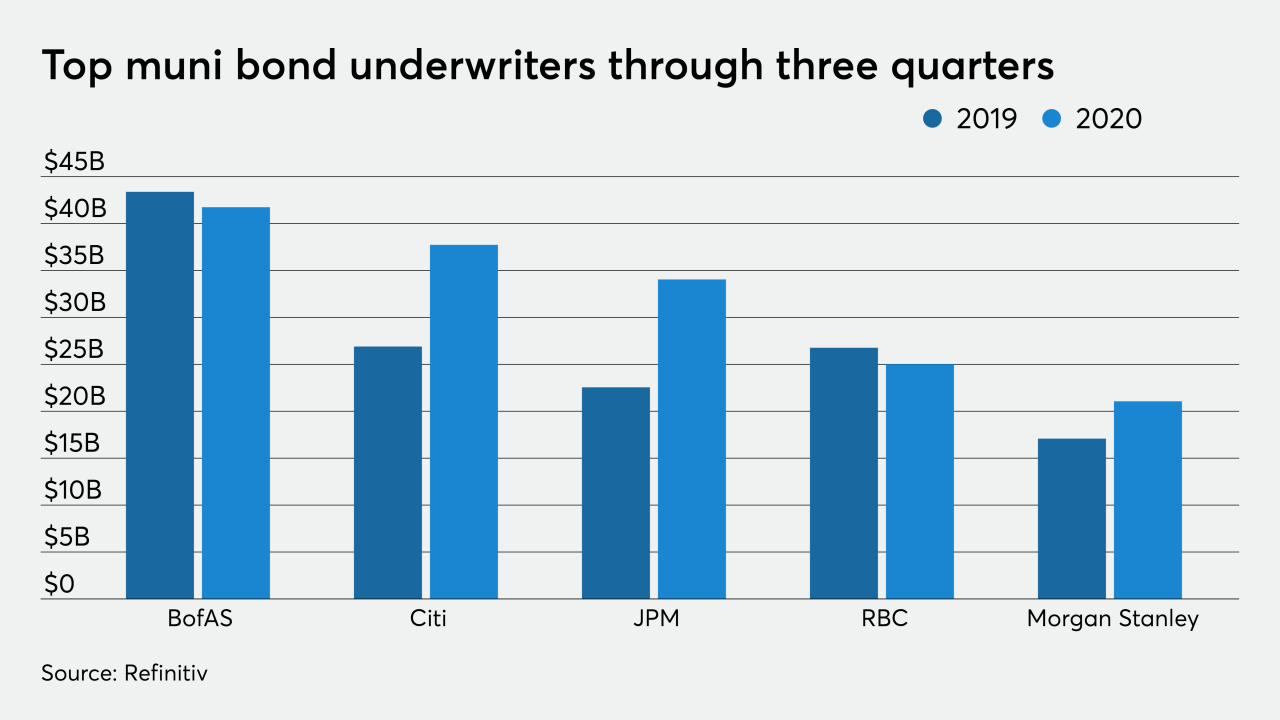

Municipal bond underwriters are on pace to easily surpass last year's total, despite the COVID-19 pandemic. Top bookrunners have accounted for a total of $328.60 billion through the first three quarters of the year, up from the $267.91 billion in the first nine months of 2019. The top five saw small changes compared to a year ago, while spots six through 10 saw more of a mix.

October 8 -

Eaton Vance operates dozens of municipal bond mutual funds under the Eaton Vance, Parametric and Calvert brands.

