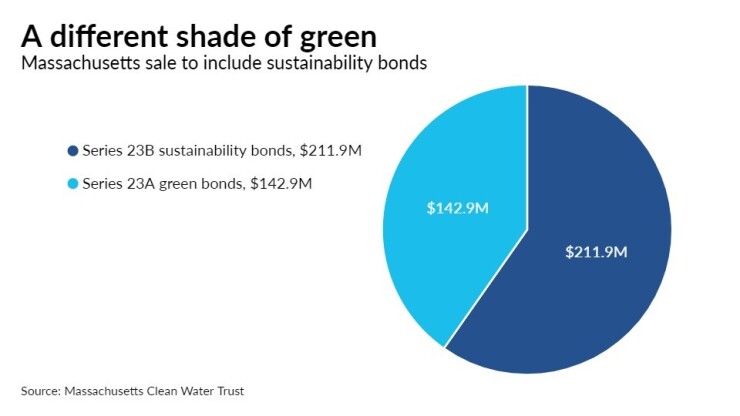

The Massachusetts Clean Water Trust intends to sell $355.5 million of state revolving fund bonds this week, including a tranche that officials say is the first sustainability bond issuance for any state revolving fund program in the country.

Retail and institutional sales are planned for Wednesday and Thursday, respectively, with proceeds to finance projects statewide that adhere to the environmental and health standards of the Clean Water Act and the Safe Drinking Water Act.

According to Sue Perez, the executive director of the trust and deputy state treasurer, the breakthrough $212.3 million Series 23B sustainability bonds will provide investors an opportunity to support Massachusetts communities identified as the most economically disadvantaged.

Morgan Stanley is the senior manager for the underwriting syndicate and Jefferies LLC and RBC Capital Markets are co-senior managing underwriters.

PFM is the financial advisor.

The trust’s $143.2 million Series 23A green bonds will be its sixth such issuance since Massachusetts launched the program in 2014.

“It’s unique to have a combination of green bonds and sustainability bonds in a single issuance,” Perez said. “We also offer these bonds at the strongest credit rating levels, so there’s the highest level of investor security.”

Fitch Ratings, S&P Global Ratings and Moody’s Investors Service all rate the bonds triple-A.

“The rating is based on the strong overall credit quality of the underlying loan portfolio and strong management of the program,” Moody’s said in a presale report. Moody’s said its rating incorporates projected default tolerance of 51% for all of Massachusetts Clean Water Trust's indentures combined as well as “very strong credit characteristics of the combined loan pools.”

While green bonds are expected to provide environmental benefits, according to Perez, sustainability bonds are expected to provide both environmental and social benefits.

Closing date is May 11.

In conjunction with the Massachusetts Department of Environmental Protection, the trust, which began in 1989, helps communities build or replace water quality infrastructure that enhances ground and surface water resources; ensures drinking water; protects public health; and develops resilient communities.

It provides low-interest loans and grants to cities, towns and water utilities through the Massachusetts SRF programs, which are pooled, revolving loan funds. The SRFs are a partnership between the Environmental Protection Agency and the commonwealth, and function like an environmental infrastructure bank by financing water infrastructure projects at a subsidized rate to the communities.

According to bond documents, 99% of the trust’s borrowers carry an A rating or better and 91% carry at least an AA rating. Its largest borrower, the Massachusetts Water Resources Authority, serves 61 communities in the Boston area.

Officials say the American Rescue Plan, the latest federal rescue package, provides $4.5 billion to Massachusetts, is a positive for its credit. In addition, local governments in the commonwealth, many of which borrow from the trust, are in store for an additional $3.7 billion.