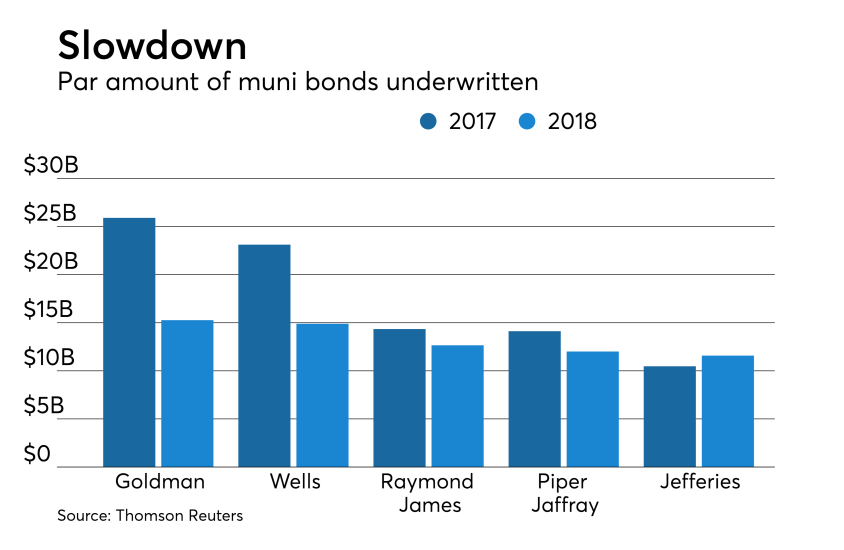

Municipal bond underwriters suffered from muted issuance under the new tax laws, as Bank of America Merrill Lynch remained on top of the year-end rankings. For 2018, the par amount underwritten plunged 21% to $320.25 billion in 8,550 transactions from $408.421 billion in 10,582 deals, according to data from Thomson Reuters. The top four remained the same from 2017, but there were some shuffles in the other spots.

Only one firm was able to achieve a higher par amount in 2018 than in the previous year and all top firms made fewer deals in 2018.