October 8 -

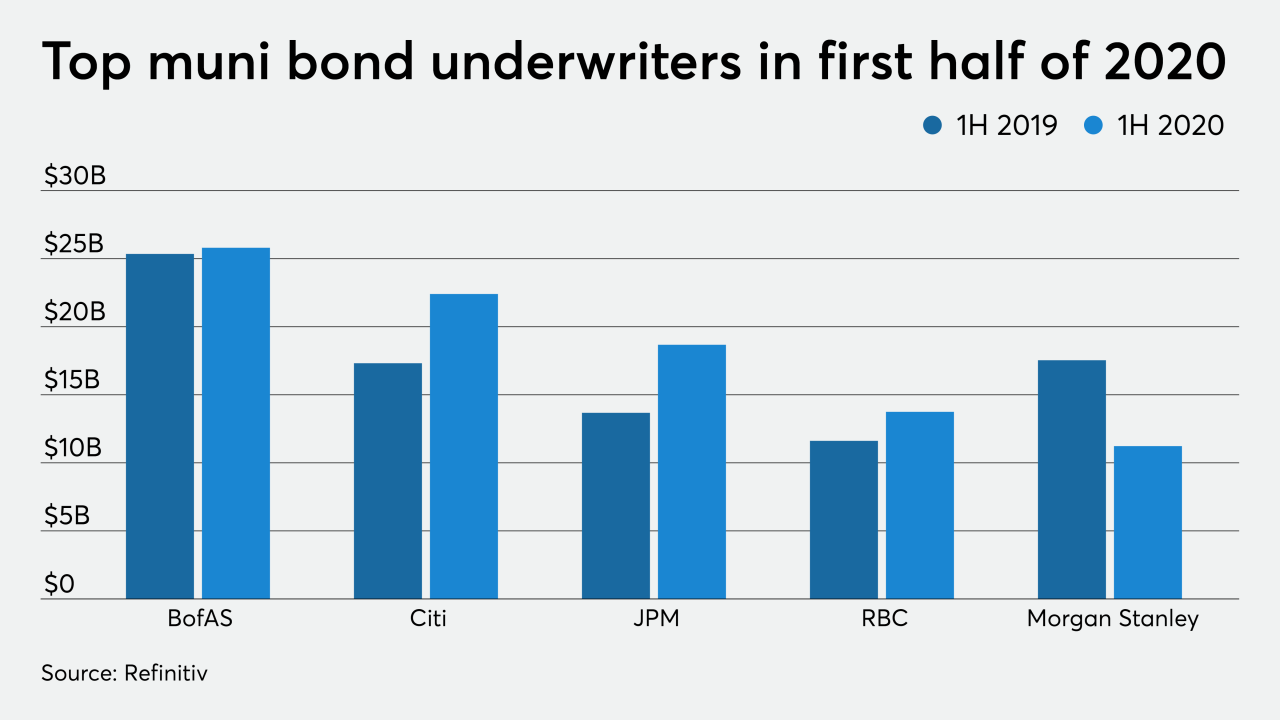

The top 10 saw three firms that were not in it last year and only one firm remained in the same position compared to the previous year's first six months.

July 8 -

Underwriters of municipal bonds did the majority of business during the first two months of the year, before COVID-19 swept the country with sickness and severe spreading. The top underwriters accounted for $87.84 billion of bonds throughout 2,119 transactions, compared to $75.84 billion in 1,809 deals in first quarter of 2019.

April 7 -

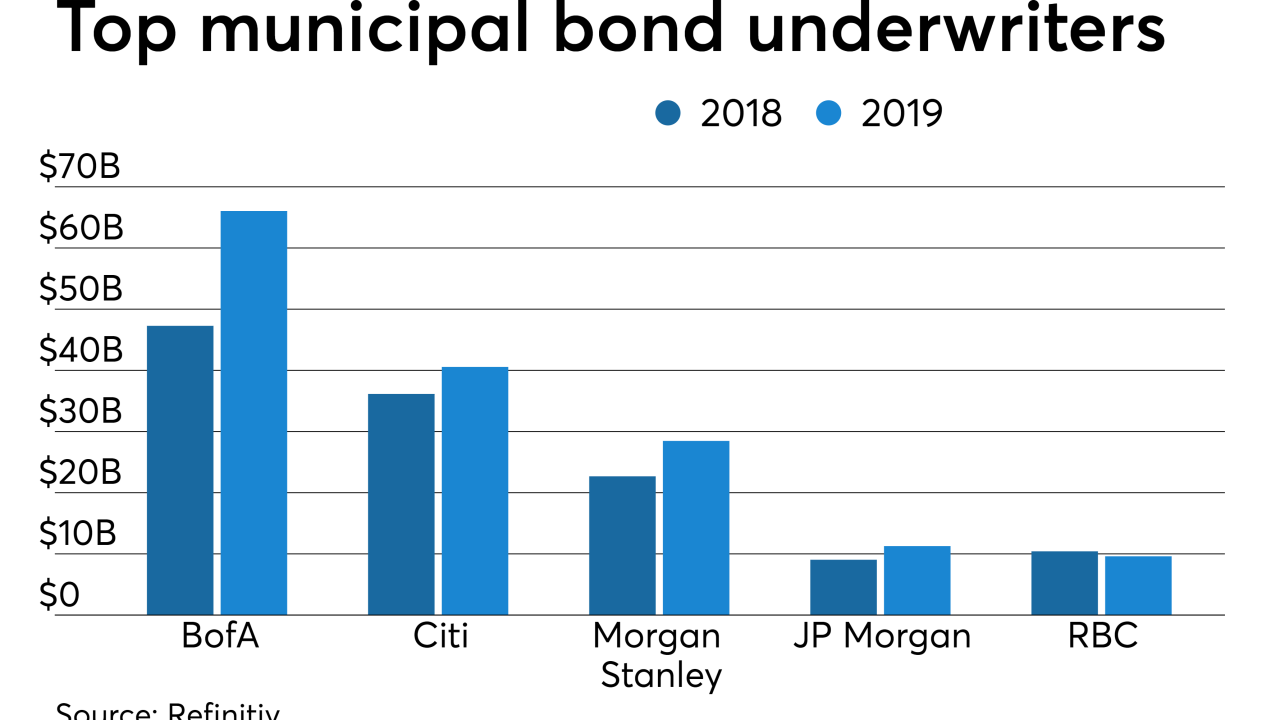

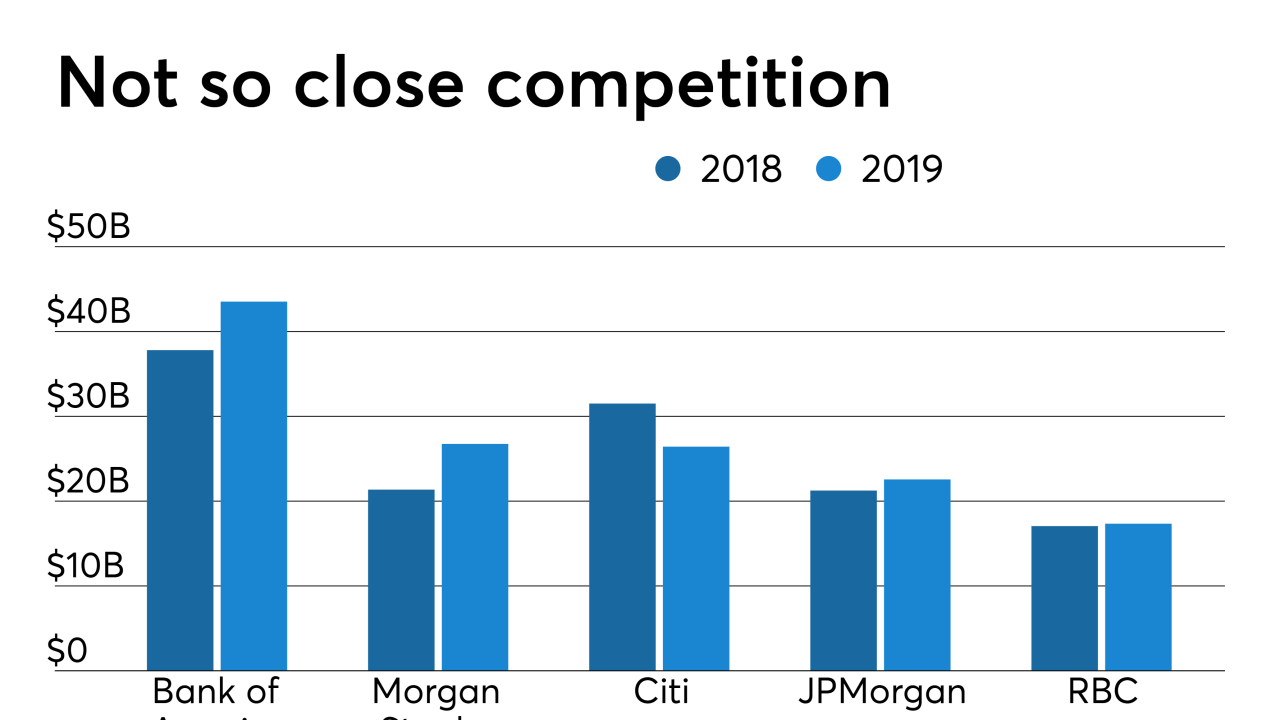

The top muni underwriters accounted for $406.51 billion in 10,582 transactions in 2019 compared to $320.35 billion in 8,549 deals in 2018. There was only one change in the top five year-over-year but spots six through 10 saw three changes. Barclays and Stifel both had big improvements in the rankings, while Raymond James dropped the most.

January 8 -

Municipal underwriters saw increased business, as demand for muni bonds jumped through the roof. Top muni underwriters accounted for $267.51 billion in 7,310 deals, up from $239.33 billion in 6,406 transactions in the first nine months of 2018.

October 7 -

The top municipal bond underwriters have outperformed their 2018 first halves in both volume and transactions year over year.

July 5 -

Municipal underwriters jockey for position as business increased 21.9% from the first quarter of last year.

April 4 -

Municipal bond underwriters suffered from muted issuance under the new tax laws, as Bank of America Merrill Lynch remained on top of the year-end rankings.

January 16